Millionaires have long been associated with opulence and numerous riches, including luxury cars, high-end outfits, and luxurious homes. But increasingly now, many are choosing the way of “under-consumption,” which aims to live simply and frugally. Such a trend has become popular lately as social media influencers support minimalist lifestyles, encouraging decluttering of spaces and no-buy challenges.

Secondhand House, Used Car…

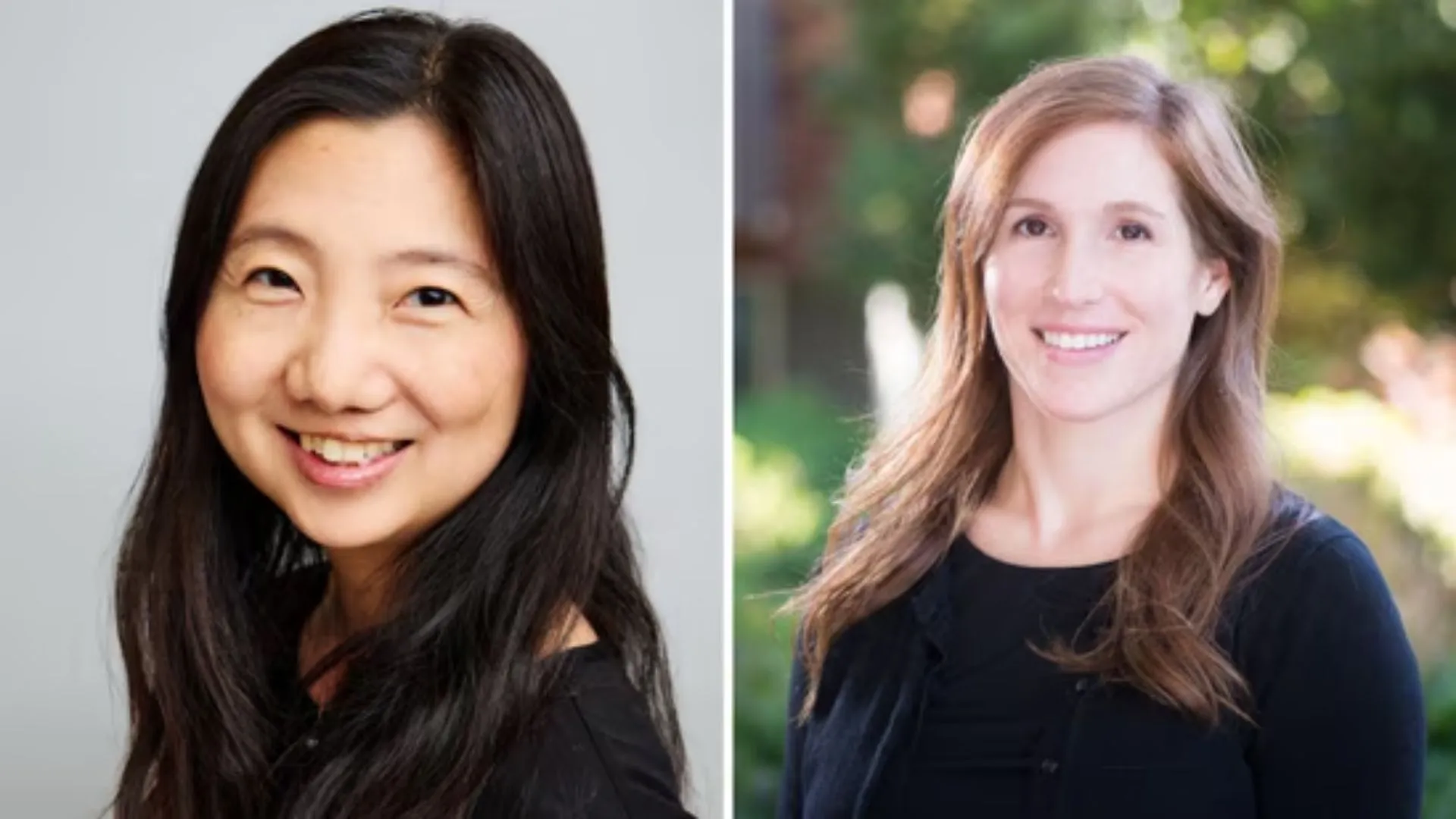

Entrepreneur Shang Saavedra is a Harvard graduate who, along with her husband, co-manages a personal-finance website; the couple has become multi-millionaires. However, their lifestyles tell otherwise. They reside in a Los Angeles four-bedroom house they rented; secondhand for 16 years, the couple shares a used car, and most food items they purchase have frozen labels on them. The children wear hand-me-down clothing and play with playthings purchased from Facebook Marketplace.

The couple prioritizes their children’s education, property investments, and philanthropy over material purchases. “Of course I still am tempted to go for luxury items and experiences, and every now and then we have a nice date night at a very nice restaurant—but understanding the reason why you want something … comes from a pain for an unfulfilled part of your life and oftentimes is a psychological need,” Shang shared with ‘Fortune’.

Self Haircut, Hiking, Swimming…

Similarly, Annie Cole is a contracted researcher and personal finance expert who owns assets worth over a million dollars but spends only $4,000 a month. She sold her car, cooks meals for the week to save money, and even cuts her own hair. She shops for clothes just three times a year, opting for used items. When vacationing, Cole and her husband enjoy free activities like hiking and swimming, using air miles for flights.

Wholesale Shops, Saving Fuel…

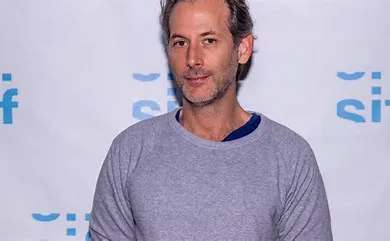

Another example is that of dentist Robert Chin and his partner Jessica Pharar, who make six-figure salaries in Las Vegas but opt for a more austere lifestyle. They share one car to save on fuel, pack lunches, and shop at wholesale markets to save on groceries. They dine out only once or twice a month and rent their home for flexibility. Their objective is to retire early and live off their savings and investments. “We only eat out one or two times a month and live in a rented property to have the flexibility to purchase a better home when we want,” Chin explained.