Real estate has always had a quiet certainty to it. For anyone considering where to place their money, it offers a sense of clarity, whether you’re thinking short term, looking a few years ahead, or planning for decades. What makes it such an interesting investment is how it works across timeframes, adapting to your financial approach without needing to chase trends.

Value Over Time

Mid term, the story grows. This is where real estate shows its stability. As properties appreciate over time, they tend to move upward at a steady pace. You’re not just waiting and watching. You’re earning, too. Rental income from residential or commercial spaces becomes a dependable stream. There’s comfort in this kind of predictability. You may not be flipping properties anymore, but you’re building something quietly valuable, year by year.

For long-term investors, real estate offers what few other assets can: a real, physical store of growing value. Hold on to a property for ten, fifteen, or twenty years, and the returns tend to be significant. That’s not just due to appreciation, but also because equity builds. Over time, the financial load reduces, rental income improves, and the value of what you own becomes a meaningful part of your overall wealth. You’re not just earning; you’re establishing a legacy.

Active Ownership

And in every phase, short, mid, or long term, what remains constant is this: real estate is grounded in value. The market may move, prices may shift, but well-chosen property continues to be a solid part of any portfolio.

It’s also flexible. Whether you’re a first-time investor, a seasoned owner, or someone exploring options with a longer horizon, real estate meets you where you are. It’s never about just one way to succeed. It’s about choosing what works for your timing and vision.

Growing Institutional Interest in Real Estate

In recent years, real estate has also grown as a core part of Alternate Investment Funds (AIFs) in India, accounting for the largest share in the segment. This signals a growing institutional and high-net-worth interest in the space, where investors prefer structured, long-term strategies with a focus on fundamentals. It’s a space where thoughtful investment, based on clarity not crowd-following, often leads to better outcomes. Those who do well tend to understand the asset, engage with it actively, and take a long view, knowing that steady value often rewards steady vision.

In the end, investing in real estate isn’t just about returns. It’s about direction. A sense of moving forward with something that holds meaning, security, and potential. And that’s what makes it worth considering, today, tomorrow, and for the years to come.

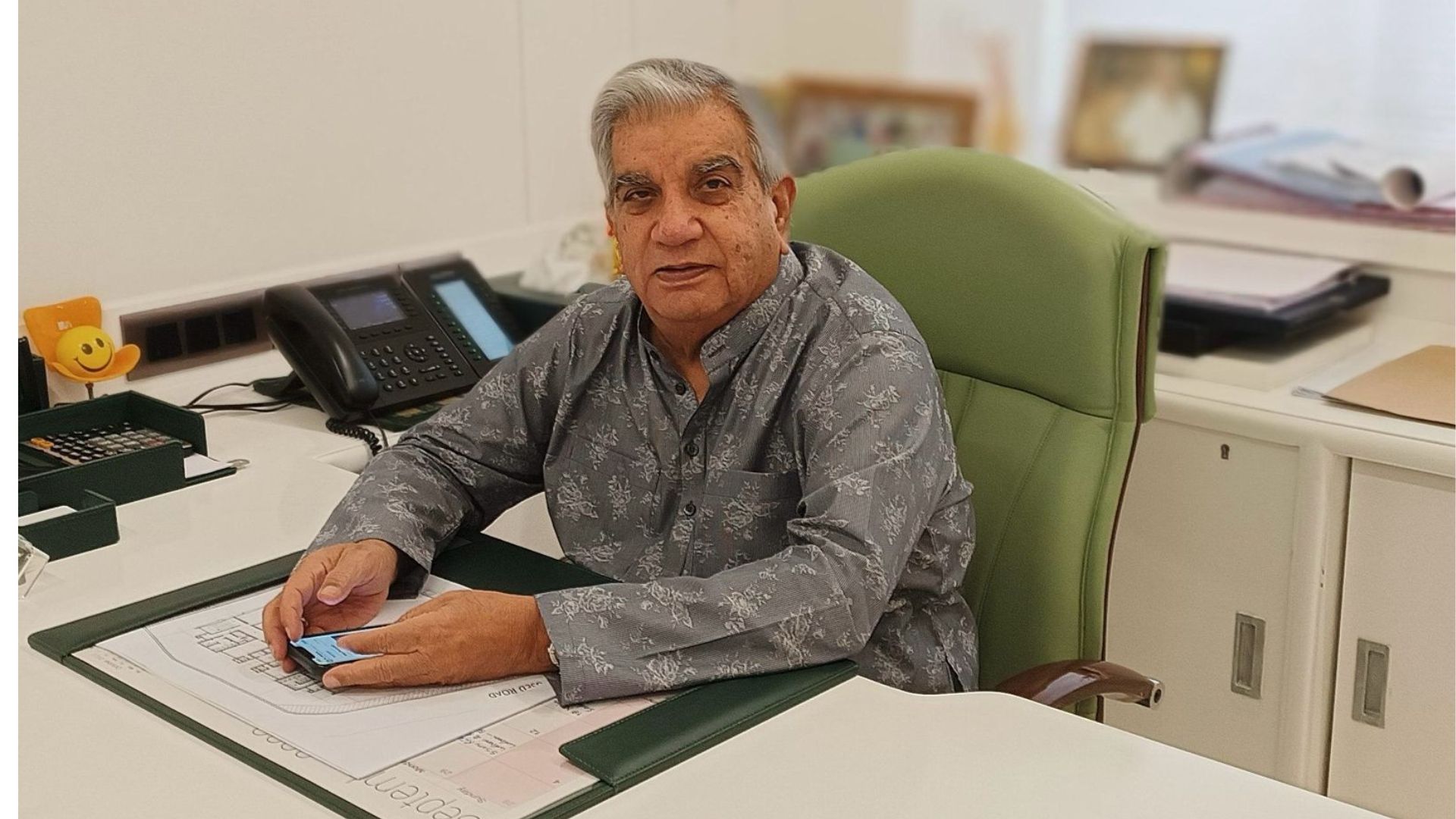

Lachman Ludhani, Chairman & Managing Director – Evershine Group