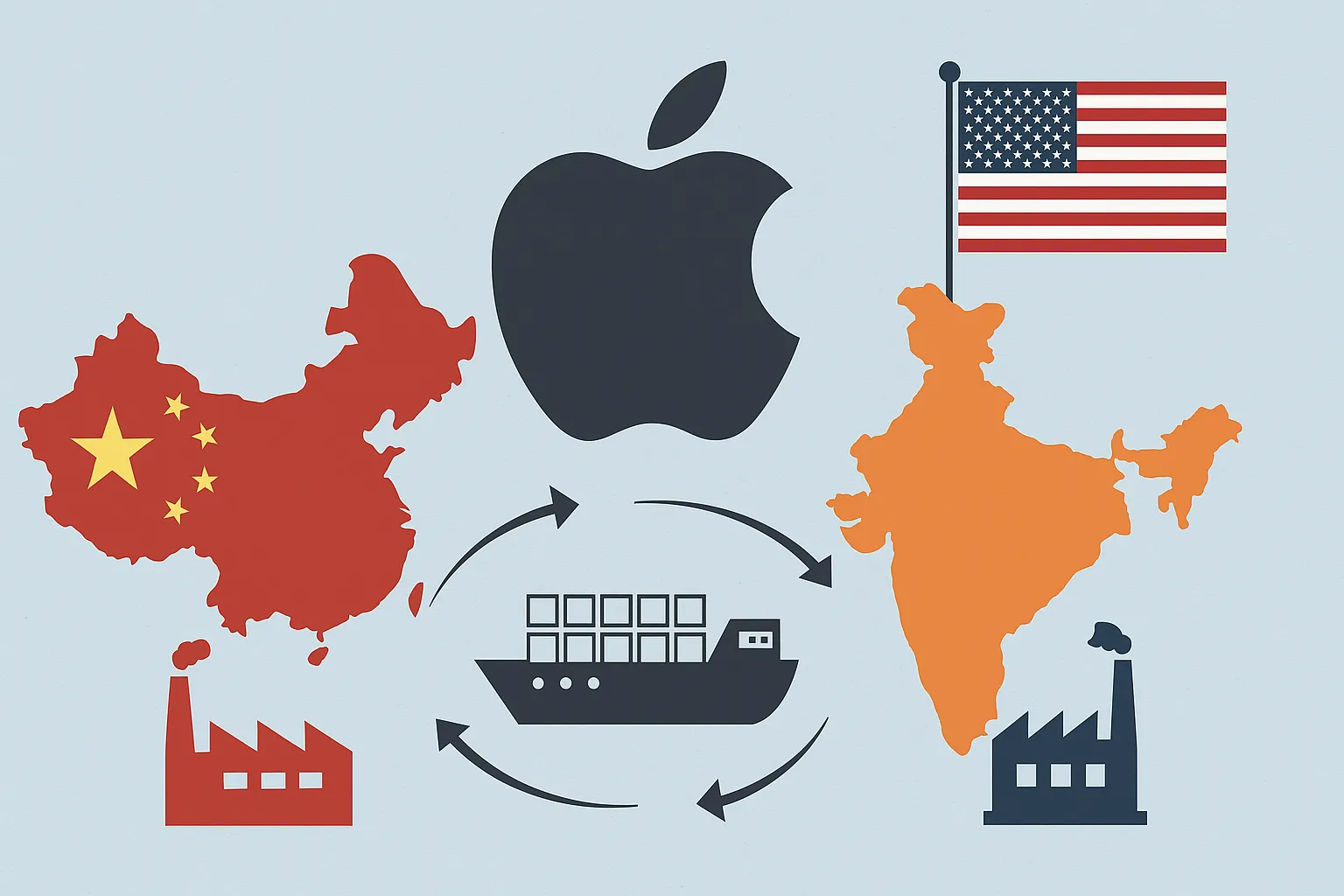

As geopolitical tensions rise and global supply chains are reshaped, one of the world’s biggest tech giants—Apple—is quietly making a historic shift: moving a significant portion of its manufacturing base from China to India.

This isn’t just a business decision. It’s a major realignment in global power dynamics, involving the United States, China, and India—three of the most influential economies today.

So why is this shift happening? What does it mean for India? Is the US being hypocritical in its global manufacturing strategy? And if the US is so developed, why doesn’t it manufacture Apple products on its own soil?

Let’s break it all down.

Why Was China Apple’s Manufacturing Hub for So Long?

For over a decade, China was Apple’s go-to manufacturing base. And for good reason:

- Established Supply Chains: China built a mature and efficient electronics ecosystem where everything—from microchips to machinery—was locally available.

- Affordable Skilled Labor: China offered high-quality workmanship at low costs, perfect for large-scale production.

- Government Support: China welcomed tech giants with subsidies, tax breaks, and fast-tracked clearances—making it a dream location for companies like Foxconn (Apple’s main manufacturing partner).

But over time, cracks began to appear…

Why Is Apple Shifting Out of China?

Several major events forced Apple to reconsider its China-heavy approach:

1. US-China Trade War

- Under Donald Trump, the US imposed hefty tariffs on goods imported from China.

- Apple, with a majority of its products made there, started feeling the pinch.

2. COVID-19 Lockdowns

- China’s strict lockdowns during the pandemic caused severe disruptions to Apple’s supply chains.

- Production delays, revenue losses, and bottlenecks forced Apple to rethink its risk exposure.

3. Geopolitical Uncertainty

- Tensions between China and Taiwan (a key chip supplier) increased fears around over-dependence on one country.

The result? Apple needed a Plan B. Enter: India.

Why Is Apple Betting Big on India?

India is emerging as the next big manufacturing hub for Apple—and the reasons are compelling:

Key Advantages:

- Low-Cost Labor: Similar to China, labor in India is affordable and increasingly skilled.

- Growing Market: Apple sees huge sales potential in India, both as a manufacturing base and a consumer market.

- Government Support: India’s Production Linked Incentive (PLI) schemes are attracting global players with tax rebates and subsidies.

- Global Perception: As a democracy with a rising global profile, India is viewed as a trustworthy alternative to China.

But There Are Challenges Too:

- India’s infrastructure (like roads, ports, logistics) is still catching up.

- The electronics supply chain isn’t as mature yet.

- Some key materials and components still need to be imported.

But Why Not Manufacture in the US Itself?

If the US is the most advanced economy in the world, why doesn’t Apple just manufacture everything back home?

1. High Labor Costs

- A factory worker in the US earns 5–10x more than one in India or China.

- Add health insurance, employee protections, and safety regulations—it becomes too expensive to manufacture at scale.

2. Weaker Manufacturing Ecosystem

- China and now India have local suppliers for almost every component.

- In the US, most parts must be imported, raising costs and complexity.

3. Division of Labor: Innovate in the US, Build in Asia

- US companies like Apple focus on design, software, R&D, and marketing.

- They outsource physical manufacturing to countries with cost advantages.

“Designed in California. Assembled in India or China. Sold worldwide.”

4. US Lost Its Mass-Manufacturing Culture

- Since the 1980s, the US has shifted from factories to finance, tech, and services.

- Most large-scale production was outsourced to cheaper countries.

So, for Apple, manufacturing abroad isn’t about capability. It’s about cost-efficiency and strategic focus.

The Tariff Twist: Is the US Being Hypocritical?

While the US under Trump increased tariffs on Indian exports to “protect American workers,” it simultaneously encouraged US companies to shift production out of China—to places like India.

So Apple moving to India:

- Reduces reliance on China (good for US strategy)

- Boosts Apple’s profit margins (good for business)

- But doesn’t bring jobs back to the US (bad for “Make in America” ideal)

This contradiction leads many to label it hypocrisy or double standards.

But in reality? It’s simple:

“For the US, profits > politics.”

Will This Move Hurt India-China Relations?

Potentially, yes.

Risks:

- India helping Apple reduce reliance on China might be viewed by Beijing as hostile or as siding with the West.

- It could add friction to already tense India-China relations, especially after military standoffs along the border.

But India’s Playing It Smart:

- India hasn’t officially taken sides.

- It’s pursuing economic growth and foreign investment, not making political statements.

So while risks exist, India is focusing on opportunity, not opposition.

Winners & Losers in This Global Shuffle

Apple, in diversifying its supply chain, stands to gain a more resilient global operation, with less dependency on China, lower manufacturing costs, and a broader supply chain network. However, the company faces initial setup costs and the challenge of adapting to India’s manufacturing ecosystem. For India, this shift brings job creation, foreign investment, and an enhanced global manufacturing profile, but it may also place strain on existing infrastructure and risk further tension with China. The US benefits from Apple’s continued profitability and reduced reliance on China, but domestic manufacturing jobs aren’t returning. For China, the move means losing business from top global brands like Apple and a reduction in its leverage over global electronics manufacturing.

Why Is the US Still Called “Developed” If It Depends on Other Countries for Manufacturing?

Because in today’s world, value = ideas + brand + capital, not just factories.

1. Innovation Pays More Than Labor

- Apple’s design, iOS software, and branding are all done in the US.

- Manufacturing may only earn $5–10 per device for workers abroad, but Apple earns $300–400 in profit per iPhone.

2. Brand > Factory

- People buy Apple for its trust, ecosystem, and user experience—not for where it’s assembled.

3. Knowledge Economy

- The US leads in technology, finance, education, and global capital.

- It owns the innovation and captures most of the value—even if the product is physically built elsewhere.

What’s Next for India and China?

China is no longer just a factory—it’s building its own tech brands (Huawei, DJI, BYD) and innovating in AI and EVs.

India, too, is stepping into high-tech sectors—semiconductors, AI, EVs, and now Apple.

The future of a nation’s power isn’t just about how much it builds—but how much it creates, owns, and exports intellectually.