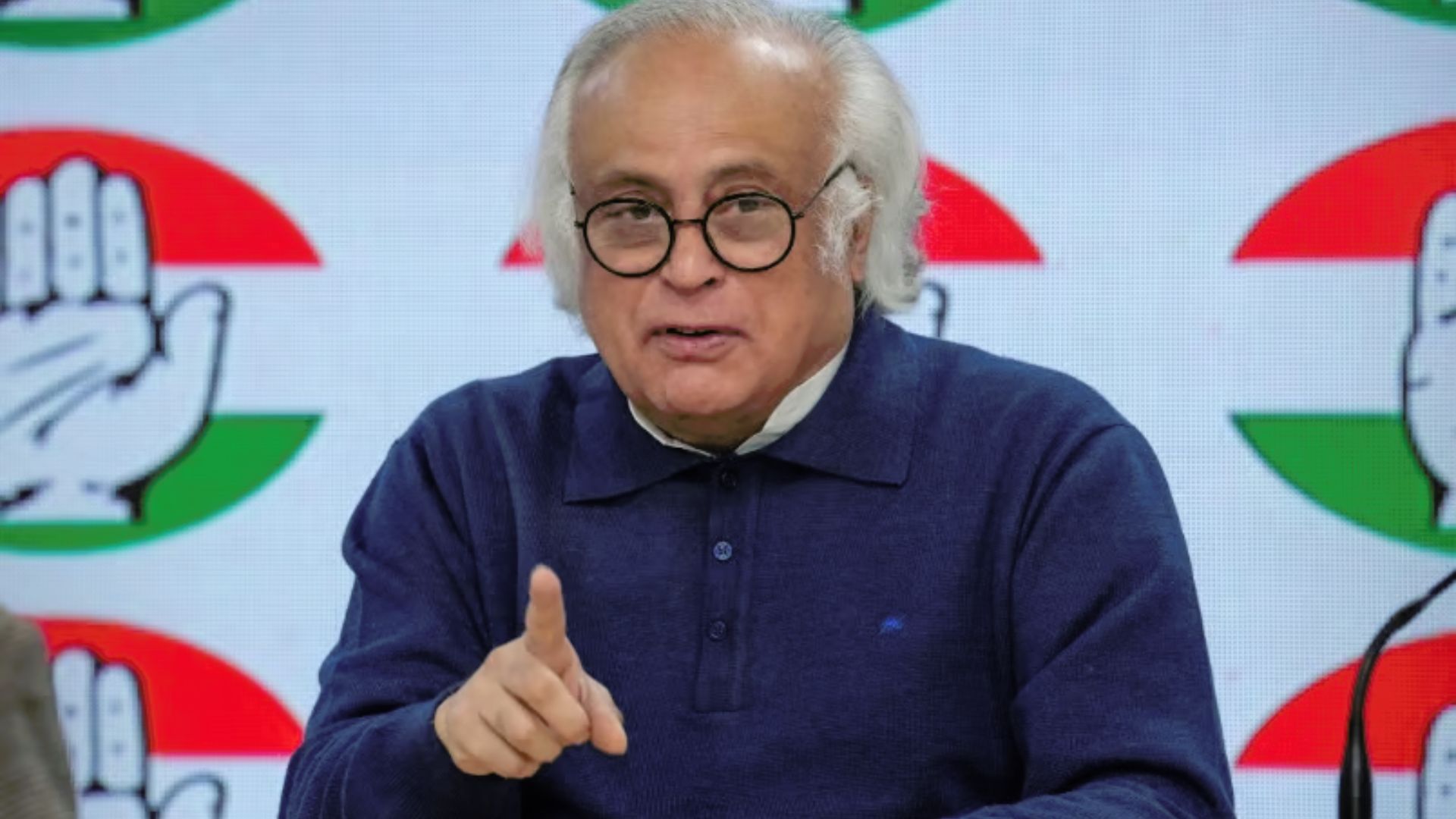

Congress leader Jairam Ramesh attacked the BJP-led central government over tax collection data on Sunday, saying more taxes are being paid by people than companies, while “the middle class is paying disproportionately high taxes” and Rs 2 lakh crore has been transferred to the “pockets of billionaires” in the name of corporate tax cuts.

Ramesh informed that Income tax collection from April 1 to July 1, 2024, stood at Rs 3.61 lakh crore, while gross corporate tax collections were Rs 2.65 lakh crore. Speaking on the social media platform X, he said, “As we move into the Budget on July 23rd, just released data available now tells us that gross personal income tax collections were Rs 3.61 lakh crores during April 1-July 1 2024, while gross corporate tax collections were Rs 2.65 lakh crores. This reconfirms and re-establishes conclusively a point which we had been making for quite some time now—’, ‘-that people are paying much more taxes than corporations.”

The Congress general secretary also highlighted how during the Manmohan Singh era, the share of personal income tax in the overall collection of taxes was 21% due to income under his regime, which had risen by 7 percentage points to 28%. At the same time, corporate tax, he said, had fallen from 35% to 26%. He also attacked the reduction in corporate tax rate in 2019, stating that it hadn’t brought about the expected private investment and instead, private investment has fallen from 35% under UPA rule to less than 29% now.

“When Dr Manmohan Singh demitted office, personal income tax formed 21% of total tax collections and corporate tax 35%. Today, the share of corporate taxes out of total tax collection has dropped sharply to its lowest level in a decade at just 26%. While the share of personal income tax in total tax collection has shot up to 28%,” Ramesh said. He said, “Corporate tax rates were slashed on 20 Sept 2019 in the hope of inducing a boom in pvt investment. But that has NOT happened. Instead, pvt investment has collapsed from a peak of 35% of GDP under Dr. Manmohan Singh to below 29% during 2014-24. The corporate tax cut has put over Rs.2 lakh crore into the pockets of billionaires, but the middle class continues to bear heavy taxation.”