The coronavirus (Covid-19) outbreak has snowballed into a major global crisis causing immense personal and financial suffering for consumers, communities, and businesses. The banking industry, in addition to facing its own challenges, is expected to help customers in this hour of need. While banks have welldefined business continuity plans, it is time for banks to visualise and brainstorm whether they are adequate to “continue business” in the middle and long term.

The fundamental keystone for banking customers is trust and reputation. With the crisis, these terms have gained new and expanded meaning. The current crisis is a grave challenge, the response to which will have a lasting impact on their longterm performance, success, and market positioning. Presently, the focus of banks and NBFCs is on the short-term firefighting related to moratorium and loan defaults. But as the lockdown ends, the new normal of everyday living is going to emerge where people shall still be hesitant to step out of their homes unless really necessary.

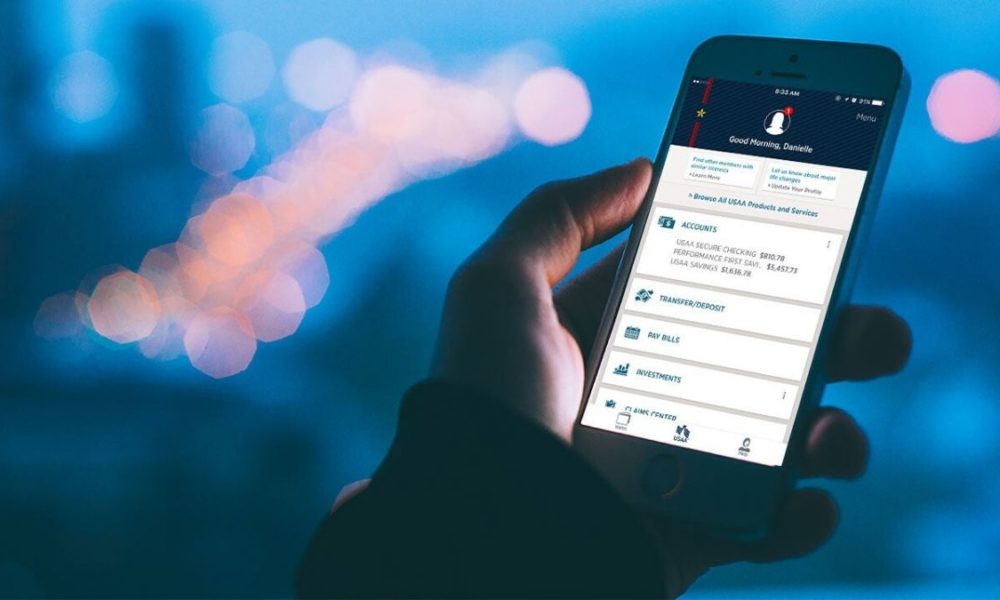

This is where the digital banking services and payment systems offered by banks shall emerge as game changers. A fundamental shift in customer behaviour is expected in the banking sector a decrease in the physical branch visits is certain with an immediate increase in online transactions, peer-topeer payments, wallet usages, etc. The countries with the earliest impact of the virus China and Italy have already seen a 20% increase in online transactions.

Similarly, of 17,000 people from 19 countries interviewed by Mastercard, 46% have swapped out their top-ofwallet card for one that offers contactless transactions this proportion climbs to 52% among those under 35 years old because it is a cleaner way to pay and the speed of tap and pay enables customers to get in and out of stores faster.1 In a recent deliberation organized by Bridge Policy Think Tank India, non-banking finance companies and fintechs acknowledged that these new age consumers are the most sustainable and conscious customers they have and they intend to market their products to them more frequently.

It is up to the banks now to step up their game to convert more of these experiences into positive stories for long-term digital adoption. For India, the problem begins not from the micro but the infinitesimal or diminutive level. High personal interaction and use of ‘paper only’ services have been the norm plaguing many parts of the banking services. For example, it is still not possible to open a business bank account in India or undertake a high value RTGS transaction without tendering a cheque from an existing bank account.

Wire transfers by businesses require paper documentation and declarations possible only after visiting the bank branch. Company incorporations and other services still insist on a physically‘“stamped’ bank statement. Many current accounts opened by banks just before the outbreak are still not functional just because the banks make accounts functional by servicing a ‘kit’ including debit cards, cheque book, banking passwords and account details.

This is sent to customers through courier services which is not reaching customers because of the lockdown. Payments to informal sector is disrupted because despite payment aggregator advertisements showing payments to nanny using a digital platform, in the real India, most informal sector workers such as maids, drivers, nannies etc. still do not have bank accounts in their name. Most small businesses like a flower vendor supplier for weddings or a vegetable vendor accepts payments only in cash.

Like always, ATMs in India have gone dry because it is becoming difficult to reload cash in lockdowns. It is important for the industry to wake up to the fact that these problems are not going to go away. They are here to stay and need to be addressed for banking services to kickstart again. Transactional banking is becoming the norm, where banks offer simple and transparent fees for sending and receiving customer funds, as opposed to traditional banking options provided by legacy institutions.

In the post-Covid world, the race is on to offer businesses and HNWIs robust and cost-effective banking. Banking that is safe, tax efficient and truly global. Digital banks are emerging as an option to the traditional banks. There are many similarities between the leading digital banks EQIBank, Monzo, Revolut, N26, Starling, Moven, Simple and Chime have all created compelling brands, interesting apps, innovative UI/UX and streamlined services.

But there are differences, Monzo, Revolut, N26, Simple and Chime are focused on banking retail clients and SMEs in the onshore markets. On the other hand, EQIBank focuses on the needs of corporate and private clients and provides services to over 180 countries across the globe. EQIBank is said to have seen a dramatic increase in accounts during the quarantine period as people reassess their relationship with their banks.

Some banks in India have been proactive in this regard. Some existing products include Kotak 811 and Axis Bank ASAP. For example, ICICI has launched a digital banking platform‘“ICICI Stack’ a set of comprehensive digital banking services and APIs (Application Programme Interface) including digital account opening, loan solutions, payment solutions, investments, insurance and care solutions.2 But the banks need to ask themselves if this will be enough to compete with digital banks which offer‘“no linesno paper services’.

Similar rethinking is required in the case of payment systems. In Europe, Mastercard is leading the contactless payment revolution with 75% of its existing payments already contactless and plans to increasing contactless payment limits across Europe.3 In countries like the Netherlands where lockdown restrictions are being eased and even schools being reopened, banks are reportedly encouraging customers to make contactless payments in stores with no requirement for a PIN. Media reports state that for small contactless payments, i.e. up to €25, customers will not have to touch the payment terminal.

The initiative will also see the increase in the cumulative limit for contactless payments with a debit card from €50 to €100. In India, the Reserve Bank of India (RBI) has allowed tap and pay contactless payments without any PIN, for up to INR 2000 since 2015. It is prudent now to increase the limit for contactless payments in light of the pandemic. RBI had also in the past released guidelines on tokenisation for debit/ credit/prepaid card transactions in January 2019.

This involves a process in which a unique token masks sensitive card details. Thereafter, in lieu of actual card details, this token is used to perform card transactions in contactless mode at Point of Sale (POS) terminals, Quick Response (QR) code payments, etc. and can work well in post pandemic world too. However, in January 2020, the RBI has asked banks and other card issuers to only provide optional contactless payment options over security concerns, which has been extended till mid of June due to Covid-19 pandemic.

It is only when a user proactively requests for contactless payments on its cards that the facility shall be allowed.4 As a consequence, most payment cards in India may not be available by default, for tap-to-pay. In the present scenario however, pushing for tap to pay, QR Code, card not present transactions shall become imperative. Banks should, in fact, consider promoting contactless and digital payment options and minimizing use of instruments/processes which would require a contact for transactions, as part of their business continuity measures.

At the same time, banks shall also have to devise appropriate fraud and cyber security controls. At the Asian Credit Risk Colloquium 2020, cyber security expert Durga Dube, head of Cyber Security and Information Management Risk, Reliance Industries, spoke of how cyber security is one of the top five risks from the lens of a global perspective along with climate change and poverty.

He further pointed out that a vulnerability or breach in the system of one bank can cause all other operators in the network including wallets, payment systems and supporting fintechs. The pandemic has pushed the envelope for a lot of the sectors. Even the courts which were unconvinced for so many years finally went online reluctantly. Companies are re-thinking work from home.

The government is also considering creating policies around the work from home framework. Problems in farm to market transfer of perishables came to limelight despite being a neglected problem for decades. Loopholes in direct benefit transfers became more pronounced with the Purulia ration card mortgage problem. It is time that the banking and finance sector too accept that all will never go back to the way it once was. It is time to embrace the new normal and start preparing for it. (Endnotes)

1. https://www.finextra. com/newsarticle/35732/ covid-19-spurs-contactlesspayments-takeup—mastercard

2. https://ibsintelligence. com/ibs-journal/ibs-news/ icici-bank-launches-its-digital-banking-platform-inthe-wake-of-covid-19/

3. https://ibsintelligence. com/ibs-journal/ibs-news/ mastercard-increases-contactless-payment-limitsacross-europe-amidst-covid-19/

4. Reserve Bank of India Notification no. DPSS.CO.PD No.1343/02.14.003/2019-20 dated January 15, 2020 Kritika Krishnamur thy, Founding Partner at AK and Partners and Rajiv Mohapatra, Director & Senior Counsel Regulatory Affairs (Asia Pacific), Mastercard.