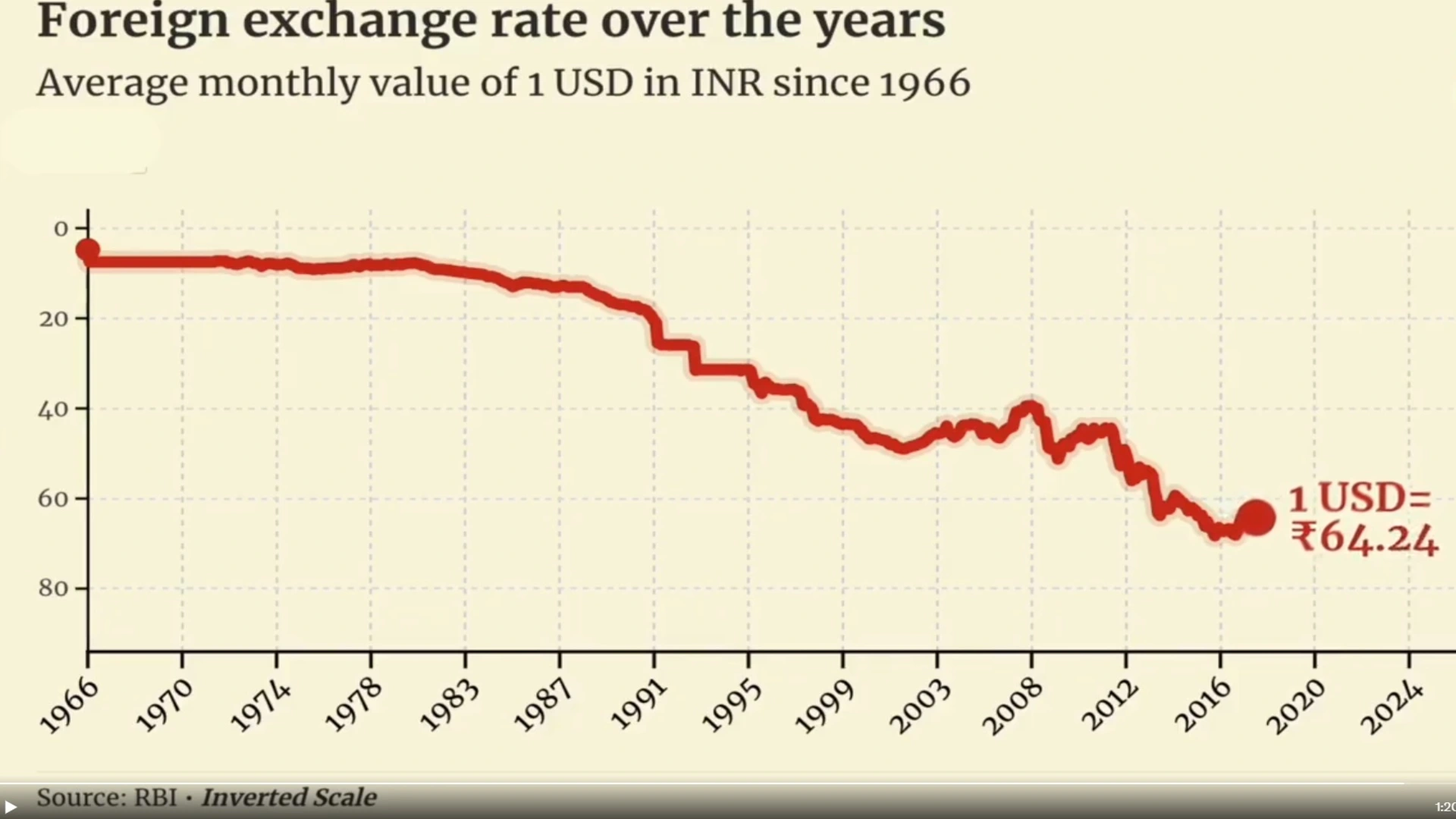

The Indian Rupee’s journey against the US Dollar reflects the evolution of India’s economic policies, global events, and financial reforms over the decades. From 1966 to 1983, the rupee remained relatively stable, with the exchange rate staying under Rs 10 per US dollar. However, the economic landscape shifted dramatically thereafter.

WATCH

PTI INFOGRAPHICS | The Indian Rupee's exchange rate with the US Dollar has changed significantly over the years. From 1966 to 1983, the average monthly rate stayed below ₹10, hitting ₹10 for the first time in 1983. After dipping to ₹13 in 1988, it plummeted to ₹49 by 2002. A… pic.twitter.com/LmN6vdRwQW

— Press Trust of India (@PTI_News) September 25, 2024

In the 1980s, the rupee began to devalue, reaching Rs 13 by 1988. This was largely due to India’s growing trade deficit and inflationary pressures. By 1991, India faced a major balance of payments crisis, leading to economic reforms and liberalization. As a result, the rupee was allowed to float more freely, and by 2002, the exchange rate had plummeted to Rs 49 per dollar.

The period between 2002 and 2007 saw some recovery as India’s economy grew rapidly, strengthening the rupee, which briefly dipped below Rs 40 in 2007. However, the 2008 global financial crisis, coupled with rising oil prices and slowing growth, reversed this trend, and the rupee began weakening again.

Since 2012, the rupee has been on a steady decline due to multiple factors, including a strong US dollar, high inflation, and global uncertainties. By September 2024, the rupee had weakened to around Rs 83.60 against the dollar.

Also read: Wildfire Sweeps Through Quito As Ecuador Battles Historic Drought Crisis

This long-term decline reflects India’s evolving economic challenges, such as trade deficits and global market dynamics. Today, exchange rates are influenced by complex factors like global oil prices, foreign investments, inflation, and India’s trade policies.