Chinese stocks experienced their largest single-day surge in 16 years on Monday, fueled by robust stimulus measures from Beijing. Domestic A-shares recorded their highest-ever turnover as investors rushed to capitalize on the rally, with the CSI300 blue-chip index closing up 8.5%, marking a nearly 30% increase since its February low.

This dramatic rise comes as the broader Shanghai Composite Index soared 8.1%, achieving a total turnover of 1.17 trillion yuan ($166.84 billion) and a five-day gain of 21.4%—the highest since 1996. The Shenzhen index also saw significant gains, surging 11% with a turnover of 1.4 trillion yuan.

Last week, the Chinese government announced aggressive stimulus measures aimed at reviving the faltering economy, including substantial interest rate cuts and fiscal support. The People’s Bank of China introduced new tools to enhance market liquidity, facilitating access to funding for institutional investors to buy stocks.

This has led to a substantial turnaround for Chinese equities, which had recently been hovering near multi-year lows. Investor sentiment has shifted dramatically, with many fearing they would miss out on potential gains ahead of a week-long holiday starting Tuesday.

Additional support came from news that banks would lower mortgage rates for existing home loans by October 31, alongside various cities lifting restrictions on property purchases. These developments propelled shares of property companies and consumer staples, boosting overall market optimism.

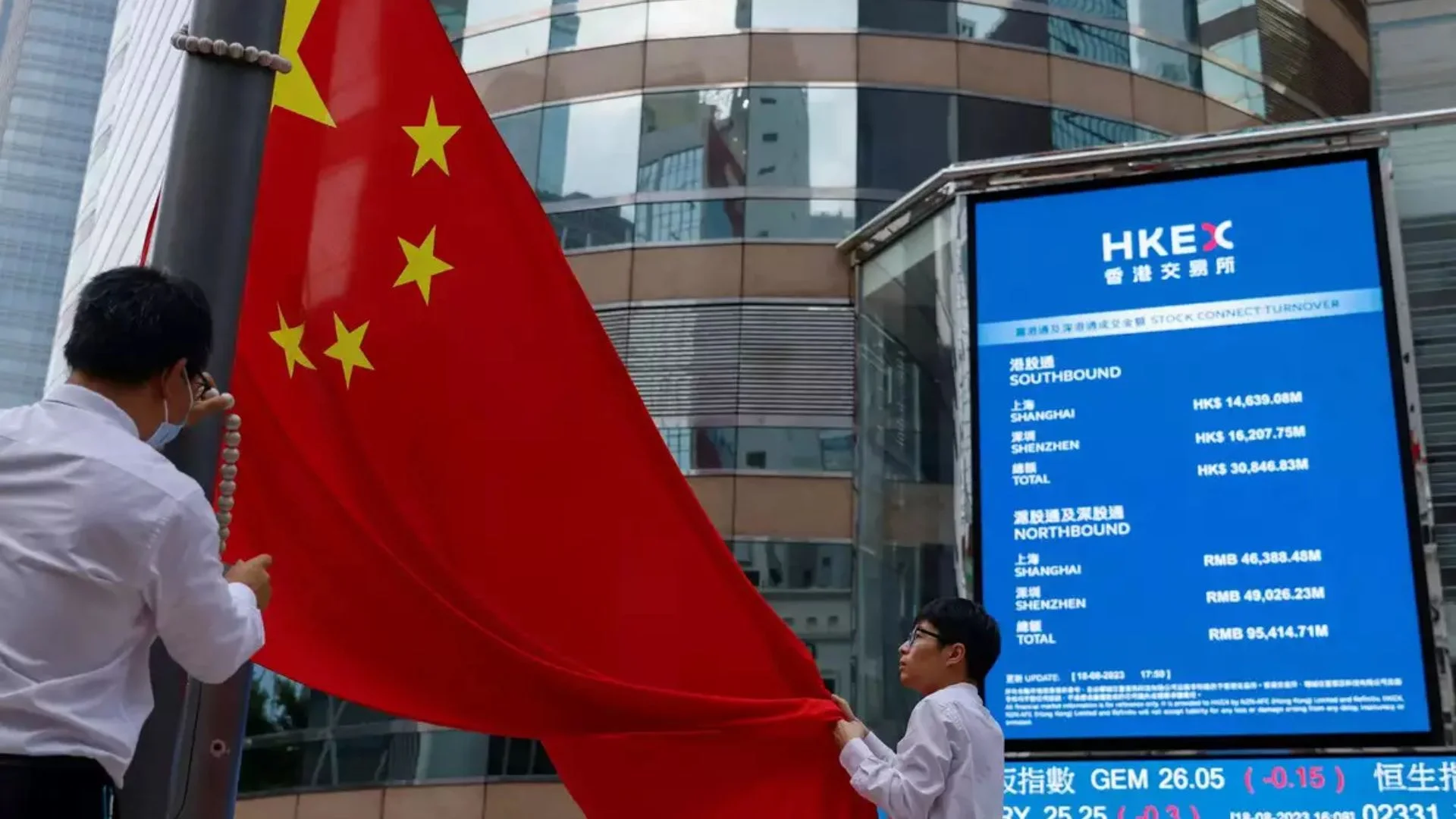

As mainland financial markets prepare to close for the National Day holidays from October 1-7, the CSI300 index recorded a 21% gain for September—its best performance since December 2014—while the Shanghai Composite Index saw a 17% increase. The Hang Seng Index in Hong Kong rose 2.4% on Monday, up roughly 24% for the year, becoming Asia’s top-performing stock market.