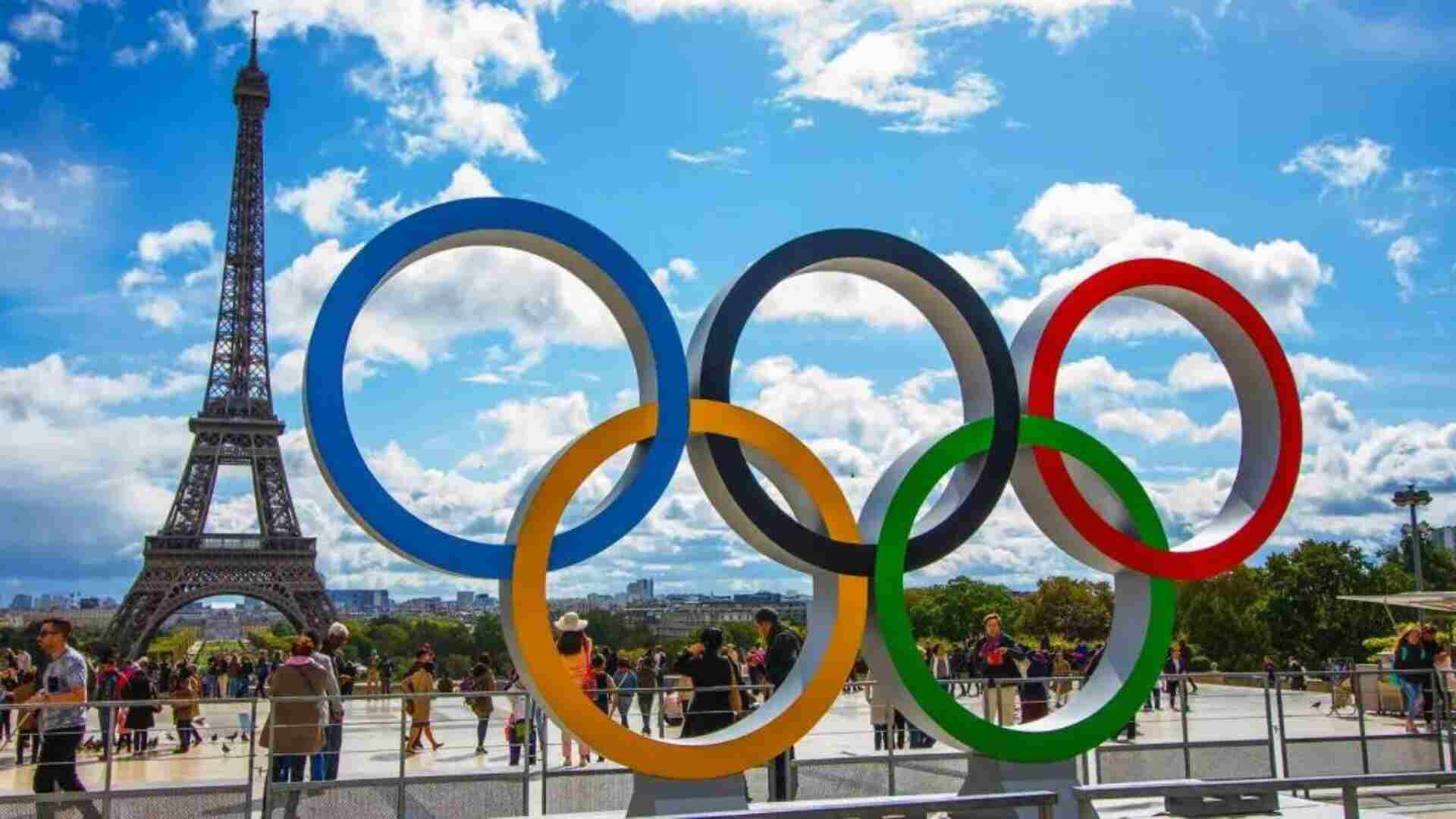

When the Olympic Games begin on July 26, the stands are likely to be filled predominantly with French spectators.

According to Paris je t’aime, the city’s tourism board, Paris anticipates hosting 11.3 million visitors during the Olympic weeks, with only 1.5 million expected to be international tourists.

While this visitor count will ensure busy stadiums, businesses such as hotels, airlines, and travel agencies are experiencing disappointment instead of the anticipated surge.

Alan Bachand, the owner of sports travel firm 14sb, has traditionally capitalized on major events like the Super Bowl, FIFA World Cup, and Olympics by purchasing blocks of hotel rooms in advance and bundling them with tickets at competitive rates for avid fans.

However, Bachand stated to Bloomberg that this year’s sales have fallen short by 80% compared to his expectations based on previous Olympic Games.

“This is the first time in 25 years that we will accept less money than we paid for hotel rooms that we contracted 30 months ago,” he says.

At this stage, Bachand is aiming to at least break even rather than incur losses from the event. However, he remains uncertain if achieving this goal will be feasible.

Airlines are facing similar challenges. Delta Air Lines Inc. projected losses of $100 million as travelers chose to avoid France during the Olympics, resulting in excess unsold seats. Air France, which increased its flight capacity to Paris from US cities by 15% during the games, finds itself in a comparable situation. Its parent company, Air France-KLM, has reported revenue losses of at least 180 million euros ($195.5 million) for July and August, attributing these losses to the Olympics. With many of the additional seats still unsold, the airline is reducing prices, particularly for customers booking with points, where the extent of discounts is less transparent.

“Cities with non-stop flights to Paris like New York, Chicago, Atlanta and L.A. still have jaw-dropping reward flight availability for late July and into August during the Paris Olympics,” said Gilbert Ott, a spokesman for point.me, a reward travel search engine. “In recent days, I’ve found flights on Air France from New York for 20,000 points one-way, Atlanta for 15,000 one-way, or even further afield like Los Angeles for 30,000 one-way.”

This amounts to approximately $200, based on the usual exchange rate of one cent per point.

The trend is widespread across the industry. While international flights to Rio de Janeiro surged by 115% year-over-year during its Olympics in 2016, Paris has only experienced an 8% increase, according to data from travel analytics firm ForwardKeys.

Bachand notes that travelers are not hesitant to spend money currently, but they recognized that prices were too steep. “People want to go but they’re also willing to hold out,” he remarks, mentioning that many travelers preferred to delay their plans to see how geopolitical developments and the outcome of the French election unfolded, which would provide more clarity on safety concerns before committing to travel.

As the July 26 opening ceremony approaches, hotels are growing increasingly anxious. The rush to increase occupancy rates by lowering nightly rates and removing minimum stay requirements is evident across nearly all segments of Paris’s hotel industry, encompassing both apartment rentals and luxury hotels.

This trend occurs against the backdrop of a record year for tourism in Europe, with international visitors, largely driven by Americans, expected to contribute €800 billion to the region’s economy.

“To stay competitive with other Parisian hotels, we are forced to lower our prices because many properties initially set very high prices and have been continuously lowering them for months,” says Orso Hotels’ Director of Operations Gilles Le Bras.

The Wallace, a boutique four-star hotel offering rooms at approximately €410 ($446) per night, has been one of its top performers, likely due to its proximity to various Olympic venues, according to sources. On Priceline, its room rates have recently been further discounted, selling for $340 during the initial week of the games.

Another four-star hotel, Hôtel Dame des Arts, situated in the Latin Quarter, is providing a 15% discount code for stays between July 26 and August 11. They are encouraging potential guests to use the promotion by August 8, hoping to attract last-minute travelers.

According to CoStar data released on June 26, hotel occupancy levels in Paris during the event are around 80%. This is notably lower than the average hotel occupancy rates seen during the London 2012 Olympics (88.6%) and the Rio 2016 Olympics (94.1%).

Not all hotels are reducing prices, and those that maintained reasonable rates from the start are coming out ahead. For instance, Generator, which offers a combination of hostel and traditional hotel rooms, has seen its gross rates increase compared to last year. The price for the cheapest category, a bed in a large dorm room, is currently around €76 per night, double the €38 charged at the same time last year. Private rooms are priced at €205, marking a 72% increase from 2023 rates.

Securing tickets to highly sought-after events like track-and-field and swimming typically requires months of advance planning. As a result, it’s improbable that a sudden surge of spontaneous tourists will fill empty rooms in the City of Lights. Families and friends of athletes who have recently secured spots on national teams, some as recently as the past month, have already made their travel arrangements by now.

“We are not seeing a last-minute boom,” Orso’s Le Bras says.

Bachand has already labeled the event as a “miss,” shifting his focus to next year’s Super Bowl. However, he hasn’t completely ruled out future opportunities in Paris. “We’ll break even if we can sell just 100 more hotel rooms, and the last-minute deals are really good.”