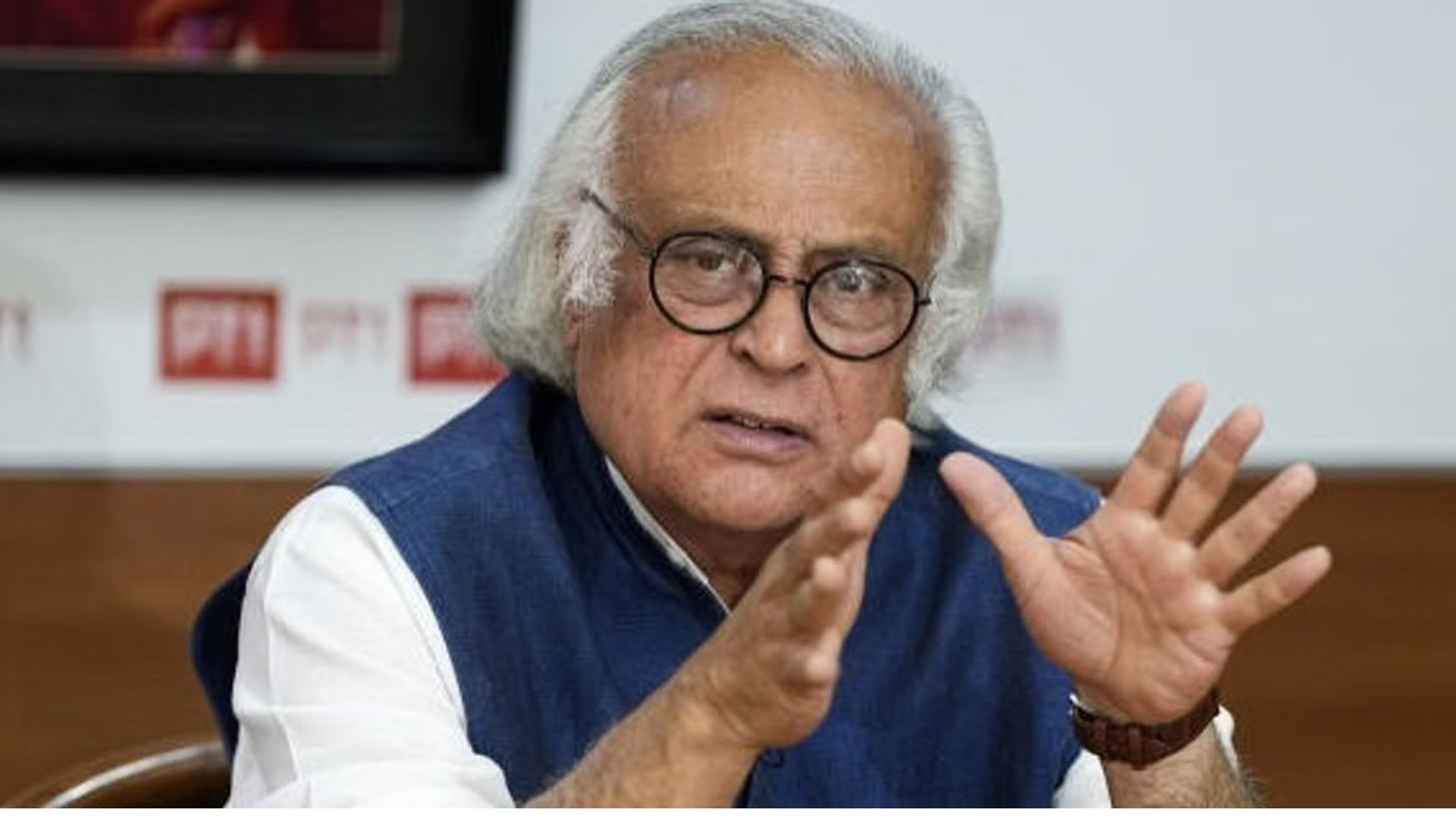

Congress General Secretary Jairam Ramesh has raised concerns over what he describes as “three dark clouds” that pose significant challenges to India’s economic growth in the coming years. Taking aim at Prime Minister Narendra Modi and the NDA government, Ramesh criticized what he called the “bombastic claims” regarding the economy, suggesting these issues would hinder India’s growth potential.

Unsteady Private Sector Investment

In a statement shared on social media platform X, Ramesh pointed to an “unsteady path of private sector investment” as a key challenge. He noted that new project announcements in the private sector had fallen by 21% between FY 2023 and FY 2024, following a brief surge during the COVID-19 recovery. This decline, he argued, reflects a lack of investor confidence and uncertainty caused by inconsistent government policies and what he termed “raid raj.”

“New project announcements by the private sector fell by 21 per cent between FY23 and FY24. This reflects a lack of investor confidence in India’s consumer markets and the uncertain investment climate generated by the government’s inconsistent policymaking,” Ramesh said.

Stagnation in Manufacturing Sector

Ramesh also highlighted the stagnation of India’s manufacturing sector despite the government’s “Make in India” initiative. According to him, manufacturing’s contribution to GDP has remained unchanged over the past decade, and its share of total employment has marginally declined. India’s share in global merchandise exports has also stagnated, and exports as a share of GDP are falling.

“India’s manufacturing is stagnating, and exports are falling as a share of India’s GDP,” Ramesh stated, comparing the situation unfavorably to the rapid export growth seen between 2005 and 2015 under the UPA government.

The third issue raised by Ramesh was the decline in real wages and productivity for India’s laborers. Referring to the Annual Survey of Industries (ASI) for 2022-2023, he noted that the growth in Gross Value Added (GVA) per worker, a measure of labor productivity, had slowed dramatically since 2014-15. This decline in productivity has contributed to stagnating real wage growth, which, combined with rising inflation, has weakened consumption and dampened investment.

“Real wages are stagnating, and consumption will remain weak, resulting in low investment that has been a consistent restraint on India’s growth,” he warned.

Ramesh expressed concern over what he called the “financialization” of India’s economy, with companies focusing more on stock market valuations rather than revenue growth. He argued that this trend, coupled with declining private sector investment, bodes poorly for the medium- to long-term prospects of India’s economic growth.