The Wall Street suffered a punishing selloff on Friday, August 1, 2025, with the key US stock indexes taking the hits sharply to end a turbulent week punctuated by growing economic fears and abrupt policy jolts. The crash has been painful, and not the usual crash-pain. It smells bloodbath and the investor community hopes to evade it with minimum trading scalps.

As It Happened

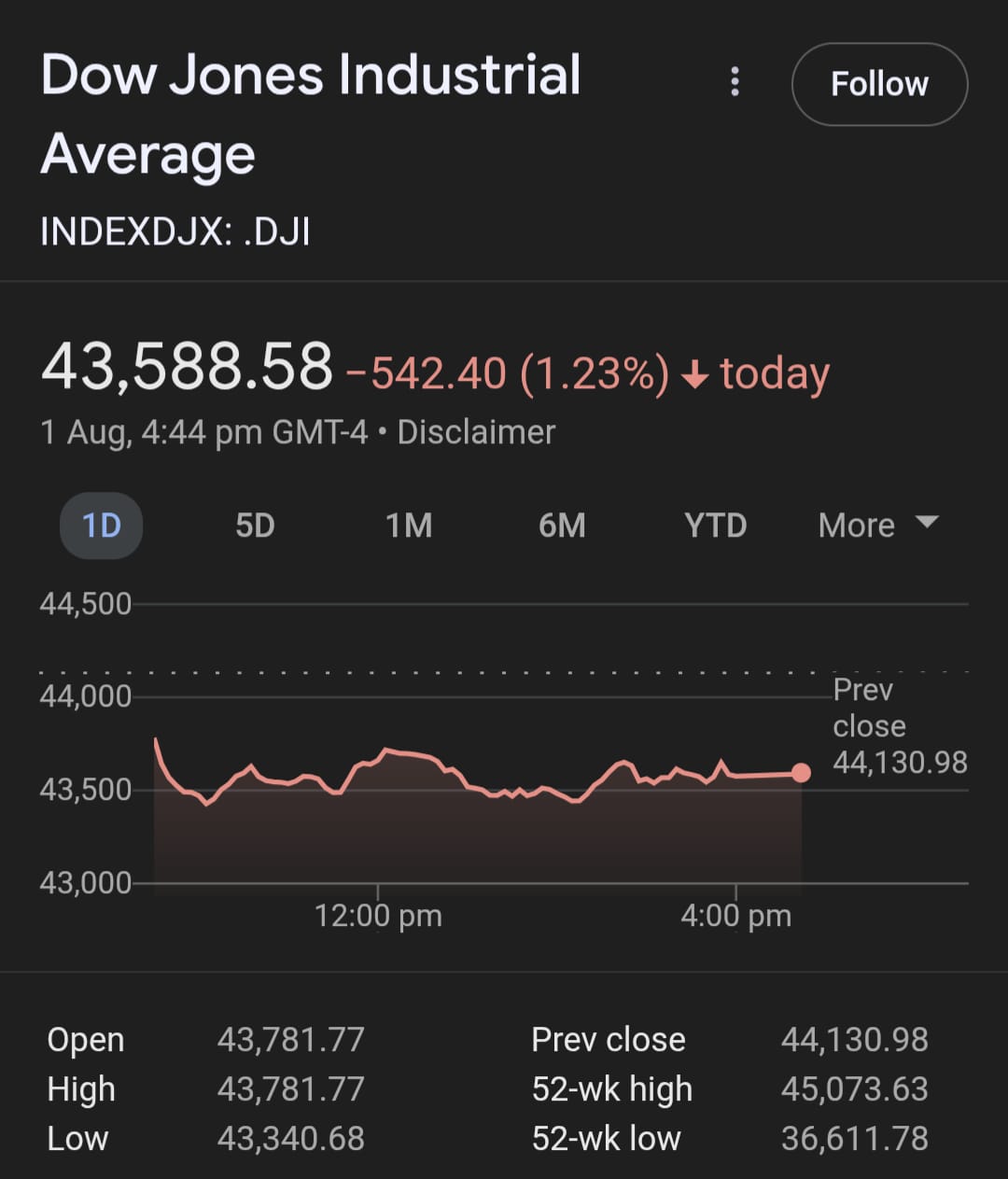

- Dow Jones Industrial Average: Slid 1.2%, down more than 540 points.

- S&P 500: Lost 1.6%, its sharpest one-day decline since May.

- Nasdaq Composite: Dropped 2.2%, dragged lower by blue-chip tech names.

All three saw weekly declines of more than 2% after four straight decline sessions.

The combined market value loss amounted to more than $1 trillion in one day, which indicates the extent of investor anxiety.

Why was the crash so-crashing?

- Trump’s Sweeping Tariffs Spark Global Angst : Late Thursday, President Trump shocked markets by declaring severe new tariffs on imports from more than 90 nations, including leading partners such as Canada (tariffs increased to 35%), Taiwan, South Korea, and India, effective for most of them on August 7. The scope and seriousness of these duties renewed fears about supply chains, cost inflation, and global trading partners’ retaliation.

- Weak July Jobs Report Reignites Recession Concerns : Friday’s jobs report for July revealed the US economy created only 73,000 jobs, by far the weakest figure in months and significantly lower than predictions. More ominously, job creation for earlier months was revised sharply lower. The unemployment rate rose a tick to 4.2%. The weak figures dispelled expectations of a soft landing and exposed increasing cracks in the labor market.

Emerging Economic Uncertainty

Market participants also processed mixed corporate reports, particularly from the technology behemoths such as Amazon (down 8% on poor cloud guidance) and Nvidia (lower on concerns of AI demand).

President Trump’s demand for the commissioner of the Bureau of Labor Statistics to be fired, whom he accused of politically driven data manipulation, fueled new political uncertainty.

Rates were left alone by the Federal Reserve, but Friday’s chaos has markets speculating about a possible rate cut as early as September—a testament to how spooked sentiment has become.

Weekly Recap: Broader Context

The week had started on optimistic notes after good showing in July, but then sentiment disintegrated as jobs and trade data hurt. Breadth in the markets contracted as past tech leaders pulled indexes lower. The S&P 500 and Nasdaq had each lost more than 2% by the end of the week.

Investor Reactions

Flight to Safety: Investors flocked to safe-haven assets such as gold, which rose 30% year-to-date, and US Treasury yields declined as Federal Reserve rate cut bets ramped up.

Volatility & Risk-Off Attitude: Rising volatility and generalised selling swept across all sectors, with specific weakness in technology, industrials, and financials.

Looking Ahead: What’s Next for Wall Street?

- Cautious Sentiment: With tariffs to widen on August 7 and upcoming economic data (CPI, Fed meeting) in view, volatility should stay elevated.

- Fed Policy Watch Prospects of a September rate cut are growing. The Fed will be compelled to respond if labor market softness continues or trade uncertainty intensifies.

- Key Risks: Ongoing trade disruptions, weak jobs growth, and elevated market valuations may keep investors anxious.

- Potential for Recovery: Some view room for stabilisation if rhetoric on trade eases or the Fed communicates strong support. Others caution that the combination of macro risks renders a quick rebound unlikely.

The Market Summary:

Friday’s US stock market plunge was the climax of a volatile week after investors were hit with the double whammy of aggressive import tariffs and an appalling jobs report. With economic instability and geopolitical tensions rising, Wall Street’s short-term prognosis is characterized by caution, increased volatility, and close monitoring of both policy and data in the coming weeks.