Mandatory PAN-Aadhaar linking before Dec 31, 2025. Avoid deactivation and financial disruptions. As notified by the UIDAI and Income Tax Department, if you fail to connect your PAN to Aadhaar before December 31, 2025, it will be rendered inactive from January 1, 2026. This might involve several inconveniences like various restrictions in banking services and difficulties with filing income tax returns.

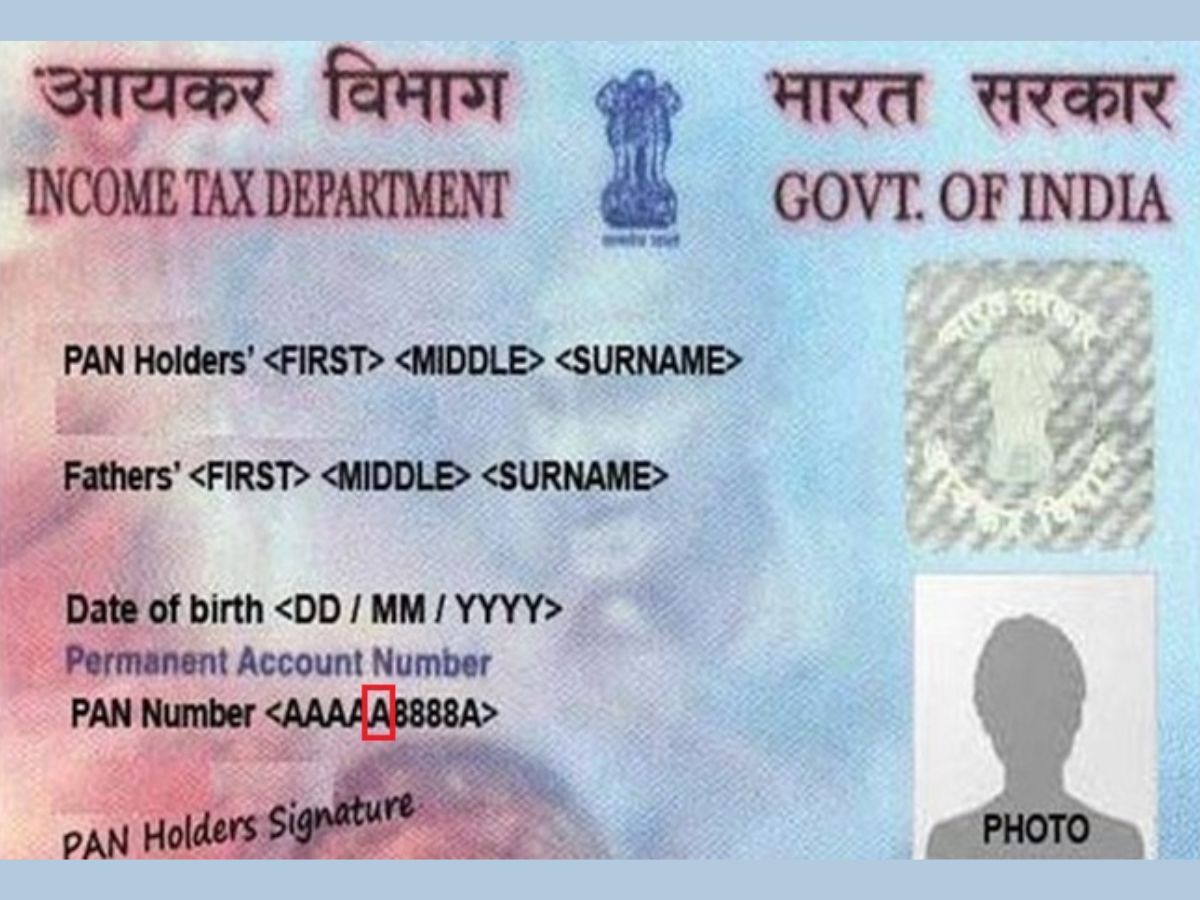

What is PAN Card?

A PAN card plays a vital role in handling monetary activities in India and it is mandate in any kind of banking transaction. Starting with filing one’s returns, opening bank accounts, to high-value transactions, it is one of the most important identity and financial documents.

Imagine going to file your taxes or open a bank account and being told your PAN card has been deactivated because it isn’t linked to your Aadhaar. This could be the scenario one will have to face if linking of the two documents is not done before the deadline.

Also Read: Why Did Andrew Cuomo Reject Donald Trump’s Endorsement in NYC Mayoral Race?

Why You Must Link PAN with Aadhaar

In case the deadline of December 31, 2025, is missed, from January 1, 2026, your PAN card will be rendered inoperative. Your unlinked PAN and Aadhaar may disrupt your financial planning, so the linking process needs to be completed at the earliest.

How to Link PAN with Aadhaar

Access the Income Tax e-filing portal: https://www.incometax.gov.in/iec/foportal/

Click “Link Aadhaar” on the bottom left of the homepage.

Enter your 10-digit PAN and 12-digit Aadhaar numbers.

Follow the on-screen instructions and pay ₹1,000 as the linking fee.

Click on ‘Submit’: your linking will be processed by the portal.

How to Check Aadhaar-PAN Linking Status Online

Visit the same e-filing portal.

Click on “Link Aadhaar Status.”

Enter your PAN and Aadhaar numbers.

The system will show if the two are connected.

How to Check Aadhaar-PAN Link Status via SMS

Type: UIDPAN <12-digit Aadhaar> <10-digit PAN>

Send it to either 567678 or 56161.

You will receive an SMS confirming your linking status.

Keep your mobile number that has been registered with Aadhaar active, and use that during OTP verification while linking online; it cannot be done without this. Therefore, link your PAN with Aadhaar before December 31, 2025, to avoid deactivation of your PAN on January 1, 2026.

Also Read: Canada to Crack Down on Visa Fraud, May Cancel Applications from India and Bangladesh