According to the Reserve Bank of India (RBI), Re-KYC (Know Your Customer) is required for accounts opened under the Pradhan Mantri Jan Dhan Yojana (PMJDY) in the early years. On completing 10 years of operation of the programme’s success, Sanjay Malhotra, RBI Governor, stated in a statement released by the Monetary Policy Committee (MPC) on Wednesday that many Jan Dhan accounts, particularly those opened in 2014 and 2015, are now required by law to undergo periodic KYC updates.

The PMJDY was introduced in 2014, to seek to make finance accessible to everyone. There are currently about 56 crore people who are formally enrolled in banking. However, many of the accounts have stopped complying with KYC standards after ten years, which prompted the RBI to take action.

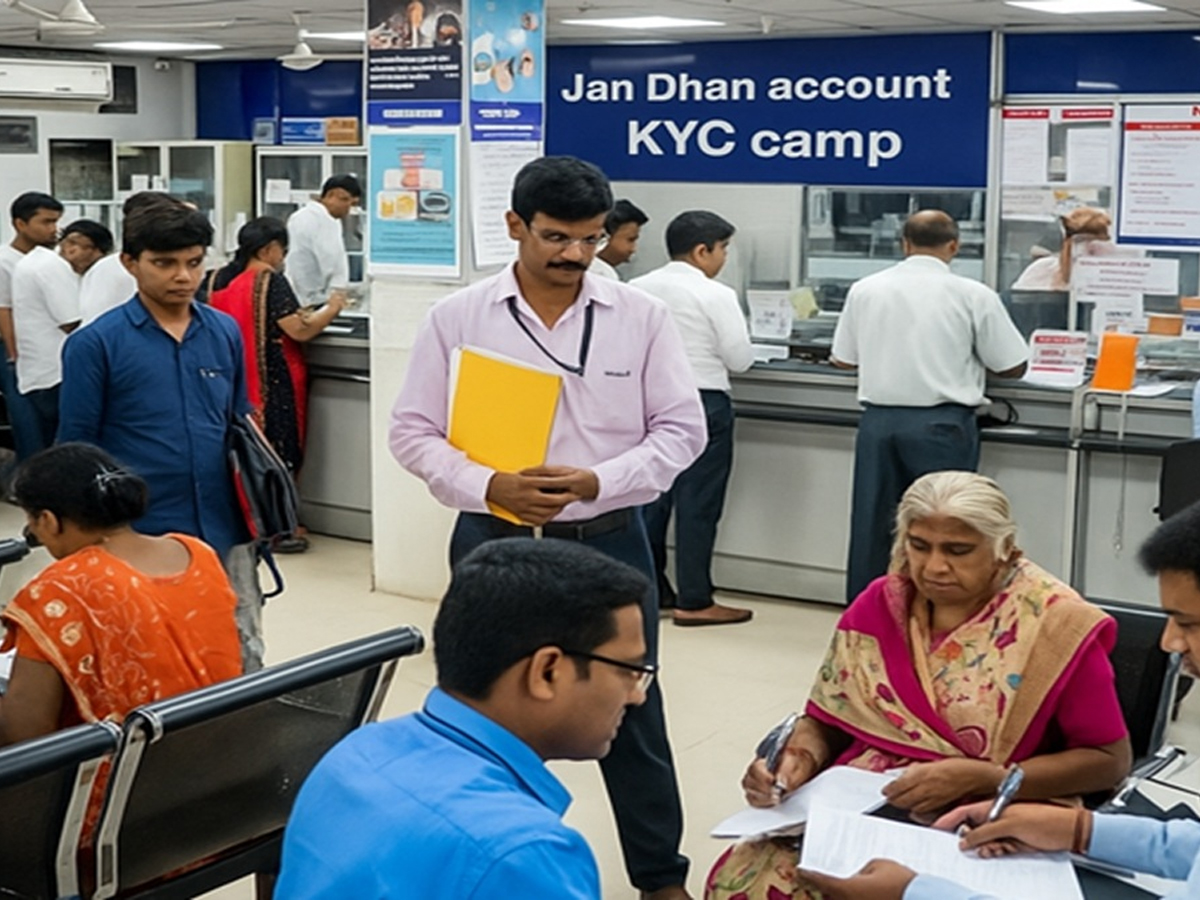

Banks Hold Doorstep Camps for Re-KYC

To make the re-KYC process convenient for rural and semi-urban customers, Malhotra announced that banks are organising dedicated re-KYC camps at the Panchayat level. These camps will run for three months, from July 1 to September 30, offering doorstep services.

“The banks are organising camps at Panchayat level from 1st July to 30th September, in an endeavour to provide services at customer doorsteps,” Malhotra said.

ALSO READ: PM Jan Aushadhi – Affordability in Real or just Numbers? : Reality Check

He added that apart from facilitating re-KYC, the camps also focus on promoting micro-insurance, pension schemes, and addressing customer grievances.

“The camps are aimed at bringing services to customers’ doorsteps,” the RBI governor said.

What Is Re-KYC and Why Does It Matter

In order to maintain compliance and account functionality, Re-KYC entails updating your personal and address information with your bank. This step is essential for Jan Dhan account holders because these accounts have many advantages, such as:

• Zero-balance savings account

• Interest on deposits

• RuPay debit card with accident insurance

• Overdraft facility of up to ₹10,000

• Direct Benefit Transfers (DBT) for government subsidies

If the KYC is outdated or incomplete, the account may be restricted or deactivated, affecting the beneficiary’s ability to receive government subsidies or access banking services.

Don’t Delay—Visit the Nearest Camp

Those who started their PMJDY accounts in 2014 or 2015 need to take immediate action. To update the information, people should visit the nearest re-KYC camp with necessary documents, such as their Aadhaar card and address proof.

The RBI’s most recent action seeks to strengthen financial inclusion while guaranteeing that recipients maintain uninterrupted access to all services.