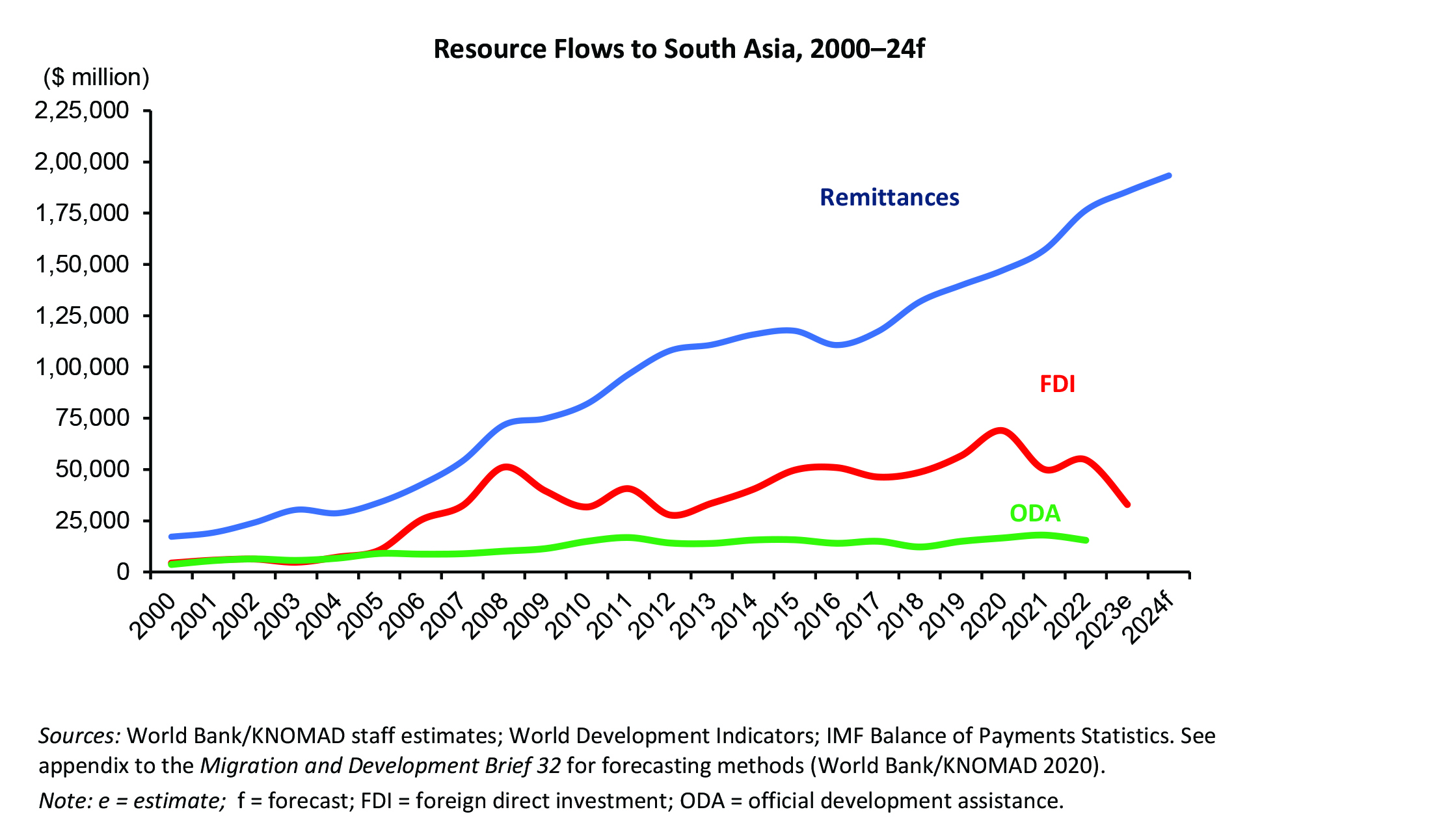

While South Asia’s remittance growth outlook for 2024–25 is still well above the forecast for all other regions, significant downside risks point to a slowdown as strong labor market conditions in key migrant destinations stabilize after a peak in 2023. The downside risks hinge on forecasts of subdued GDP growth, persistence of high commodity prices, and risk of a conflict-driven persistence in inflation, especially related to elevated food prices.

Besides external factors, the domestic economy conditions prevailing in South Asia’s three largest recipients—India, Pakistan, and Bangladesh, that collectively receive 91 percent of the total remittance flows to South Asia—will play a fundamental role in driving remittance growth. The single most important risk on the downside is from a weak economic recovery from the recent crises in Pakistan and Bangladesh that would motivate migrants to opt for informal over formal money transfer channels, resulting in lower remittance growth.

Remittance growth in Bangladesh, Nepal, Bhutan, and the Maldives has also been associated with large-scale emigration of less-skilled economic migrants in the recent past.

This trend is unlikely to continue unabated as South Asian migrants compete for the same jobs as climate-change-affected and economic migrants from other migrant-sending countries. Unbounded and illegal emigration from South Asia is already encountering resistance at the United States’ southern border and in Europe