The bright growth prospects of the Indian economy in 2024-25 supported by strengthening rural demand, rising consumer confidence, optimism on employment and income, strong prospects of the manufacturing and services sectors are among the factors cited by Reserve Bank of India Governor in pushing for a vote to keep the policy repo rate unchanged at 6.50 per cent. “The strong growth momentum, together with our GDP projections for 2024-25, give us the policy space to unwaveringly focus on price stability.

Price stability is our mandated goal and it sets strong foundations for a period of high growth,“ said Das, emphasising on continuity with withdrawal of accommodation, at the 48th meeting of the Monetary Policy Committee of the RBI (April 3-5), 2024, the minutes of which were released on Friday. The meeting also saw members Shashanka Bhide, Ashima Goyal, Rajiv Ranjan, Michael Debabrata Patra and Shaktikanta Das voting on status quo.

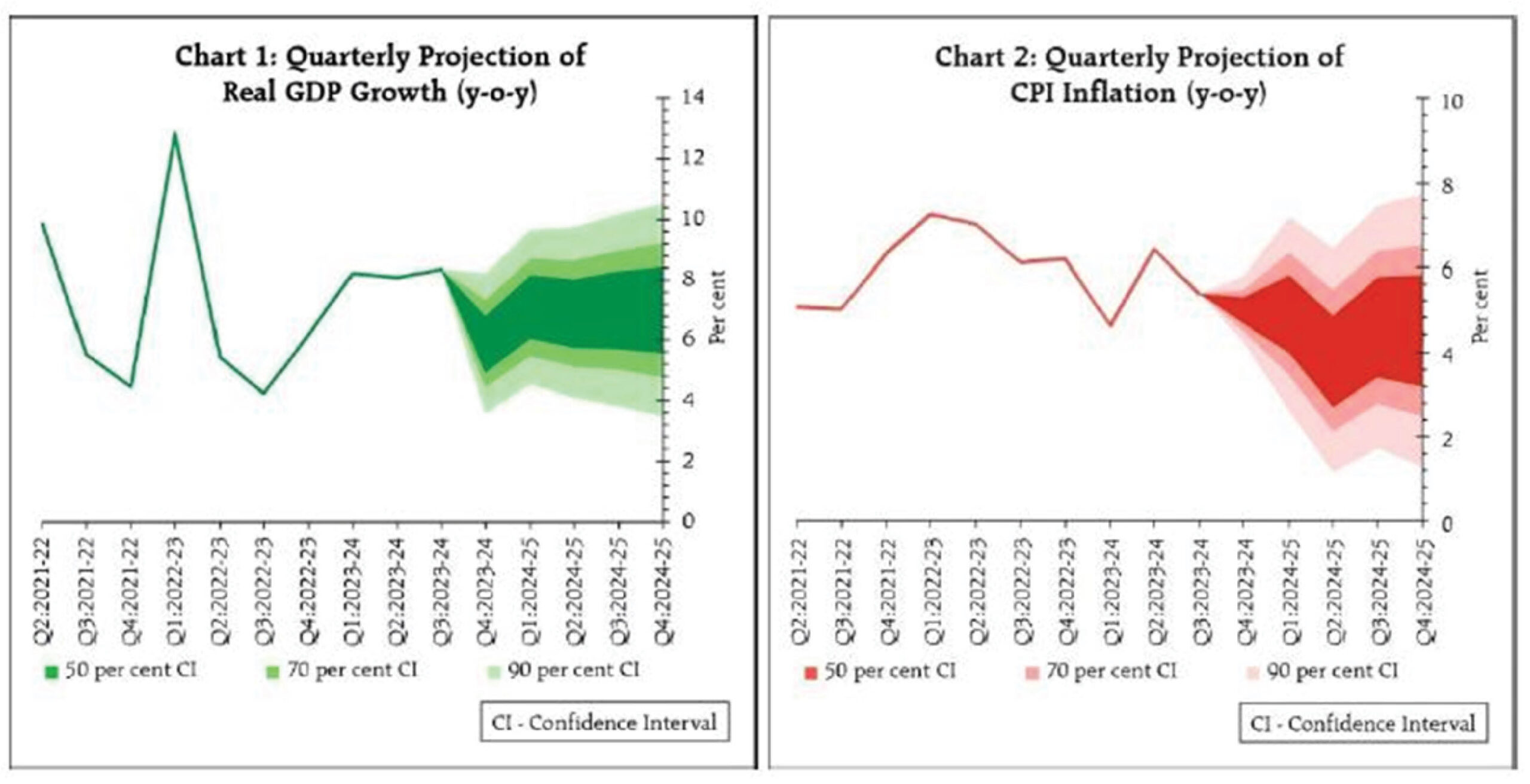

The MPC underlined the strong momentum in the domestic economy, the GDP expansion at 7.6 per cent in 2023-24 on the back of buoyant domestic demand, strong investment activity and a lower drag from net external demand. According to Das, upbeat business outlook of firms, healthy corporate and bank balance sheets, upturn in private capex cycle with capacity utilisation ruling above the long period average can be expected to give further boost to domestic investment activity. Das was positive that improving global growth and international trade prospects may provide thrust to external demand. With the Indian economy is growing at a robust pace of an average annual rate of 8 per cent, the last three years has seen India continuing to be the fastest growing major economy in the world, supported by an upturn in investment cycle and revival in manufacturing. Services sector continues to grow at a strong pace, Das noted.

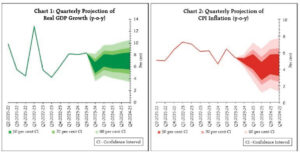

The RBI Governor also expressed satisfaction over the CPI headline inflation during January-February 2024 which has stayed at 5.1 per cent in each of the months, and moderated from the elevated level seen in December 2023 when it was 5.7 per cent. While the persistent and broad-based softening in CPI core inflation (CPI excluding food and fuel inflation) by 180 bps since June 2023 is driving the disinflation process, Das expressed concern that volatile and elevated food inflation is disrupting its pace.

Going ahead, while the baseline projections show inflation moderating to 4.5 per cent in 2024-25 from 5.4 per cent in 2023-24 and 6.7 per cent in 2022-23.

Das advised caution against getting distracted — by the success in the disinflation process — from the vulnerability of the inflation trajectory to the frequent incidences of supply side shocks, especially to food inflation due to adverse weather events and other factors. Das also flagged overlapping food price shocks, which apart from imparting volatility to headline inflation, may also result in spillovers to core inflation. “Lingering geo-political tensions and their impact on commodity prices and supply chains are also adding to uncertainties in the inflation trajectory,” observed Das, suggesting that these considerations should dictate the need for the monetary policy actions to tread the last mile of disinflation with extreme care.

Besides, market expectations are also closely aligned with that of the MPC, monetary policy transmission is continuing and inflation expectations of households are also getting further anchored, Das pointed out.

At this stage, Das pointed out, the gains in disinflation achieved over last two years have to be preserved and taken forward towards aligning the headline inflation to the 4 per cent target on a durable basis.

The RBI Governor and other members of the MPC were unanimous in the view that the global economy exhibiting resilience is likely to maintain its steady growth in 2024.

Inflation is treading down, supported by favourable base effects though stubborn services prices are keeping it elevated relative to targets and as the central banks navigate the last mile of disinflation, financial markets are responding to changing perceptions on the timing and pace of monetary policy trajectories, the MPC agred.