India was one of the ‘large economies — apart from China, Indonesia, the Russian Federation, the United States, among others – which escaped the financial trouble that loomed earlier in the year 2023 – thus emerging as a stakeholder in the world economic growth of 2.7 per cent, just 0.2 percentage point more than the threshold of 2.5 per cent that is often associated with a global recessionary phase. This also happened as the risks that threatened to substantially slow down global economic growth in 2023 remained subdued, and as a result of which, the UN Trade and Development (UNCTAD) report update said on Wednesday.

The report warns of further growth deceleration in 2024, citing falling investments and subdued global trade dynamics which are expected to slow down global growth to 2.6 per cent in 2024, slightly slower than in 2023. This makes 2024 the third consecutive year in which the global economy will grow at a slower pace than before the pandemic, when the average rate for 2015–2019 was 3.2 per cent. The report finds policy discussions continuing to centre on inflation, conveying confidence that anticipated monetary easing will heal the world’s economic woes.

Amidst these global woes, UNCTAD highlights that India grew 6.7 per cent in 2023 and it is expected to expand by 6.5 per cent in 2024. The expansion in 2023 was driven by strong public investment outlays as well as the vitality of the services sector which benefitted from robust local demand for consumer services and firm external demand for the country’s business services exports. These factors are expected to continue to support growth in 2024.

In the outlook, an increasing trend of multinationals extending their manufacturing processes into India in an effort to diversify their supply chains will also have a positive impact on Indian exports, while moderating commodity prices will be beneficial to the country’s import bill. The Reserve Bank of India is expected to keep interest rates constant in the near term, while restrained public consumption spending will be offset by strong public investment expenditures.

The prospect of interest rate cuts could improve the fiscal outlook for governments and businesses, but as UNCTAD notes, “the monetary policy alone cannot solve all pressing global challenges. Strategies to revive investment and trade, support full employment and fair income distribution are crucial to driving robust growth and meeting sustainable development goals”.

In other Southern Asian countries, however, economic growth remains more subdued with three countries in the region – Bangladesh, Pakistan and Sri Lanka – currently under IMF programmes, the conditionalities of which necessitate the application of tight monetary policies and fiscal austerity measures whose impacts are most severely felt by low-income households.

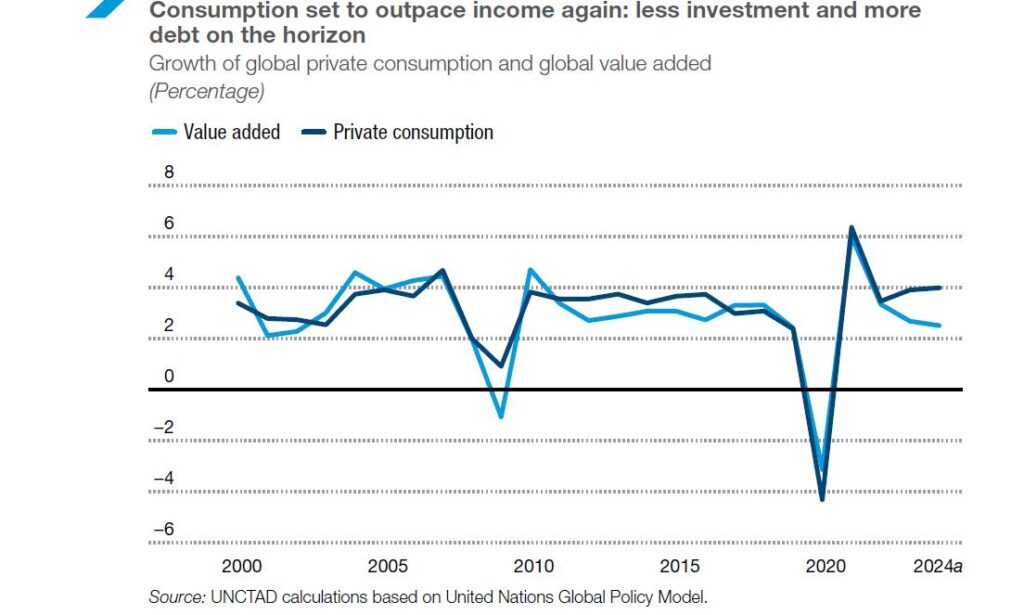

Meanwhile, the pressing challenges of trade disruptions, climate change, low growth, underinvestment and inequalities are growing more serious. Even more concerning than its projected pace, is the fact that global growth appears to be strongly driven by private consumption which in 2024 is projected to grow about 4 per cent while total income is only projected to expand 2.6 per cent. In practice, patterns observed since the early 2000s indicate that periods of fast consumption growth tend to be financed by borrowing. Given that the savings accumulated during the pandemic (mainly by more affluent households) have now mostly returned to pre-2020 levels, debt is the likely source of funding for a large share of consumption.

In Asia, the economy of China, its largest economy, expanded by 5.2 per cent in 2023. For 2024, the Government set an official growth rate target of “around 5 per cent”, indicating its economic confidence and ambition. The economic data for January–February also showed positive signals, with the total value added of the manufacturing sector expanding 7.7 per cent year on year and the value of merchandise trade growing 8.7 per cent. Yet, the economy has been facing some headwinds, such as external uncertainties, troublesome housing market, underperforming labour market and subdued consumption. However, with the total government debt-to-GDP ratio standing at 55 per cent and inflation at 0.2 per cent at the end of 2023, fiscal and policy spaces allow for proactive fiscal policies and prudent monetary policy.