A recently released report from the U.S. Department of Health and Human Services (HHS) sharply criticizes private equity investment firms for their increasing influence in the healthcare sector. This report highlights how private equity’s involvement in healthcare has led to a decline in both quality and access to care for patients, as well as rising costs. The consequences of these practices, according to the report, include poorer patient outcomes, a rise in patient deaths, and systemic inefficiencies across the healthcare system.

The report comes in the wake of growing concern over private equity’s role in the healthcare system, particularly its effect on nursing homes, hospitals, and other essential healthcare services. The report underscores a worrying trend, with studies showing that private equity investment in nursing homes was linked to an 11% increase in patient deaths. Furthermore, the consolidation of healthcare markets through private equity firms’ aggressive acquisitions has led to a reduction in competition, which has driven up prices for patients and decreased the availability of affordable care.

The Impact of Private Equity on Patient Care

One of the most disturbing findings of the HHS report was the correlation between private equity investment and a sharp decline in patient care standards. Private equity firms, in their quest for profit, often cut essential services, reduce staff, and hire inadequately trained personnel. These practices, although profitable for the firms themselves, have had deadly consequences for patients.

For instance, studies have shown that insufficient staffing in private equity-owned healthcare facilities led to a marked decrease in care quality. One healthcare professional who spoke out in the report revealed how, after her practice was acquired by a private equity firm, she was forced to see 45 patients a day with only one medical assistant to help. She described the situation as “unsafe” and expressed her concern that the cutbacks were leading to poor outcomes for patients.

Another significant issue raised by the report was the replacement of credentialed workers with unqualified staff in private equity-controlled healthcare systems. The report included an account from a physical therapy assistant, who described how her private equity-owned hospital reduced costs by giving more hours to unlicensed technicians, while cutting the hours of licensed therapists and physicians. The unlicensed workers, she noted, were often dressed in the same scrubs as their licensed counterparts, leading to confusion among patients and families. This deliberate misrepresentation of staff credentials has been labeled as fraud by some healthcare professionals.

The Rise of Monopolies in Healthcare

Private equity firms frequently use the practice of “roll-ups” to consolidate market power, which involves buying out competing healthcare practices in the same area and creating monopolies. As these firms acquire healthcare facilities, they reduce competition, which in turn increases the prices patients have to pay for care. This process, according to experts, is a major factor driving up healthcare costs for American families. By reducing competition, private equity firms can raise prices without fear of losing customers, leaving patients with fewer options for care.

In the report, officials pointed out that these acquisitions often result in a lack of transparency for patients. Many private equity firms do not announce their acquisitions publicly, and healthcare facilities frequently retain their original branding even after being acquired. For patients, this can make it difficult to understand when their healthcare provider has been bought out by a private equity firm, leaving them unaware of the potential consequences on the quality of care.

Workers within these facilities, however, are often the first to notice the changes. Healthcare professionals in facilities acquired by private equity firms reported increasing work demands, layoffs, and a reduction in the quality of care provided. This has resulted in a growing frustration within the healthcare workforce, which is becoming more vocal about the negative impact of private equity on patient care.

The Lack of Accountability and Transparency

The HHS report highlights the lack of transparency surrounding private equity investments in healthcare. The report suggests that private equity firms do not adequately disclose their involvement in healthcare systems, making it difficult for patients to know when their healthcare provider is being operated by an outside investor. Even as the government works to implement stricter documentation and disclosure requirements, the report suggests that there is still much more to be done to hold private equity firms accountable for their impact on healthcare.

As private equity firms continue to expand their presence in the healthcare industry, concerns have been raised about the long-term consequences for patients and workers alike. Emergency rooms, urgent care centers, and even nursing homes are now increasingly owned by private equity firms, raising the specter of further consolidations in the healthcare market.

Healthcare workers are particularly concerned about the financialization of healthcare, which they believe has shifted the focus away from patient care and towards maximizing profits. The report reflects a growing concern that as private equity continues to gain control of more healthcare facilities, the quality of care will continue to decline, and patients will be left to bear the burden of higher costs and reduced services.

Private Equity and the Price of Healthcare

Private equity firms’ investments in healthcare are often presented as “rescuing” struggling hospitals and practices. However, as the report notes, these claims are frequently exaggerated. While private equity may provide temporary financial relief to distressed healthcare facilities, the long-term effects of their involvement tend to lead to worse outcomes for both patients and healthcare workers. As the firms cut costs, reduce staffing, and replace credentialed workers with lower-paid, less qualified staff, the quality of care often diminishes significantly.

One of the most pressing issues raised by the report is the increased cost of healthcare for patients. As private equity firms consolidate healthcare markets and eliminate competition, patients are often left with no choice but to accept rising prices for care. In some cases, patients are forced to pay exorbitant costs for services they previously could have accessed at a more affordable price.

The rise of private equity-backed healthcare facilities also has implications for healthcare workers. As private equity firms seek to maximize profits, they frequently reduce wages and benefits for healthcare employees, leading to lower morale and job dissatisfaction. This trend has been especially evident in nursing homes, where understaffing and low wages have led to high turnover rates among employees and a decline in care quality.

Addressing the Crisis

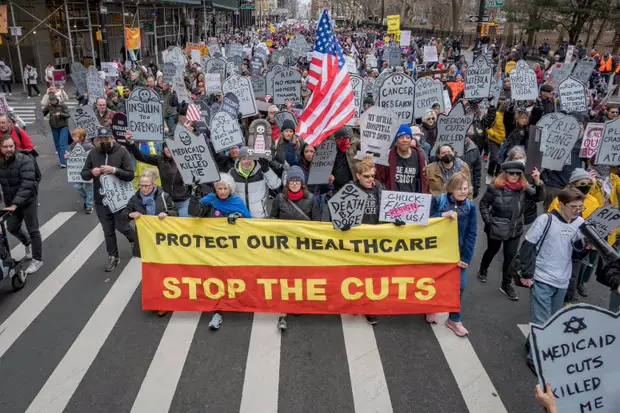

The Biden administration, through the efforts of the Federal Trade Commission (FTC), the Justice Department, and the HHS, has sought to address the issue of private equity’s growing influence in healthcare. The “all-government approach to promoting competition” has been aimed at addressing the lack of competition in healthcare markets and increasing transparency regarding private equity’s role in the industry. While some progress has been made in curbing the rise of private equity in healthcare, much more work remains to be done.

Federal officials have called for increased scrutiny of private equity investments and have emphasized the need for better disclosure requirements to allow patients and healthcare workers to make informed decisions. However, with the incoming administration under Donald Trump potentially reversing some of these efforts, there is concern among healthcare advocates that private equity’s influence will continue to grow unchecked, exacerbating the challenges faced by patients and healthcare workers.

The growing influence of private equity in healthcare represents a significant threat to the quality of care and the accessibility of services for patients. The recent HHS report sheds light on the dangers of private equity investments, including increased patient deaths, rising healthcare costs, and the degradation of care standards. As the government continues to investigate and address these issues, it is clear that action must be taken to protect both patients and healthcare workers from the negative effects of private equity’s profit-driven approach to healthcare. The future of the American healthcare system depends on ensuring that healthcare remains a service focused on the well-being of patients, rather than a profit-driven industry that prioritizes financial gain over patient care.