-

Supreme Court: Double Taxation Avoidance Agreement Cannot Be Enforced Unless Notified By Centre Under Section 90 Of Income Tax Act

-

Allahabad High Court: Notice Without Din Not Invalid, If Assessee Responds To Manual Notices| S. 148 Income Tax Act

-

ITAT: Income Tax Deduction Allowed On The Interest Income Received From The Co-operative Bank Under Section 80P(2)(d) of the Income Tax Act

-

ITAT: IBC Has Overriding Effect On All The Acts Including Income Tax Act

-

ANALYSIANG SECTION 194R OF THE INCOME TAX ACT

-

SUPREME COURT: EVEN IF THE REGISTRATION APPLICATION IS NOT DECIDED WITHIN SIX MONTHS U/SEC 12AA OF THE INCOME TAX ACT NO DEEMED REGISTRATION WILL BE THERE

-

8 STAGES OF ASSESSEMENT/REASSESSMENT PROCEDURE UNDER INCOME TAX ACT, 1961

-

Supreme Court Affirms Acquittal: Sec 138 NI Act – Accused Relies On Income Tax Returns To Show Complainant Did Not Have Financial Capacity

-

Tax Benefits Every Small Business Owner Should Know About

-

Adani Energy Solutions Reports 172% Surge in Q2 Profits, Total Income Rises 68.9%

-

Trump’s Economic Plan: Tariffs, Tax Cuts, And Energy Reforms

-

India’s Income Tax Overhaul: Government Launches Revamp Process

-

18% GST Decision On Transactions Under 2000 Delayed, Fitment Committee to Review

-

Tax-Saving Mutual Funds: How To Invest And Reap The Benefits

-

Flying Abroad? CBDT Clarifies When You Need A Tax Clearance Certificate

-

Kamala Harris’s Economic Proposal: New Affordable Homes and Tax Cuts for 100 Million Americans

-

Do Olympic Medalists Pay Taxes On Gifts And Rewards?

-

Record-Breaking ITRs Filed; Direct Tax Collections Surge 24% to Rs 8.1 Lakh Crore

-

Tax Odyssey: From Raj to Reform

-

Union Budget 2024-25: Controversy Over Health Insurance Taxation

-

Akhilesh Yadav’s Fiery Response to Income Question Goes Viral: ‘Stop This Bullst…

-

![Income Tax-Free Havens: Explore The World’s Top Tax-Free Countries]()

Income Tax-Free Havens: Explore The World’s Top Tax-Free Countries

-

Katy Mirza, The Actress Who Played A Role In Unseating Indira

-

Centre Clarifies ‘Not All Residents’ Need Tax Clearance for Foreign Travel

-

Over 5 Crore ITRs Filed As Deadline Nears: Income Tax Dept’s Update

-

![TAX FREE LIFE : COUNTRIES WITH ZERO INCOME TAX]()

TAX FREE LIFE : COUNTRIES WITH ZERO INCOME TAX

-

100% Income Tax-Saving Trick? Karnataka Man’s Humorous Video For Salaried Class Goes Viral

-

Tax Clearance Certificate Now Mandatory For Leaving India

-

Old vs New Income Tax Regime: What Will Be Beneficial For Whom?

-

Will the Budget 2024 Make You Richer or Poorer? Key Factors That Will Affect Your Finances

-

![Income Tax Regime 2024]()

Income Tax Regime 2024

-

Tharoor and Chidambaram Praise Angel Tax Abolition But Criticize Budget’s Overall Impact

-

Budget 2024: Revised Tax Slabs And Increased Standard Deductions By Rs. 25,000

-

Budget 2024: Gold Shines With Import Duty Cuts, Middle Class Rejoices With Tax Relief

-

Budget 2024: Taxpayers and Pensioners to Benefit from New Simplified Tax Measures

-

Budget 2024: Major Revisions in Income Tax Slabs, Standard Deduction Increased to Rs 75,000

-

Union Budget 2024-25: Key Expectations and Impact on Mutual Funds Sector

-

![A Quick Guide: File Income Tax Return Online For Free]()

A Quick Guide: File Income Tax Return Online For Free

-

Budget 2024: Six Key Income Tax Benefits for Taxpayers to Watch Out For

-

Income tax Budget 2024 Expectations: 5 Key Demands Salaried Taxpayers Have for FM Nirmala Sitharaman on July 23

-

Delhi Man Pays Rs. 50,000 CA Fee For Income Tax Notice Over 1 Rupee Dispute

-

Union Budget To Be Presented On July 23, Here’s What Taxpayers Can Expect In Potential Income Tax Adjustments

-

ITR Filing 2024: What Documents Are Required At The Time Of Filing An Income Tax Return?

-

![Income Tax ITR Filing 2024 : Step-By-Step Guide To Register Online For E-Filing]()

Income Tax ITR Filing 2024 : Step-By-Step Guide To Register Online For E-Filing

-

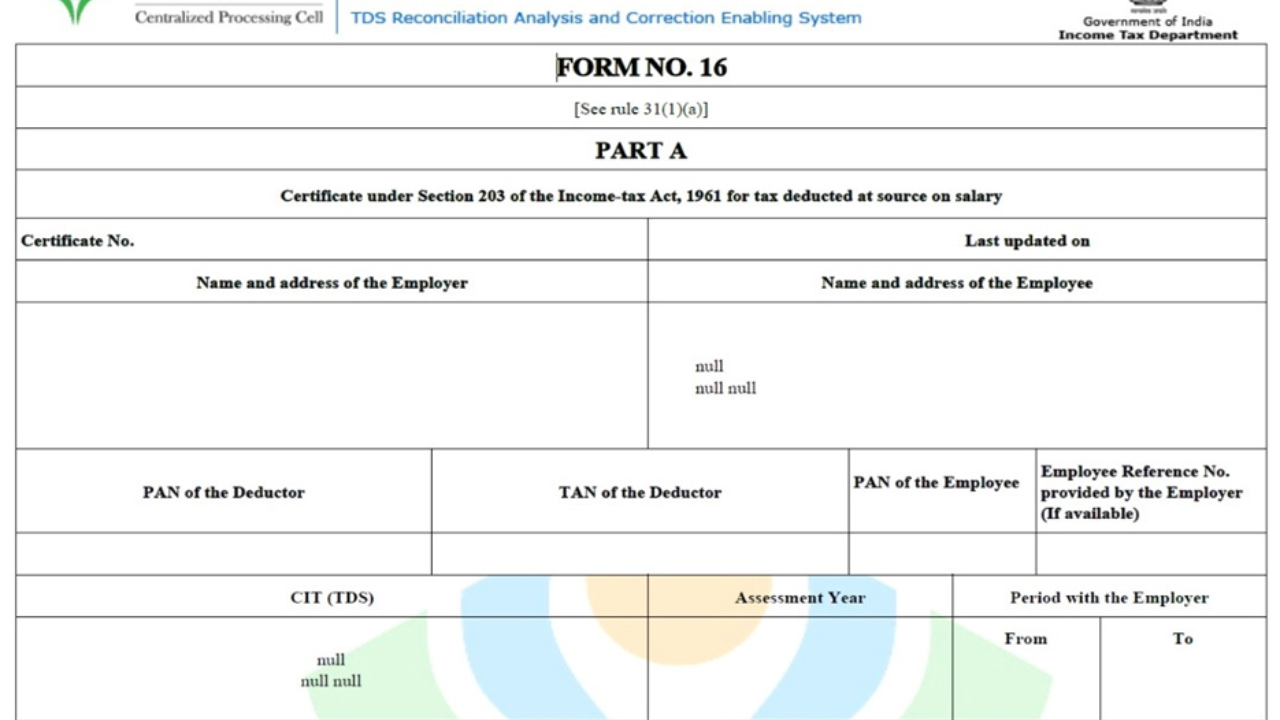

Form 16: Are You Checking These Top Points Before Filing Your Income Tax Return?

-

Modi 3.0’s First Budget Could Bring Relief in New Tax Regime | Key Insights

-

ITR Filing 2024: Mismatch Between Form 16 And Form 26AS Could Trigger Tax Notice

-

Income Tax Refund Delays: Reasons And Solutions For Awaited Refunds

LOAD MORE

No More

Advertisement

Advertisement