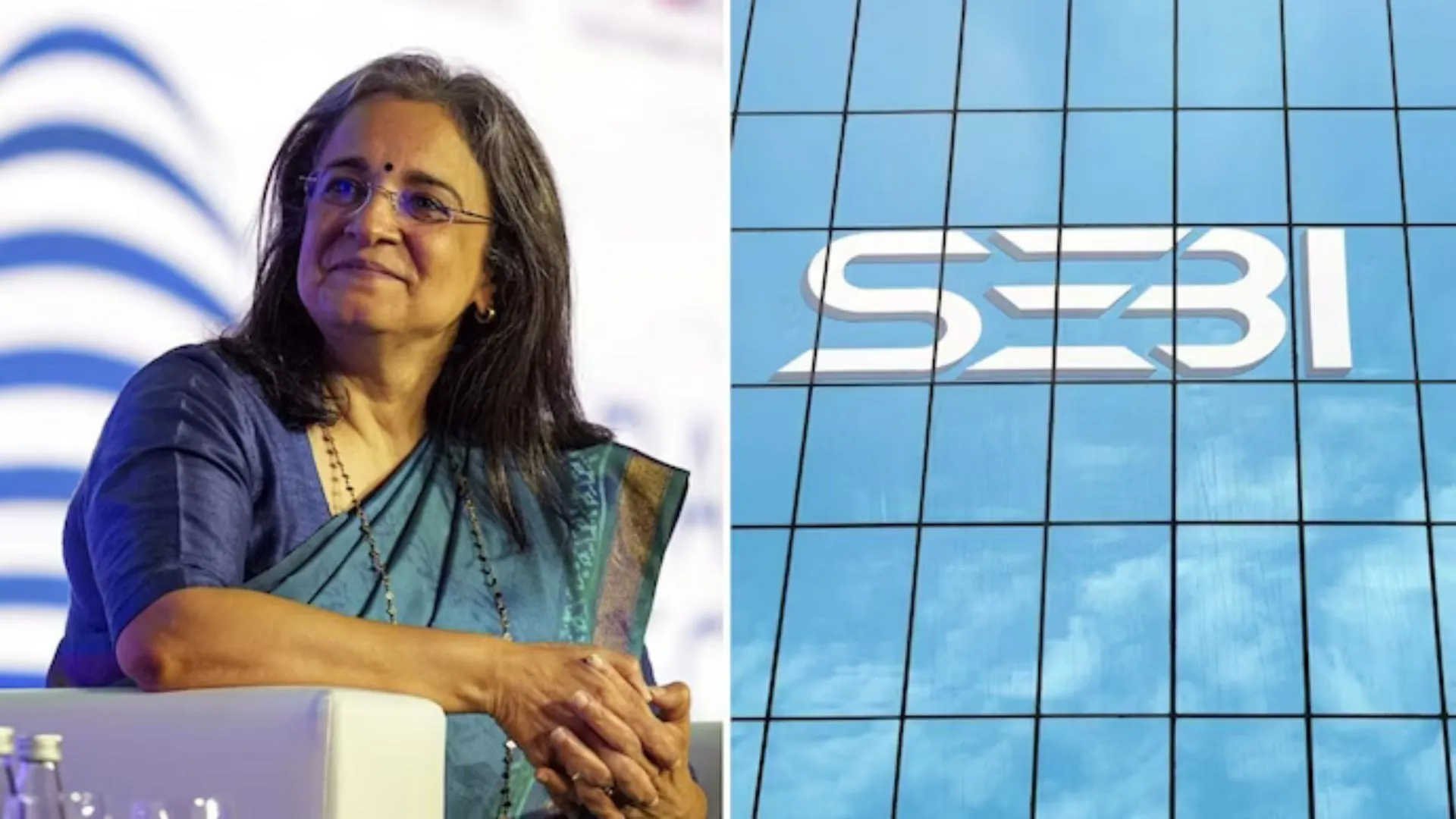

Over claims of stock fraud and regulatory breaches, a Mumbai special court has instructed the Anti-Corruption Bureau (ACB) to issue an FIR against former SEBI Chair Madhabi Puri Buch and five other top officials. The court said it would oversee the inquiry and requested a 30-day status report.

Charges for market manipulation and rule breaking

Filed by a reporter, the case claimed the defendants participated in corruption, regulatory infractions, and major fraudulent financial activities.

The complaint alleges a company was deceptively listed on the stock exchange with the assistance of regulatory officials, especially SEBI, without following the SEBI Act, 1992, and associated rules.

The court observed that based on the accusations, there seems to be a cognisable offence demanding an inquiry. It highlighted that judicial interference was required under the Criminal Procedure Code (CrPC) given the absence of activity by SEBI and law-enforcing agencies.

The complainant also argued that SEBI officers neglected their legal responsibilities, supported market manipulation, and permitted a business to be listed even if it failed to satisfy regulatory standards. The reporter also said that several complaints to the police and regulatory agencies had been ignored, therefore starting legal proceedings.

Based on the available evidence, the court ordered the ACB Worli, Mumbai Region to submit an FIR under relevant IPC, Prevention of Corruption Act, SEBI Act, among other relevant statutes provisions.

Madhabi Puri Buch as well as the Hindenburg Inquiry

India’s inaugural female SEBI head, Madhabi Puri Buch, finished her three-year stint Friday. Though she passed significant legislature like accelerated equity settlements, more stringent FPI disclosures, and increased mutual fund penetration, her last year in power was marred by conflict.

Last August, US short-seller Hindenburg Research accused Buch of a conflict of interest, saying it hampered SEBI’s inquiry of the Adani Group. Buch and her husband, Dhaval Buch, were said by the research company to have invested in offshore businesses related to Vinod Adani, elder brother of Adani Group’s inventor Gautam Adani.

Hindenburg’s charges resulted in political backlash as Congress and other opposing parties questioned SEBI’s openness. At the same time, Buch came under internal criticism for a supposedly noxious work environment inside SEBI.

Although being accused, Madhabi Puri Buch and her husband asserted that their investments were done before she became SEBI chief and that they had entirely followed disclosure rules.

Recently, Hindenburg Research, which carried many well-known financial fraud inquiries, declared it was closing its activities.

The court’s ordering an FIR means that the case against Madhabi Puri Buch and the SEBI officials is about to be more closely investigated, thus representing a major change in the financial regulatory scene of India.