US President-elect Donald Trump took to social media on Thursday to celebrate Bitcoin’s historic surge past the $100,000 mark, attributing the cryptocurrency’s success to his election victory. “CONGRATULATIONS BITCOINERS!!! $100,000!!! YOU’RE WELCOME!!! Together, we will Make America Great Again!” Trump posted on Truth Social, following a remarkable 50 percent increase in Bitcoin’s value since his election.

Bitcoin Breaks New Ground

Bitcoin reached a record high of $103,800.45 during Asian trading hours on Thursday before settling around $101,000. After Trump’s remarks, the cryptocurrency began to climb again, reaching $103,320. The digital asset has experienced a staggering 140 percent increase since the beginning of the year, although its growth had recently stalled as traders awaited new catalysts.

The surge in Bitcoin’s value coincided with Trump’s announcement of his nomination of Paul Atkins, a known cryptocurrency supporter, to lead the US Securities and Exchange Commission (SEC). This move has bolstered optimism that the incoming administration will pursue deregulation in the cryptocurrency sector.

Regulatory Changes on the Horizon

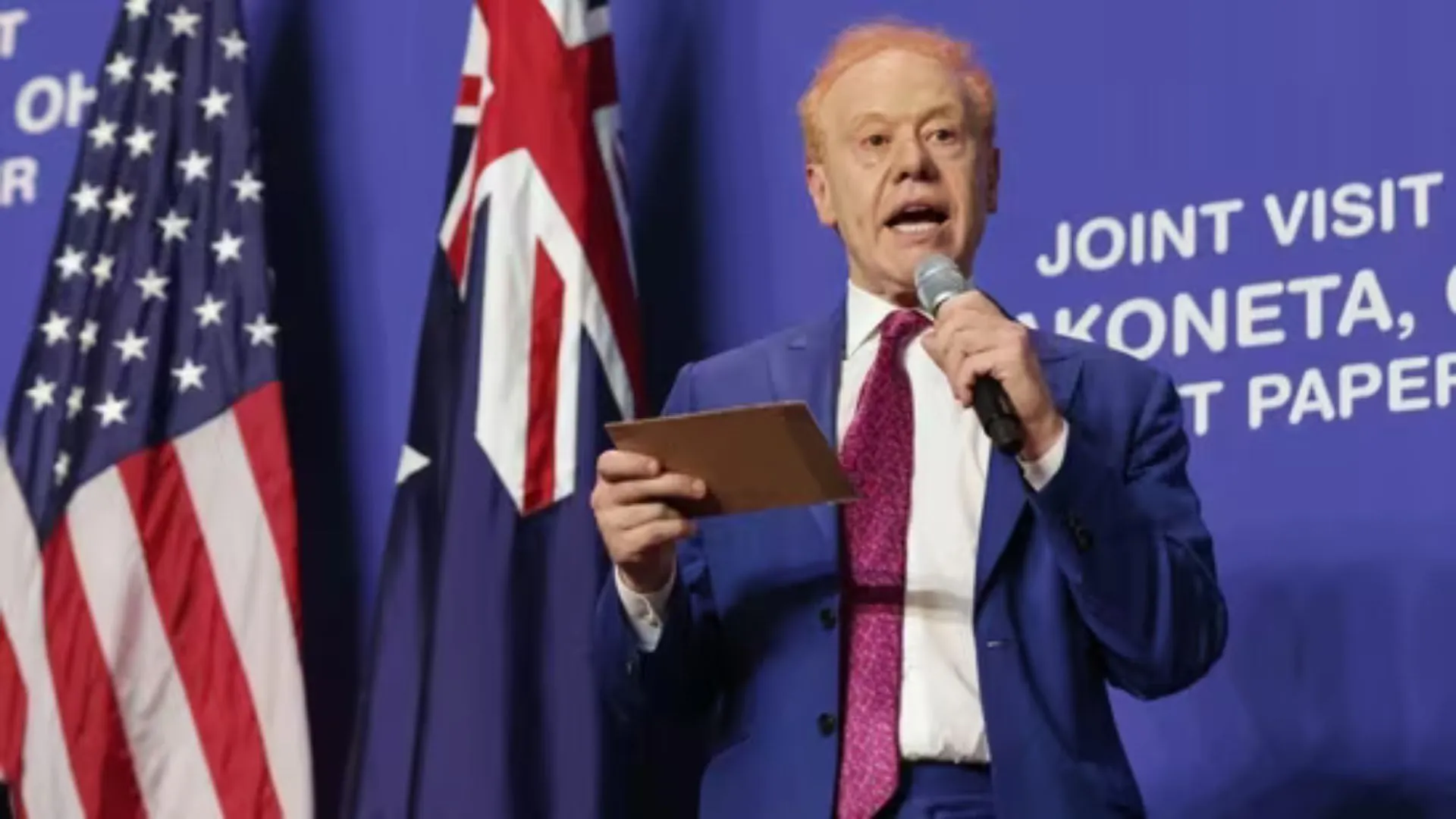

Atkins, who served as an SEC commissioner from 2002 to 2008, founded the risk consultancy firm Patomak Global Partners in 2009, which has worked with clients in the banking, trading, and cryptocurrency industries. Trump’s transition team highlighted Atkins’ role as co-chairman of the Digital Chamber of Commerce, an organization that advocates for the use of digital assets.

“Paul is a proven leader for common-sense regulations,” Trump stated, emphasizing Atkins’ commitment to fostering “robust, innovative” capital markets. This nomination marks a significant shift from the previous SEC chair, Gary Gensler, who led a crackdown on the cryptocurrency sector following a market downturn in 2022.

The SEC has recently authorized the trading of new financial products, including exchange-traded funds (ETFs), which have made it easier for the public to invest in cryptocurrencies. “Institutional interest and regulatory shifts are adding legitimacy, turning what once seemed like a fringe asset into a force reshaping finance,” said Matt Britzman, a senior analyst at Hargreaves Lansdown.

Despite previously labeling cryptocurrencies a “scam,” Trump has become a vocal advocate for Bitcoin during his campaign. In September, he announced plans to launch a digital currency platform called World Liberty Financial, alongside his sons and other entrepreneurs.

With Trump at the helm, there are expectations for the establishment of a strategic reserve of bitcoins in the United States, primarily consisting of tokens seized by courts. This initiative could encourage other countries to recognize the legitimacy of virtual currencies.

While Bitcoin’s volatility and speculative nature have drawn criticism, it remains a topic of significant interest. The cryptocurrency was created in 2008 by an individual or group under the pseudonym Satoshi Nakamoto, aiming to provide a decentralized alternative to traditional financial institutions.

Bitcoin’s reputation has been marred by its association with illicit activities, including money laundering and ransomware attacks. Despite its challenges, the cryptocurrency has gained traction, with El Salvador adopting it as legal tender in 2021, although a recent study indicated that 88 percent of Salvadorans have never used it.

As the cryptocurrency landscape evolves, Trump’s administration is poised to play a pivotal role in shaping its future.