China has announced a ban on the export of critical minerals, including gallium, germanium, and antimony, to the United States, citing national security concerns. This decision, revealed by the commerce ministry on Tuesday, follows the U.S.’s recent crackdown on China’s semiconductor sector.

The new directive specifically targets dual-use items that have both military and civilian applications and takes immediate effect. It also mandates stricter reviews of the end-use of graphite items shipped to the U.S. The ministry stated, “In principle, the export of gallium, germanium, antimony, and superhard materials to the United States shall not be permitted.”

These restrictions enhance the enforcement of existing limits on the export of these vital minerals, which China began implementing last year. However, the new measures apply exclusively to the U.S., marking a significant escalation in trade tensions between the two largest economies in the world, particularly as President-elect Donald Trump prepares to take office.

Despite the announcement, Chinese customs data indicate that there have been no shipments of wrought and unwrought germanium or gallium to the U.S. from January to October this year. In the previous year, the U.S. was the fourth and fifth-largest market for these minerals, respectively.

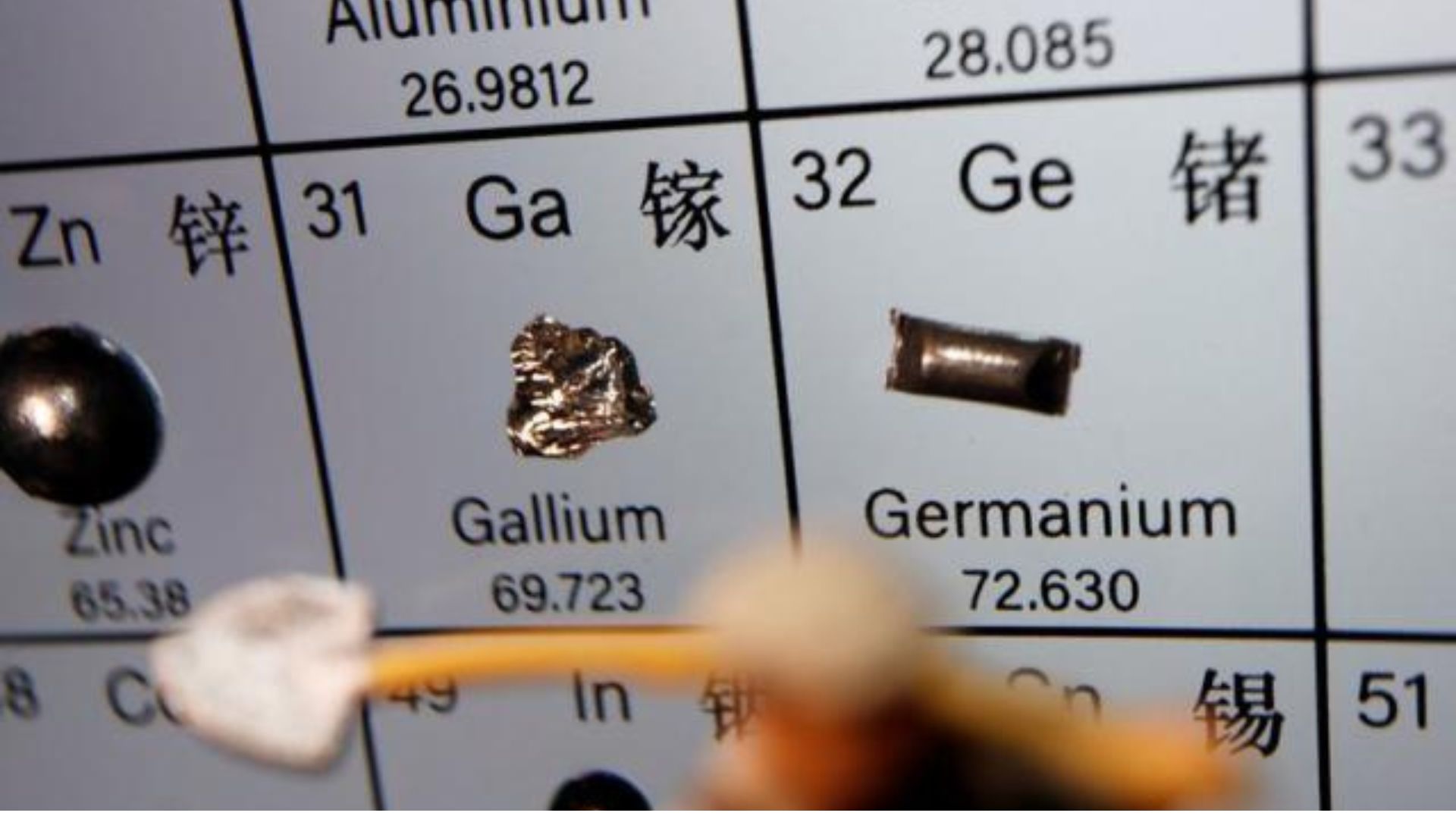

Gallium and germanium are essential components in semiconductor manufacturing

Gallium and germanium are essential components in semiconductor manufacturing, while germanium is also utilized in infrared technology, fiber optic cables, and solar cells. Following the implementation of export limits, China’s overall shipments of antimony products plummeted by 97% in October compared to September.

Last year, China accounted for 48% of globally mined antimony, which is used in various military applications, including ammunition, infrared missiles, nuclear weapons, and night vision goggles, as well as in batteries and photovoltaic equipment. This year, China has produced 59.2% of refined germanium and 98.8% of refined gallium globally, according to consultancy Project Blue.

Jack Bedder, co-founder of Project Blue, stated, “The move is a considerable escalation of tensions in supply chains where access to raw material units is already tight in the West.” Prices for antimony trioxide in Rotterdam surged by 228% since the beginning of the year, reaching $39,000 per metric ton as of November 28, according to data from information provider Argus.

A minor metals trader in Europe remarked, “Everyone will dig in their backyard to find antimony. Many countries will try to find antimony deposits.”

China’s announcement follows the U.S.’s third crackdown on China’s semiconductor industry in three years, which restricts exports to 140 companies, including chip equipment manufacturer Naura Technology Group (002371.SZ). Trump, who previously engaged in a contentious trade war with China during his first term, has indicated plans to implement a 10% tariff on Chinese goods and has threatened to impose 60% tariffs on Chinese imports during his presidential campaign.