The pandemic has decimated thousands of lives and livelihoods in the last few months, impacting society everywhere at a very fundamental level. The business dailies repetitively narrate stories of yet another industry failing and stories of pathos in which hundreds more struggle to feed their family with the closing of each business.

Among this gloom and despondency, every industry did what it could to survive the period. However, the banking and financial services industry, or BFSI as it is called, took it to a different level altogether. The BFSI used the pandemic as an opportunity to reinvent itself, accelerating its own evolution as a digital avatar. The execution of documents, KYC, security creation and recovery of dues — all basic processes of lending underwent a sea change because of compulsions set by the pandemic. It would be tempting to conclude that this progress was due to the entrepreneurial spirit of the BFSI sector alone, but the fact is that the scale and pace of change are also in a large measure due to the regulators and the judicial system.

As any person who has ever availed a loan from a lender will testify, the process of doing so is very paper-intensive. It was customary to sign reams of paper, application forms, agreements, declarations, etc, and then more for identification (KYC) and security creation. Paper-intensive processes obviously have their challenges, not just for the borrower, but also for the lender who has to collect, process and secure every sheet of paper signed or collected. The human capital employed to collect or manage this paperwork also adds its own cost, making the historic processes sub-optimal.

The onset of the pandemic changed the game for lenders. Bank staff could no longer physically obtain signatures on loan agreements. Stamping and registration before the relevant authorities being in public spaces were no longer considered safe, and no employee would agree to travel all over a city only to collect documents, at a risk to themselves and their families. The announcement of the moratoriums by the Reserve Bank of India was a temporary breather for some borrowers, but routine collection activities of sending notices, following up and collecting payments from borrowers, and litigation were severely impacted as postal and courier deliveries stalled.

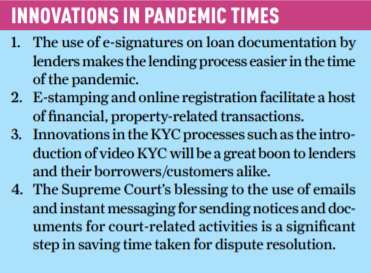

Against this backdrop of systemic issues nationwide, owing to the fact that stopping lending activities for the duration of the pandemic was neither feasible nor practical, digitization of the processes with all its innovations grew in scale and popularity. The first and most obvious touchpoint was the execution of loan documents where the manual intervention of a borrower signing the loan documents physically was replaced by the use of an Aadhaar-based e-signature facility introduced by the government and administered by NSDL. E-Sign is an online electronic signature service which permits an Aadhaar cardholder to sign a document after his or her Biometrics/One Time Password authentication is carried out, thus requiring no paper-based application forms or documents. Lenders have started using this e-signature facility instead of obtaining physical signatures on loan documents to provide loans to borrowers in need during the pandemic, providing muchneeded succour to them.

At the heart of any financial transaction is a process called KYC, or to use its full form, Know Your Customer. As the name itself suggests, every banker and lender needs to “know” their customer before offering products and services to them. The process is not one where someone merely collects the identification documents of a customer, but one where they crosscheck and verify every bit of the data and documentation they obtain from a customer, including the place of business, residence, etc. This is often a tedious activity inasmuch as it calls for multiple visits to collect the papers, seeking attestations, clarifications and additional paperwork to really get to know the customer, and complete the statutory requirements. In a series of moves predating the pandemic, the Reserve Bank of India had, in tandem with the government, sought to create repositories of borrowers’ data through CKYC and information utilities. In effect, a borrower’s details recorded across the entire network of banks and financial institutions was sought to be securely stored and used as per the borrower’s explicit consent for the borrower’s needs using CKYC. The information utilities, on the other hand, seek to track loans of all kinds so that lenders make an informed choice before offering and loading customers with financial liabilities, which they could ill afford. To these far-reaching initiatives, the Reserve Bank added video KYC, a process that would allow the verification of the antecedents of a customer over a live video feed, thus reducing the regulatory burden on both the customer and also the banks and institutions. As on date, banking majors such as ICICI and Kotak have already launched their video KYC offerings, with press reports suggesting that HDFC Bank is expected to do so soon too and count itself among the early adopters.

Many people will remember that in the not too distant past, procuring stamp paper for documents, be it for availing loans or even making a simple affidavit, would be an onerous task. Horror stories about stamp vendors would abound, overcharging was rife, and the availability of the required denominations was always a challenge. The fact that we do not face such issues today is a tribute to the governments of the day, both central and state, making changes in the law allowing franking, and also creating infrastructure where people of certain states can pay stamp duty from the comfort of their homes and print out the stamp paper certificate. In Maharashtra, one can simply obtain a challan by paying the stamp duty and affixing it to the document. Initiatives of this kind have a huge impact in terms of convenience and cost for people, more so when a person is seeking to avail a loan during the pandemic. The borrower and even the lender is no longer dependent on a stamp vendor to deliver the requisite quantity of stamp paper, and financial assistance is not held up on this count.

This is not all, of course. As far back as 2013, the government of Maharashtra took a landmark step when it enacted the Maharashtra e-Registration and e-Filing Rules 2013, permitting online registration of documents using a special module developed by the office of the Inspector General of Registration. Anyone who has ever purchased property or gotten any document registered would remember the serpentine queues at the registration offices all over the country, often located inconveniently, and requiring one to take off from work. The 2013 Rules provide a credible alternative as they allow people to register their documents online. Imagine the difference this step alone would make to the housing finance industry where people who want to complete the formalities for loans required urgently for their dream home but have been justifiably wary of approaching an office during a pandemic where hundreds of people come for their work. Registrations of leases for properties on rent, new purchases of land and residential property would no longer be dependent on when the office opens for business but can be done safely and securely without endangering the parties. For every lender seeking to create security on newly purchased property, transaction execution would be so much simpler, safer and efficient.

It is fairly well known by now that the banking and financial services industry is expecting a significant amount of defaults and non-performing assets in the months to come. Communication with borrowers, including following up to collect past dues and initiate legal action, was impacted when the lockdowns began. The unavailability of postal and courier services meant that notices requiring a defaulter to either pay on time or to respond to a demand made or take cognisance of a court hearing could not be delivered physically. A common problem which occurs even when there is no pandemic is that defaulting borrowers often change their residence and disappear without a forwarding address with the intention of avoiding their creditors. The fact that not just recovery activity was carried out, but various notices and documents related to court proceedings were also delivered to their recipients, was actually due to a series of measures initiated by the Supreme Court of India and implemented by the High Courts and the rest of the judiciary. While the use of email for sending out notices was mandated by the Supreme Court long before the pandemic arrived, the use of instant messaging services such as WhatsApp was formally blessed by the highest court in the country and immediately put into practice in July 2020.

The aftermath of the pandemic will probably be felt in the immediate future as well. The only saving grace seems to be that human ingenuity and innovations like the e-sign, the changes in stamping, registration and use of technology in communicating with borrowers look like they are here to stay.

Joydev Sengupta is a practising lawyer, specialising in laws relating to supply chain financing, digital lending and payment systems. The views expressed are personal.