There are signs that the global outlook has started to brighten, though growth remains modest. The impact of tighter monetary conditions continues, especially in housing and credit markets, but global activity is proving relatively resilient, inflation is falling faster than initially projected and private sector confidence is improving. Supply and demand imbalances in labour markets are easing, with unemployment remaining at or close to record lows. Real incomes have begun to improve as inflation moderates and trade growth has turned positive. Developments continue to diverge across countries, with softer outcomes in many advanced economies, especially in Europe, offset by strong growth in the United States and many emerging market economies.

Global activity has proved surprisingly resilient so far

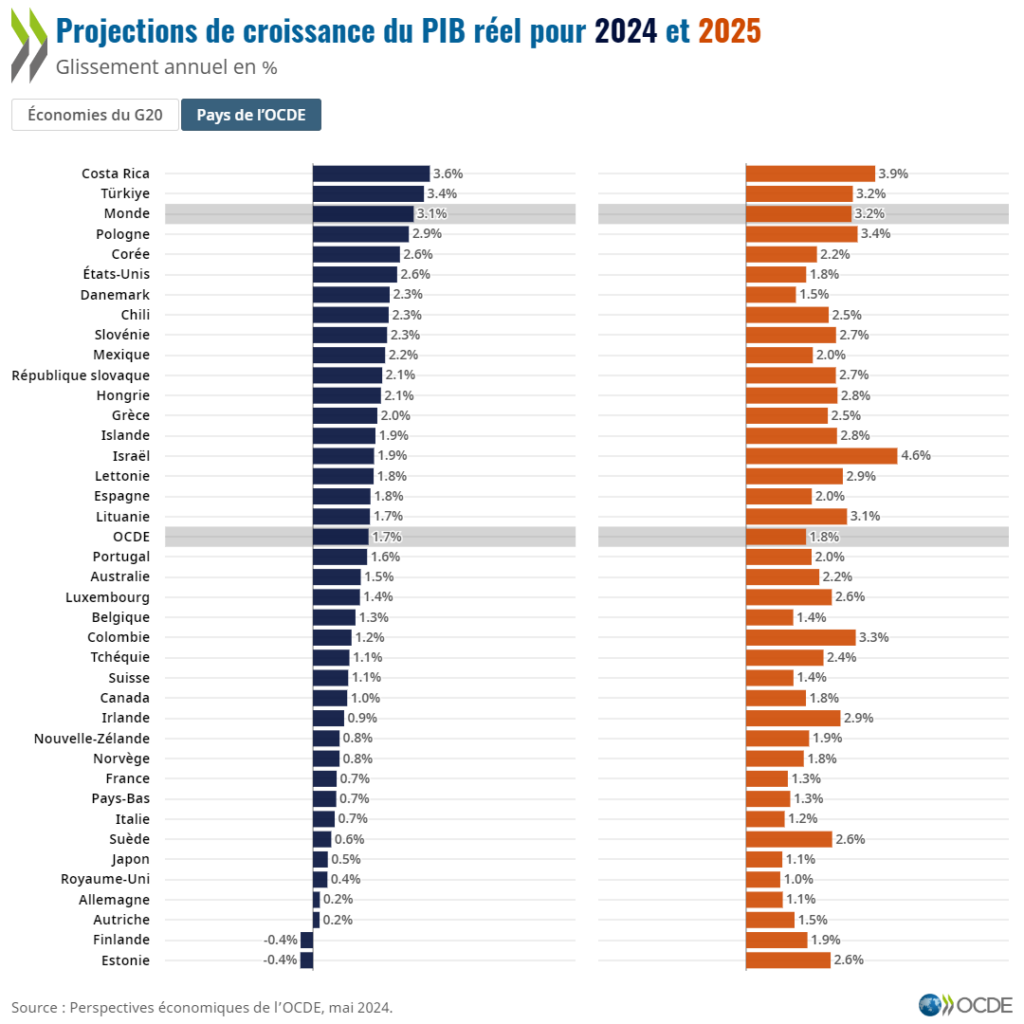

Global growth in 2023 continued at an annual rate above 3%, despite the drag exerted by tighter financial conditions and other adverse factors, including Russia’s war of aggression against Ukraine and the evolving conflict in the Middle East. Global GDP growth is projected at 3.1% in 2024 and 3.2% in 2025, little changed from the 3.1% in 2023. This is weaker than seen in the decade before the global financial crisis, but close to currently estimated potential growth rates in both advanced and emerging market economies.

Inflation has been falling towards targets, but some pressures persist

Headline inflation fell rapidly in most economies during 2023, driven down by restrictive monetary policy settings, lower energy prices and continued easing of supply chain pressures. Food price inflation also came down sharply in most countries, as good harvests for key crops such as wheat and corn saw prices fall rapidly from highs reached after the start of the war in Ukraine. Core goods price inflation has generally fallen steadily, but services price inflation has been stickier, remaining well above pre-pandemic averages in most countries.