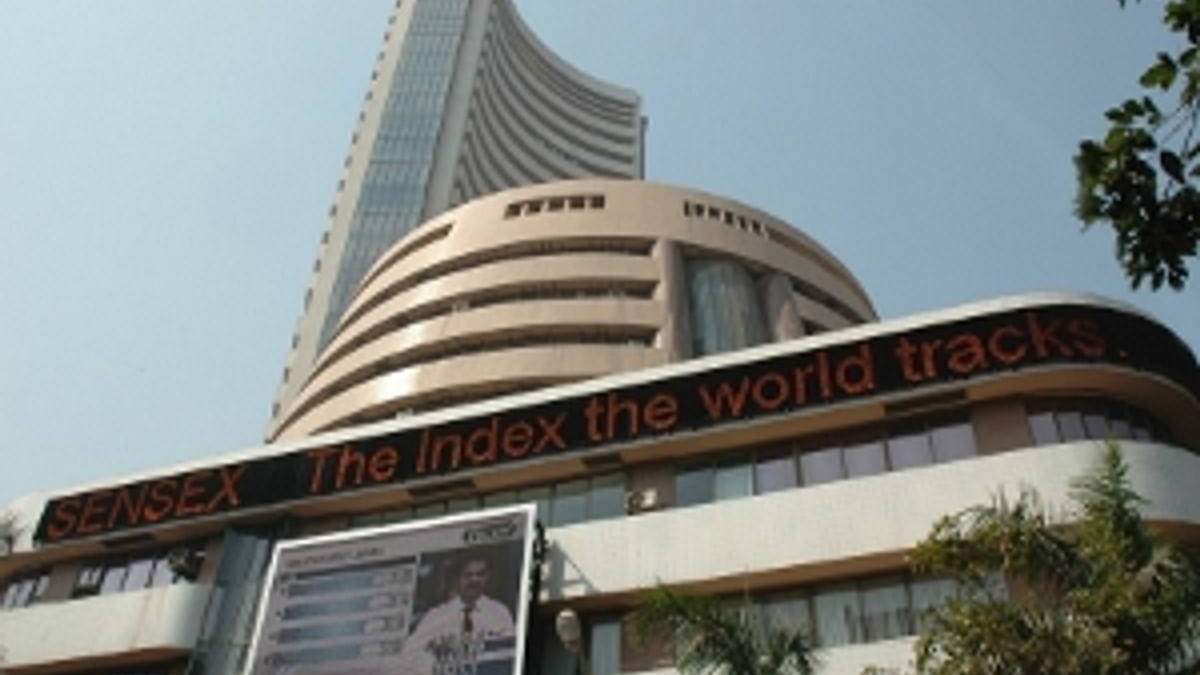

The Indian stock indices rose on Tuesday morning as they moved closer to new record highs.

This morning, the Sensex and Nifty each gained 0.6%. The Sensex was just 100 to 150 points below its all-time high of 65,898.98 points set last week when it began its morning rise. Forty four of the Nifty 50 companies were in the green today, with Britannia, HDFC Life, Apollo Hospitals, Sun Pharma, and Bajaj Finserv among the top gainers.

The consistent inflow of foreign funds, firm economic outlook, and moderation in inflation supported Indian stocks in the latest bull run.

However, several analysts pointed out that any further rally from the current levels is unlikely as valuations are on the higher side.

“The ongoing rally in the market is slowly moving from broad-based rally to specific stock-driven rally. Yesterday, in spite of the weakness in IT and banking majors Nifty rallied by 24 points, driven primarily by RIL (Reliance). Bharti Airtel and Tata Motors also have been imparting resilience to the rally,” said VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

Vijayakumar added there are no major triggers that can take the rally beyond the present levels. For fresh cues in overall domestic markets going ahead, investors await April-June earnings data of Indian companies, expected to pour in starting this week.

“Q1 FY24 results of TCS and HCL Tech due tomorrow are expected to be tepid. If the poor results lead to further correction in IT stocks that may provide buying opportunities in the segment. IT majors have a great track record of successfully overcoming many crises,” Vijayakumar noted.

Retail inflation data for June due next week will be another key monitorable for investors.

Retail inflation in India further eased in May to 4.25 per cent, hitting a two-year low. It was at 4.7 per cent in April and 5.7 per cent the previous month.

RBI’s consistent monetary policy tightening since mid-2022 could be attributed to India’s substantial decline in inflation numbers.

India’s retail inflation was above RBI’s 6 per cent target for three consecutive quarters and had managed to fall back to the RBI’s comfort zone only in November 2022.

Under the flexible inflation targeting framework, the RBI is deemed to have failed in managing price rises if the CPI-based inflation is outside the 2-6 per cent range for three quarters in a row.