The RBI’s Monetary Policy Committee (MPC) opted to maintain the repo rate at 6.50% on June 7, 2024. Consequently, there will be no immediate impact on real estate or home loan EMIs, as banks are unlikely to adjust their lending rates in the near future.

The repo rate, administered by the Reserve Bank of India (RBI), holds significant sway over home loan interest rates in the country. Fluctuations in interest rates directly influence demand in the real estate sector. Lower interest rates typically stimulate demand by making borrowing more accessible, potentially driving property prices upward. Conversely, higher interest rates may dampen demand and lead to softer property prices.

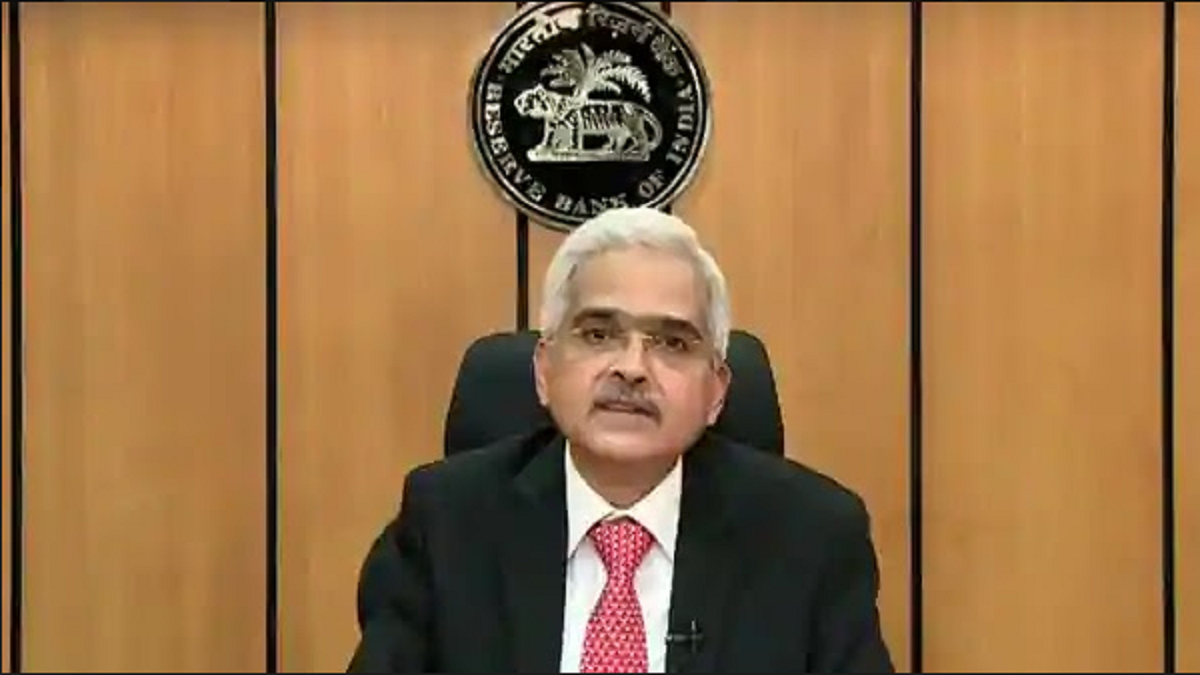

RBI Governor Shaktikanta Das says "GDP growth that we are now projecting for the current financial year 2024-25 is 7.2% with Q1 at 7.3%, Q2 at 7.2%, Q3 at 7.3%, and Q4 at 7.2%. The risks are evenly balanced." pic.twitter.com/ANWPhBXbA8

— ANI (@ANI) June 7, 2024

Experts anticipated the RBI to maintain the status quo on interest rates due to lingering concerns about inflation, despite recent rate reductions by the European Central Bank and Bank of Canada. According to a research paper by SBI, the central bank deems it necessary to continue its current stance of withdrawal of accommodation.

Ashish Agarwal, Director of AU Real Estate, noted, “Keeping the repo rate unchanged will ensure affordability for potential homebuyers, sustaining momentum in the housing market.” He emphasized the role of consumer demand in driving luxury housing and its contribution to macroeconomic indicators and the country’s growth.

S K Narvar, group chairman of Trident Realty, echoed similar sentiments, stating that stability would enable informed decisions by homebuyers, thereby driving demand for luxury housing and contributing to economic growth. He highlighted the current economic environment characterized by stable inflation rates and robust GDP growth as conducive to the real estate sector’s growth.

Repo rate changes have a direct impact on home loans:

Existing borrowers with floating-rate home loans feel the immediate impact of repo rate changes, while those with fixed-rate loans are not immediately affected. The RBI prioritizes controlling inflation, given the current inflationary pressures in the economy, believing that maintaining the current rate strikes a balance between inflation management and economic growth stimulation.