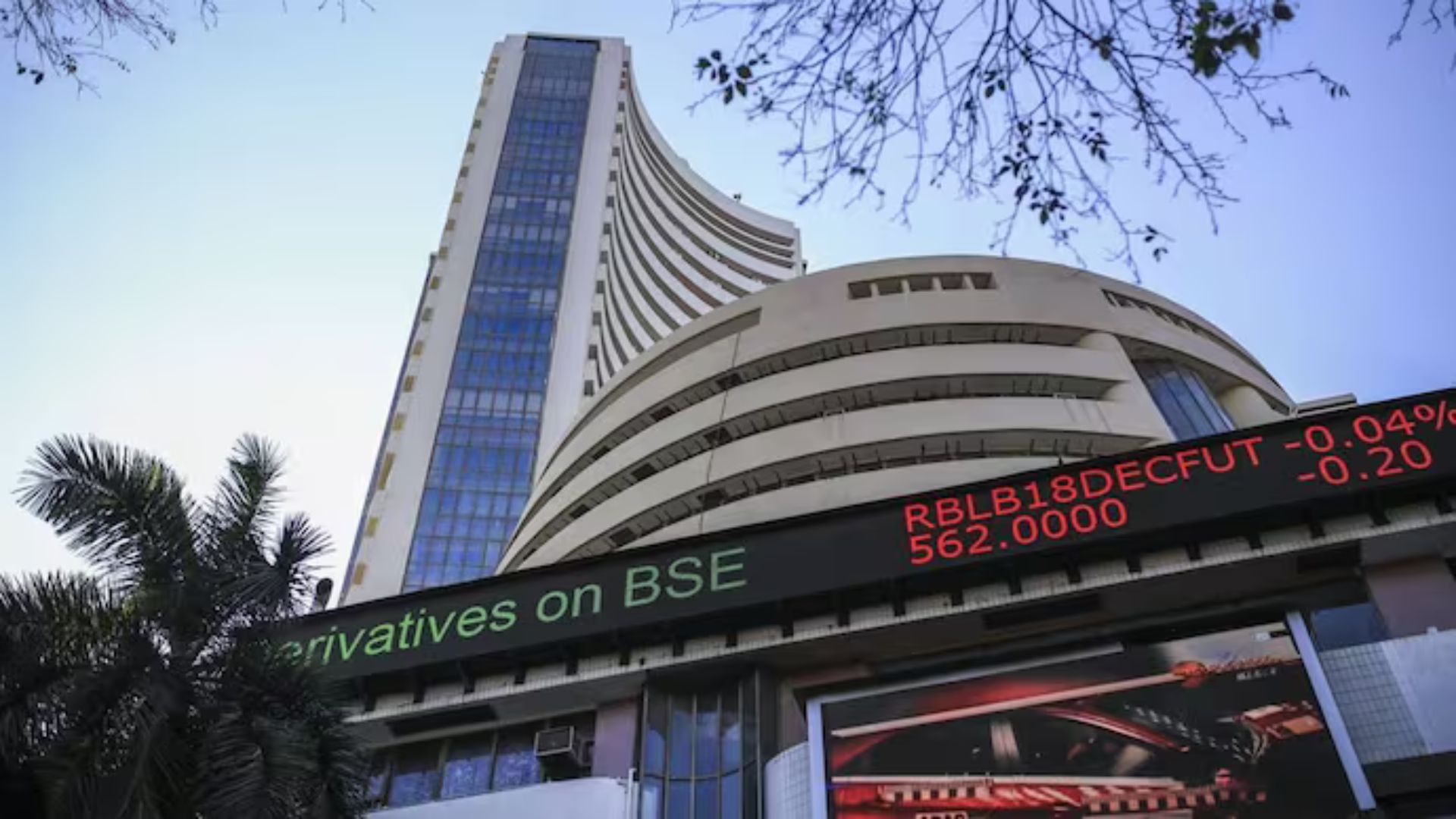

Indian stock indices surged to new heights for the fifth consecutive session on Thursday, with the Sensex almost reaching the 86,000 mark. The Sensex closed at 85,836.12 points, up by 666.25 points or 0.78%, while the Nifty ended at 26,186.00 points, gaining 181.85 points or 0.70%. Among the sectoral indices, Nifty Auto and Nifty Metal were the top performers, rising by 2.26% and 2.13%, respectively.

The recent decision by the US Federal Reserve’s monetary policy committee to cut interest rates by 50 basis points has provided fresh support to Indian stocks. The rate cut has triggered a flight of capital to markets like India, where policy rates are higher.

Foreign portfolio investors (FPIs) have also been buying Indian stocks, investing a total of Rs 49,459 crore in September alone, as per NSDL data. This marks the fourth consecutive month of net buying by FPIs. However, VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services, advised caution, suggesting that while FIIs may shift funds to other markets like China and Hong Kong, domestic liquidity could absorb any potential selling pressure. He also recommended prioritizing safety and focusing on large-cap stocks, particularly in the Bank Nifty segment, which offers valuation comfort.