The global crude oil price crash — a corollary of the global economic meltdown due to coronavirus — has massive ramifications for India. A precarious fiscal position, a slowing economy before Covid-19 hit the world limits India’s options to shore up revenues. The government had budgeted to bring down fiscal deficit to 3.5 per cent of the GDP in the current fiscal but rising expenditure commitments, falling revenues and likelihood of bailout packages for sectors mean meeting this target will be very difficult. Despite this, there has been no revision of fiscal deficit targets since the government is trying to bolster revenues through additional levies and taxes on fuel. Unprecedented levels of excise duties have been slapped on fuel that has never been cheaper in last five decades. As per a Barclays report, the sharp hike in excise duty for auto fuels — petrol and diesel — is likely to add Rs 1.4 lakh crore to government finances.

The report projects demand for both petrol and diesel will fall by 12 per cent in FY21 due to lockdowns and slower economic activity. The premise is a lower retail price at this point will not lead to any major gains in demand and hence will not boost overall economic scenario. Lower retail prices will be ineffective right now since major oil consuming sectors are grounded and subdued demand may result in limited tax collection. But the global oil crash presents itself as a once-ina-lifetime-opportunity for India which imports over 80% of its oil needs. These mammoth savings should be used by the government to ensure an effective and sizeable stimulus for the economy.

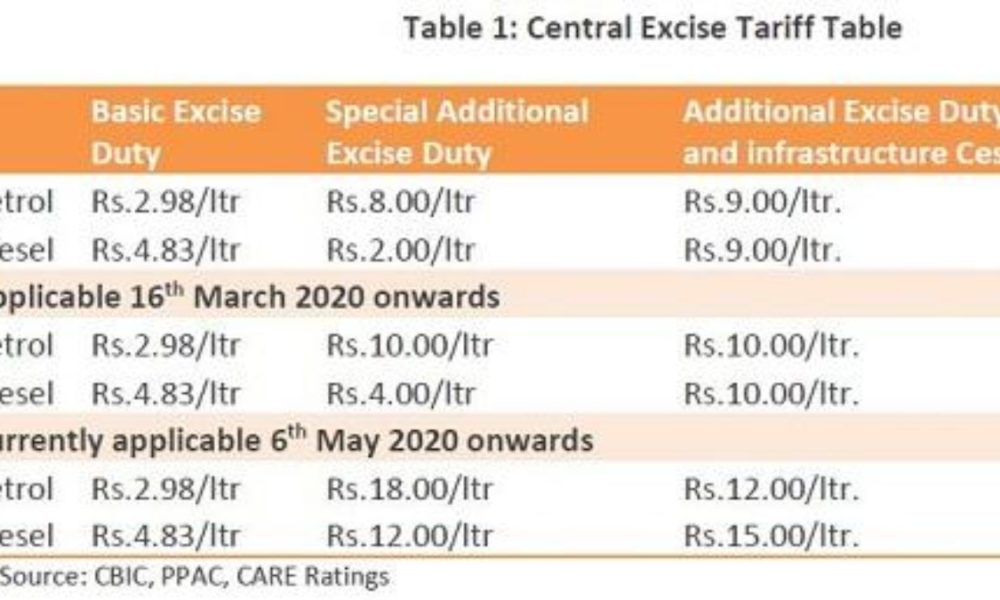

While the government has ensured basic needs of hunger and starvation are addressed, issue of livelihoods still remains. What is required are measures to address concerns of industry, measures to create more jobs and address concerns of small-scale sector that are leveraged and are staring at huge losses. Unless the worst-hit sectors of the economy are addressed with stimulus, the people of India are better off with lower fuel prices at this juncture. After all, there have been two hikes in excise duty in just over six weeks — one on 16 March just ahead of the lockdown and second announced by the government late Tuesday night. With the second revision in excise duty, the government will collect nearly 260 per cent taxes — which includes excise duty and VAT on the base price of petrol. Likewise, government will charge a whopping 256 per cent of prices as taxes for every litre of diesel. The government will collect a total of Rs 4.4 lakh crore as fuel taxes this year — which is 2.1 percent of India’s total GDP. This kind of excessive taxation can be justified only if it is spent on lifting the economy and ensuring India recovers from the Covid-induced shock. Without a concrete stimulus announcement, clamour to reduce these high levies and raise disposable income of consumers will grow.