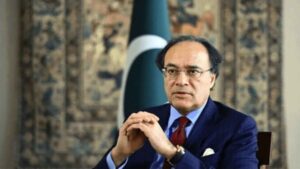

Pakistan has officially requested $1 billion in funding from the International Monetary Fund’s facility designed to assist low- and middle-income countries in addressing climate risks, Finance Minister Muhammad Aurangzeb announced on Thursday (October 24).

“We have formally requested to be considered for this facility,” Aurangzeb told Reuters during the IMF/World Bank autumn meetings in Washington. He noted that Pakistan hopes to finalize the request in the coming months.

The IMF has already approved a $7 billion bailout package for Pakistan, but further funding is accessible through the Resilience and Sustainability Trust (RST).

Must Read: Bushra Bibi, Wife Of Imran Khan, Released From Jail After Nine Months Over Toshakhana Case

The RST, established in 2022, provides long-term concessional financing for climate-related projects, which include adaptation measures and transitioning to clean energy.

According to the Global Climate Risk Index, Pakistan is among the countries most vulnerable to climate change.

In addition to discussions with the IMF, Pakistan is also in negotiations with the Asian Infrastructure Investment Bank (AIIB) for credit enhancement on its planned Panda bond, as stated by Aurangzeb. This Panda bond would represent Pakistan’s first foray into China’s capital markets.

The initial bond issuance, aimed at raising $200-250 million, is expected by the end of June.

Pakistan is also in discussions with West Asian banks for commercial loans, with one bank submitting a “significant proposal,” according to Aurangzeb.

He mentioned that Pakistan is engaging with other institutions for credit enhancements. These enhancements, which provide guarantees for bonds, can improve their ratings, attract more investors, and lower borrowing costs.

Aurangzeb stated that Pakistan’s foreign exchange reserves should reach $13 billion by the end of March, which would strengthen its ability to secure commercial loans and potentially enhance its credit rating.

As of October 18, Pakistan’s foreign exchange reserves were reported at $11.04 billion, according to the central bank.

In recent months, credit rating agencies have made slight upgrades to Pakistan’s ratings. Moody’s raised its rating to ‘Caa2’ in August, citing improving macroeconomic conditions, while Fitch increased its rating to CCC+ in July following the IMF staff-level agreement. However, both ratings remain below investment grade.

Also Read: Bangladeshi Man Casually Crosses Into India, Sparks Border Security Alarms