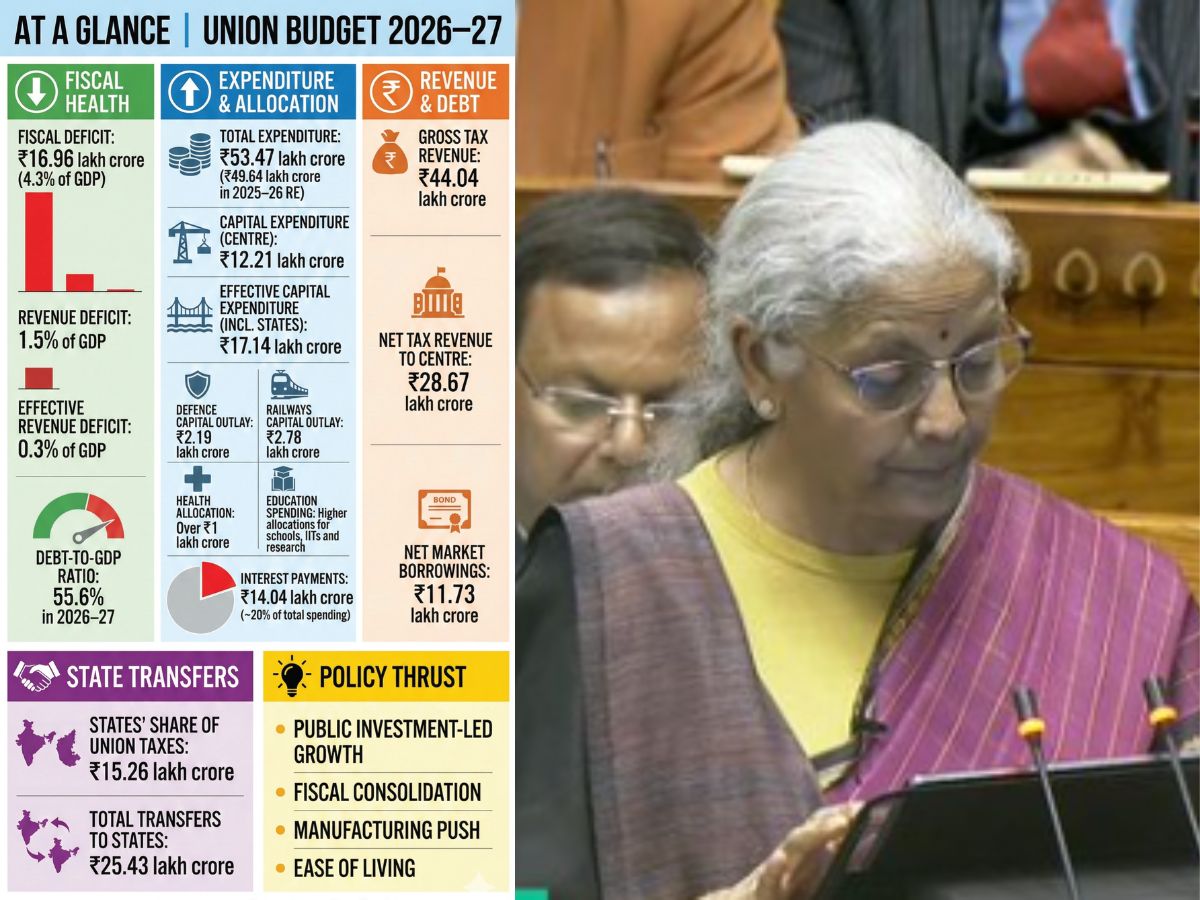

Finance Minister Nirmala Sitharaman on Friday presented the Union Budget for 2026–27, signalling a decisive shift from post-pandemic stimulus to fiscal stabilisation while maintaining a strong emphasis on public investment to sustain economic growth. Presenting her ninth Budget overall and eighth full Union Budget since 2019, Sitharaman said the focus was on asset creation, controlled revenue expenditure and preparedness for higher interest costs as government debt remains elevated. Total expenditure for 2026–27 has been pegged at Rs 53.47 lakh crore, up from a revised estimate of Rs 49.64 lakh crore in 2025–26. The increase is driven largely by capital expenditure, which rises to Rs 12.21 lakh crore for the Centre. Effective capital expenditure, including grants to states for asset creation, is estimated at ₹17.14 lakh crore, reinforcing the shift away from consumptionled spending towards investment-driven growth.

The fiscal deficit has been budgeted at Rs 16.96 lakh crore, or 4.3 per cent of GDP, marginally lower than the 4.4 per cent estimated for the previous year. The revenue deficit is projected at 1.5 per cent of GDP, while the effective revenue deficit is expected to decline sharply to 0.3 per cent. Under the FRBM framework, the debt-to-GDP ratio is projected to fall to 55.6 per cent in 2026–27, with the government reiterating its medium-term target of 50±1 per cent by 2030–31.

Gross tax revenue is estimated at Rs 44.04 lakh crore, supported by continued buoyancy in income tax and corporation tax collections. After devolution, net tax revenue to the Centre is projected at Rs 28.67 lakh crore. States are expected to receive Rs 15.26 lakh crore as their share of Union taxes, while total transfers to states, including grants, are estimated at Rs 25.43 lakh crore. Non-tax revenue, including dividends from public sector enterprises and transfers from the Reserve Bank of India, is projected at Rs 6.66 lakh crore.

Borrowing continues to finance the bulk of the deficit, with net market borrowings estimated at Rs 11.73 lakh crore. Interest payments are projected to rise to Rs 14.04 lakh crore, accounting for nearly onefifth of total government expenditure and highlighting the long-term fiscal cost of accumulated debt.

Defence spending sees a broad-based increase, led by a sharp rise in capital outlay on defence services to Rs 2.19 lakh crore. Higher allocations have been made for aircraft, naval platforms, weapons systems, infrastructure and defence research, alongside increases in revenue expenditure and pensions reflecting personnel costs. The government reiterated its emphasis on indigenisation and long-term capability building rather than announcing new platform-specific procurements.

Internal security allocations rise significantly, with higher spending on policing, intelligence agencies, border management and security infrastructure. Census-related expenditure sees a sharp increase ahead of Census 2027, while the Intelligence Bureau and border infrastructure receive notable capital boosts, reflecting a push towards technology-led, data-driven security and improved inter-agency coordination.

Indian Railways remains a central pillar of infrastructure policy, with capital outlay raised to Rs 2.78 lakh crore. Higher allocations have been made for rolling stock, network expansion, signalling, electrification and safety works, even as staff costs and pension liabilities continue to exert fiscal pressure. Passenger and freight revenues are projected to recover moderately. The Budget speech also announced plans to develop seven high-speed rail corridors through dedicated institutional and financing structures outside routine railway capital heads.

Health spending crosses the Rs 1 lakh crore mark, with higher allocations for central hospitals, AIIMS, Ayushman Bharat health insurance, public health infrastructure and biomedical research. The Budget outlines a major expansion of mental health and trauma care, including the setting up of a second NIMHANS in north India, alongside a large-scale push to expand the health workforce. The Biopharma SHAKTI initiative aims to build domestic capacity for biologics and biosimilars to address the growing burden of non-communicable diseases.

Education allocations rise across school and higher education, with increased funding for Samagra Shiksha, PM POSHAN, PM SHRI schools, central universities, IITs and research-linked schemes. The emphasis remains on implementing the National Education Policy, strengthening state universities and aligning education with employment needs and emerging technologies such as artificial intelligence.

In technology and industry, the Ministry of Electronics and Information Technology prioritises semiconductors and electronics manufacturing, with over Rs 10,500 crore earmarked for fabrication, components and ecosystem development. Production-linked incentive payouts taper as earlier commitments peak, while funding continues for Digital India, the IndiaAI Mission and digital governance institutions.

The Budget also announces tax and compliance measures aimed at improving ease of doing business and ease of living, including relief in tax collected at source on select payments, simplified return filing timelines and decriminalisation of certain minor offences.

Overall, the Union Budget for 2026–27 reflects a government that has exited emergency stimulus mode without embracing austerity. The strategy rests on sustained public investment to crowd in private capital, targeted sectoral support rather than broad tax cuts, and a gradual tightening of fiscal parameters. Its success will hinge on execution, tax buoyancy and the ability of states and public agencies to translate higher capital allocations into completed projects within the financial year.