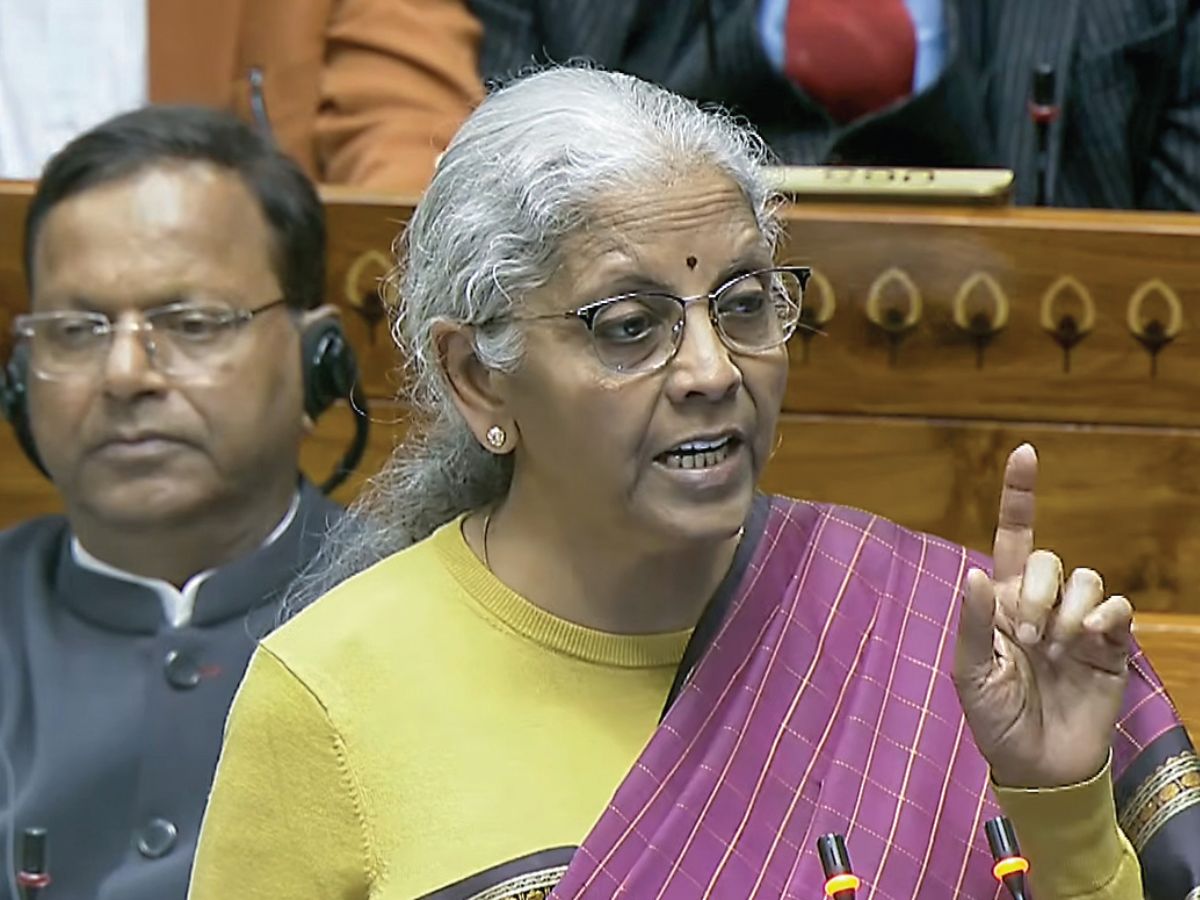

Finance minister Nirmala Sitharaman, presenting her ninth Budget overall and eighth full Union Budget since 2019, used the Union Budget for 2026–27 to signal that the government has entered a phase of stabilising public finances after years of heavy post-pandemic spending. The Budget reflects a continued focus on building long-term assets, tighter control over routine expenditure, and preparation for structurally higher interest payments as government debt remains elevated.

The government plans to spend Rs 53.47 lakh crore in 2026–27, compared with a revised estimate of Rs 49.64 lakh crore in 2025–26. Most of this increase comes from capital expenditure, which refers to spending on long-lasting assets such as roads, railways, defence equipment and public infrastructure. Central government capital expenditure has been raised to Rs 12.21 lakh crore, while effective capital expenditure, which includes grants given to states for asset creation, is estimated at Rs 17.14 lakh crore. This underscores a sustained shift away from consumption-heavy spending towards investment-driven growth.

On the fiscal side, the government has budgeted a fiscal deficit of Rs 16.96 lakh crore, or 4.3 percent of Gross Domestic Product (GDP), marginally lower than the 4.4 percent estimated for the previous year. The revenue deficit is projected at Rs 5.92 lakh crore, or 1.5 percent of GDP, while the effective revenue deficit, which excludes spending that creates assets, is expected to decline sharply to 0.3 percent of GDP. Under the Fiscal Responsibility and Budget Management framework, the debt-to-GDP ratio is projected to fall to 55.6 percent in 2026–27, indicating a gradual return towards fiscal consolidation.

Gross tax revenue is estimated at Rs 44.04 lakh crore, driven by sustained growth in income tax and corporation tax collections. After tax devolution, net tax revenue to the Centre is projected at Rs 28.67 lakh crore. States are expected to receive Rs 15.26 lakh crore as their share of Union taxes under the 41 percent devolution formula, while total transfers to states, including grants, are estimated at Rs 25.43 lakh crore. Non-tax revenue, including dividends from public sector enterprises and transfers from the Reserve Bank of India, is projected at Rs 6.66 lakh crore.

Borrowing continues to finance the bulk of the deficit. Net market borrowings through government securities are estimated at Rs 11.73 lakh crore, supplemented by small savings. Interest payments are projected to rise to Rs 14.04 lakh crore, accounting for about one-fifth of total government expenditure, highlighting the long-term fiscal cost of accumulated debt even as deficit ratios gradually decline.

The expenditure pattern reflects the government’s strategic priorities. Defence spending rises across capital equipment, operations and pensions, with capital outlay on defence services increasing sharply to Rs 2.19 lakh crore, driven by higher allocations for aircraft, naval platforms, weapons systems, infrastructure and defence research. Internal security allocations also increase, including higher spending on police forces, intelligence agencies, border infrastructure, surveillance systems and a sharp rise in funding for the national census under the Ministry of Home Affairs.

Railways remain a central pillar of infrastructure policy. Total spending exceeds Rs 2.8 lakh crore, with higher allocations for new trains, network expansion, electrification and safety works, even as staff costs and pension liabilities continue to exert pressure on railway finances. Beyond conventional rail investment, the Budget speech also announced the development of seven high-speed rail corridors as growth connectors between major cities, signalling a policy push towards faster inter-city passenger mobility.