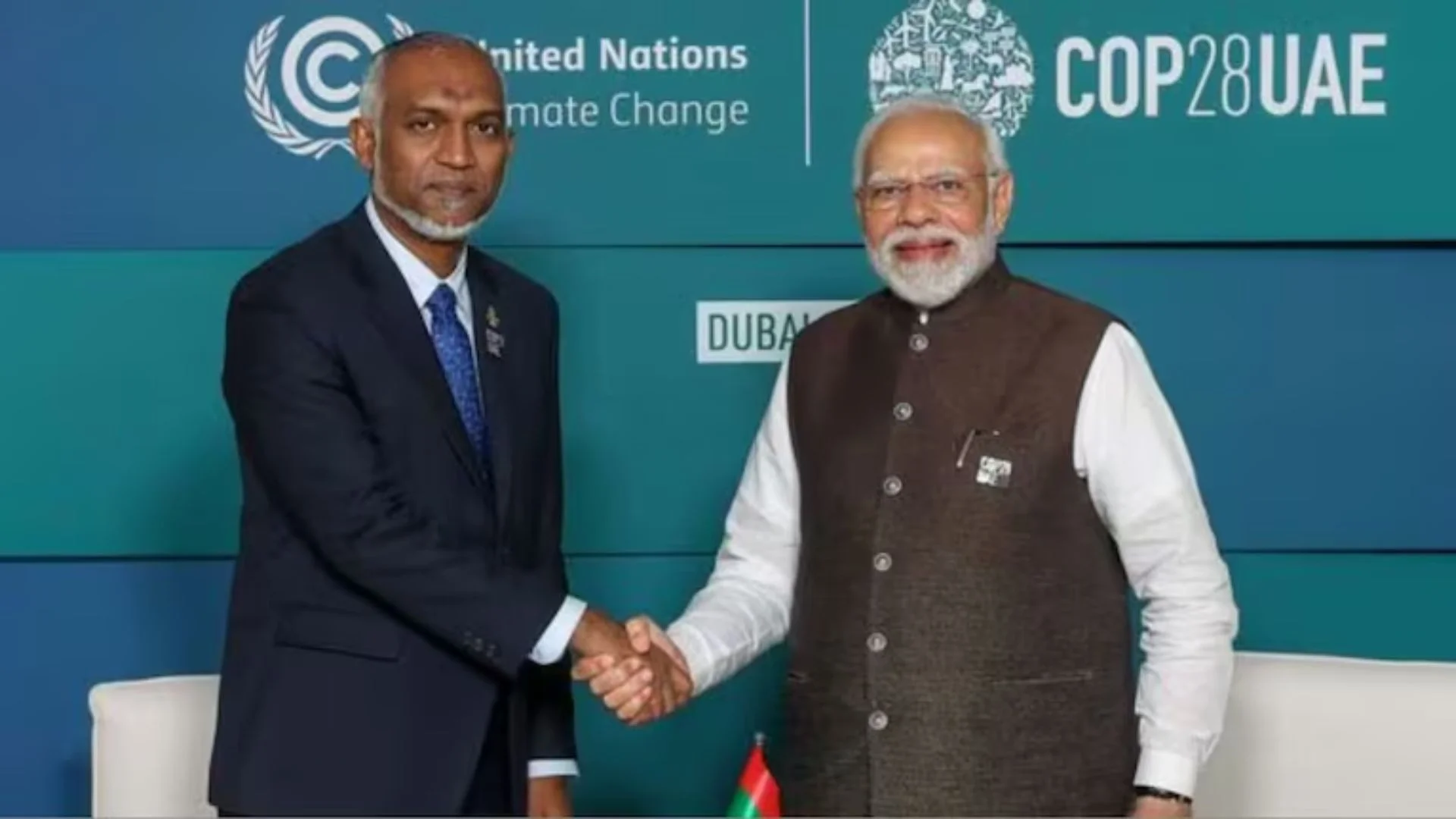

As the Maldives grapples with a looming debt default, India has extended a helping hand by rolling over $100 million in treasury bills and signing a $400 million currency swap agreement. The assistance followed a meeting between Maldivian President Mohamed Muizzu and Indian Prime Minister Narendra Modi in New Delhi.

“India and Maldives share centuries-old ties. As Maldives’ nearest neighbor and close friend, we will continue to uphold our responsibilities. Today’s agreements further strengthen our partnership in economic and maritime security,” Modi emphasized during the meeting.

Maldives debt is estimated at 110% of its GDP, and fears are rising over its ability to meet obligations, including payments on a sukuk (Islamic financial certificate). As of the end of August 2024, the country’s foreign reserves stood at just $437 million, covering only about six weeks of imports. President Muizzu, while addressing concerns, downplayed the risk of default, asserting that Maldives would not seek assistance from the International Monetary Fund (IMF).

The island nation’s total foreign debt amounts to $3.4 billion, largely owed to India and China, following years of borrowing for infrastructure projects. The World Bank reported that public debt surged to $8 billion, or 122.9% of GDP, in 2023. The Maldives’ GDP growth, which stood at 13.9% in 2022, has since slowed to 4%, as the recovery in tourism—Maldives’ economic lifeline—lags behind pre-pandemic levels.

To avoid default, Maldives requires $114 million this year, followed by $557 million in 2025, and $1.07 billion in 2026. Despite steady tourism revenue, external debt payments, fiscal deficits, and high global commodity prices are straining the country’s foreign exchange reserves. Additionally, printing currency during the pandemic to ease government cash flow led to a liquidity surplus of Maldivian rufiyaa.

Concerns peaked over a $25 million payment due on October 8, as Maldives faced the possibility of becoming the first country to default on a sukuk.

A significant portion of Maldives’ debt is in sukuk, an Islamic financial instrument similar to bonds but compliant with Sharia law. Unlike conventional bonds, sukuk does not pay interest (riba), which is prohibited in Islam. Instead, sukuk investors hold a certificate representing partial ownership in an asset or project. Returns are generated through profit-sharing from the asset’s performance, avoiding interest payments.

In a sukuk transaction, the issuer sells certificates to investors, using the proceeds to purchase an asset. Investors hold partial ownership in this asset and receive returns based on the asset’s performance, rather than interest. The issuer must also repurchase the certificates at a future date at par value.

Sukuk structures vary, but some common types include:

– Ijarah (Lease-Based Sukuk): Investors lease an asset and receive rental payments.

– Murabaha (Cost-Plus Financing): Assets are sold to investors at a profit, with payments in installments.

– Mudarabah (Profit-Sharing): A partnership where profits are shared between investors and the managing party.

– Musharakah (Joint Venture): Both parties contribute capital and share profits and losses.

While sukuk has gained popularity in Muslim-majority countries, concerns have grown in the Maldives about whether the country will be allowed to default on a sukuk payment. Similar situations in the past have seen Gulf states intervene to prevent sovereign sukuk defaults, as they did with Bahrain in 2018.

India’s financial support to Maldives is not new. The two countries signed a trade agreement in 1981, which has facilitated the export of essential commodities. Bilateral trade exceeded $500 million in 2022. In September 2024, India’s State Bank of India agreed to subscribe to $50 million in Maldivian government bonds. Additionally, the Maldives Monetary Authority is negotiating a $400 million currency swap with the Reserve Bank of India to bolster its reserves.

India’s external affairs minister S. Jaishankar reaffirmed the country’s commitment to supporting the Maldives during a meeting with President Muizzu, expressing confidence that the recent agreements will strengthen bilateral ties.