Indian stock indices saw gains on Tuesday as they followed encouraging cues from US markets and were helped by ongoing decrease in retail inflation. Sensex and Nifty were 0.5 per cent higher each when writing this report. S&P 500 index in the US closed almost 1 per cent higher on Monday.

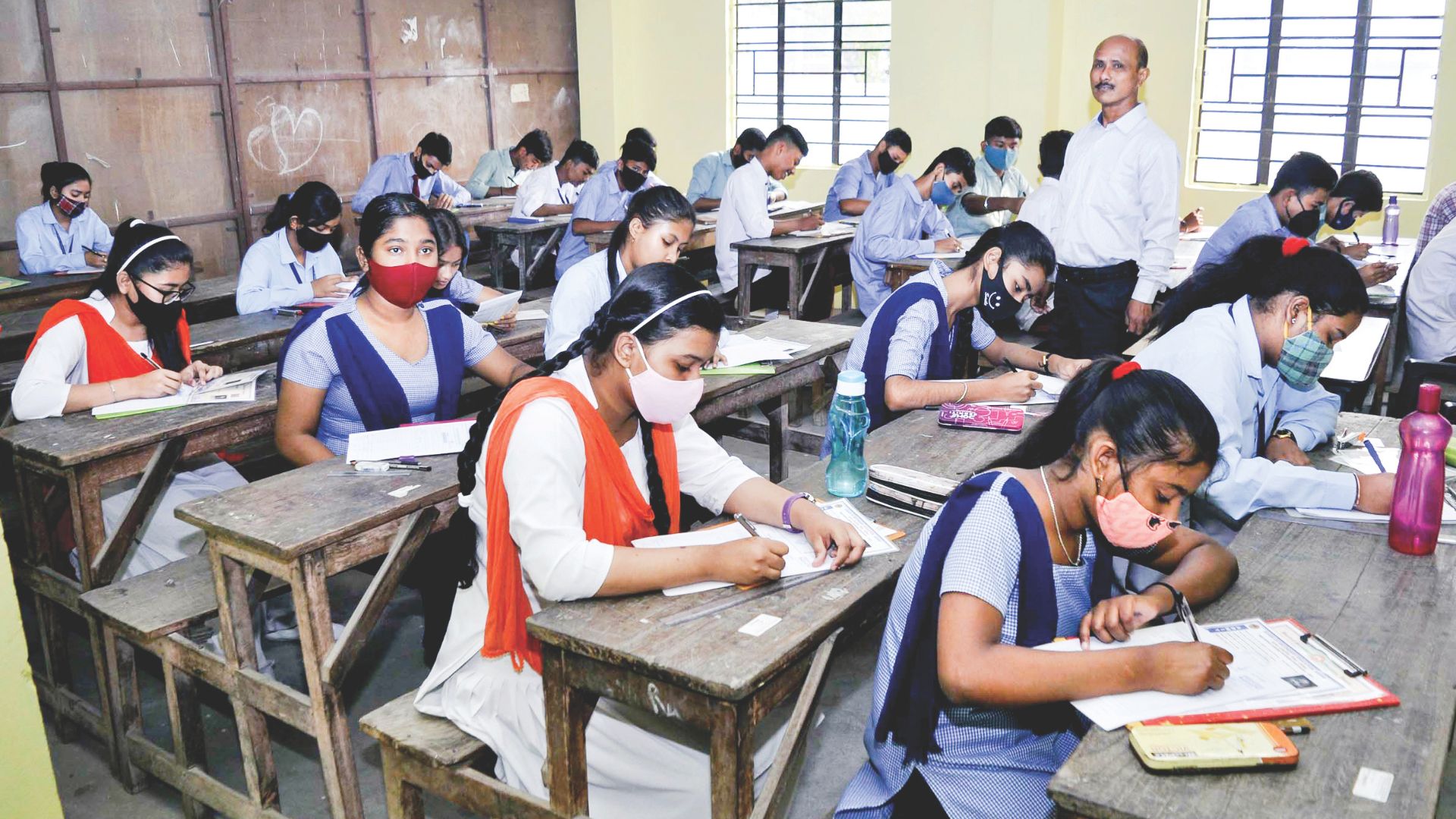

Retail inflation in India further eased in May to 4.25 per cent, hitting a two-year low. It was at 4.7 per cent in April and 5.7 per cent the previous month.

In India, retail inflation (Consumer Price Index) peaked at 7.8 per cent in April 2022 to a two-year low now, driven by a reduction in food and core inflation. In some advanced countries, inflation had in fact touched a multi-decade high and even breached the 10 per cent mark.

Notably, RBI lowered India’s inflation projection for 2023-24 to 5.1 per cent against its April estimate of 5.2 per cent.

Asian stocks opened mixed Tuesday with support from a rally on Wall Street amid optimism that the Federal Reserve will pause its monetary policy tightening, said Deepak Jasani, Head of Retail Research, HDFC securities.

All eyes are now on the US Fed policy outcome for cues, scheduled on June 14.

The US monetary policy committee, seeking to achieve inflation at 2 per cent over the longer run, hiked the key interest rate by another 25 basis points to 5.0-5.25 per cent. The rate increase in May was the ninth consecutive one and was of the same magnitude as the rate increase in March.