Indira Gandhi’s Left leanings were more radical than that of her father Nehru. Indira favoured a more aggressive brand of socialism and greatly admired the Soviet model of political centralisation. Her justification for nationalisation was to provide bank financing for the country’s marginalised classes, particularly the agrarian class as farmer distress was as prevalent then as it is now. She had the fullest support from all the Left parties who along with the public welcomed the move.

On Saturday 19thJuly 1969, without warning prime minister Mrs Indira Gandhi nationalised 14 Indian banks by special Presidential Ordinance, without consulting the Cabinet and the Planning Commission. Three days previously, she had dismissed the Finance Minister Moraji Desai and had taken the Finance portfolio for herself. Desai had been vehemently opposed to nationalisation and preferred his own policy of ‘social control’ for banks without actually owning the institutions. In relation to his dismissal Desai was later to lament to Indira, ‘You have behaved towards me in a manner in which no one would behave even with a clerk.’

Indira had nationalized 14 leading banks, the biggest was the Central Bank, controlled by the Tatas with deposits of over 4 billion rupees, and the smallest was the Bank of Maharashtra with deposits totalling 700 million rupees. Indira had struck a severe blow to other big business houses too such as the Birlas who were running United Commercial Bank, the Dalmia-Jains with Bharat Bank and its 292 branch offices, the Punjab National Bank set up by Dyal Singh Majithia, Lala Harkishan Lal, Lala Lajpat Rai and others, and some Gujarati entrepreneurs who had big stakes in Dena Bank. An economic survey of 20 leading banks of that era showed that 188 people who served as directors were also directors of 1452 companies.

Indira Gandhi’s Left leanings were more radical than that of her father Nehru. Indira favoured a more aggressive brand of socialism and greatly admired the Soviet model of political centralization. Her justification for nationalisation was to provide bank financing for the country’s marginalized classes, particularly the agrarian class as farmer distress was as prevalent then as it is now. She had the fullest support from all the Left parties who along with the public welcomed the move.

For the opposition parties, Gandhi’s move was seen as a populist one, taken for political expediency. The Congress had not done well in the 1967 elections two years previously, and Mrs Gandhi was heading a minority government. The Swatantra Party, founded by Independent India’s first Governor-General C. Rajagopalachari in 1959 to counteract the socialist policies of Nehru, was now the single largest party in the Lok Sabha, and most of its members were ideologically aligned and on first name basis with ‘Morajibhai.’

One of Desai’s close friends was R. C.Cooper, the then General-Secretary of the Swatantra Party who was holding a dinner party in his south-Mumbai home on the night of 19thJuly, when news of nationalisation was announced on the radio much to the shock of all those present. One of Cooper’s guests from the Congress Party, who he does not name, but refers to as ‘a very senior official of the Government’, seeing Cooper’s visible agitation urged him to contest bank nationalisation and the next morning -a Sunday-Cooper rushed to Delhi.

In a first person account – ‘Why I Moved The Supreme Court’, published in the February 20, 1970 issue of Himmat Weekly, Cooper wrote, ‘It was only about eight months before the actual step of bank nationalisation was taken that we had the social control legislation.

Those of us who have taken pains to study the measure of social control in great detail came to the conclusion that there is nothing more in bank nationalisation which would promote social objectives better than would be done under the social control legislation. Therefore it would be incorrect for a socialist or anyone else to suggest that bank nationalisation is a step calculated to promote social objectives.’

Arriving in Delhi, Cooper found that noted jurist Nani Palkhiwalla was co-incidentally also in the city. He immediately engaged Palkhiwalla as counsel and Cooper’s petition was framed. Cooper had all the right qualifications to petition the Supreme Court. A leading Chartered Accountant of Mumbai, with a Ph.D. in Economics, Cooper was an early proponent of Free Market Economies and was Vice –President of the influential Forum of Free Enterprise. But it was in his capacity as shareholder and a member of the Board of Directors of the Central Bank of India, that he challenged bank nationalisation. Cooper wrote, ‘I have felt that not only certain political parties but even individuals in the highest places in the political sphere have started regarding the Constitution as something which can easily be played about with. My main objective in taking the matter to the Supreme Court was to establish the sanctity of the Constitution, the rule of law and the fundamental rights of the individual, particularly the small man and the small shareholder.’

Even as R.C.Cooper v. The Union of India was being heard; the Congress government went ahead with its plans to formalize the bank nationalisation ordinance and introduced the Banking Companies (Acquisition and Transfer of Undertakings) Act of 1969.

During the court proceedings it was alleged by the government that ‘powerful big business interests’ were behind Cooper and financing the case. But Cooper made it clear that Palkhiwalla, his solicitor Jimmy Dadachanji and the entire team of young lawyers and economists who had volunteered their services, were in fact acting pro-bono.

On 10th February 1970, the verdict was finally out and an eleven judge bench of the Supreme Court gave a 10-1 majority verdict in Dr Cooper’s favour and declared the 1969 Act to be ‘invalid and unconstitutional’. On 14 Feb 1970, the President of India, V.V.Giri was forced to pass another Presidential Ordinance to provide for compensation. This became an Act on 31 March 1970 and by its provisions a total of 87.40 crore rupees was to be paid out to the 14 banks and their shareholders.

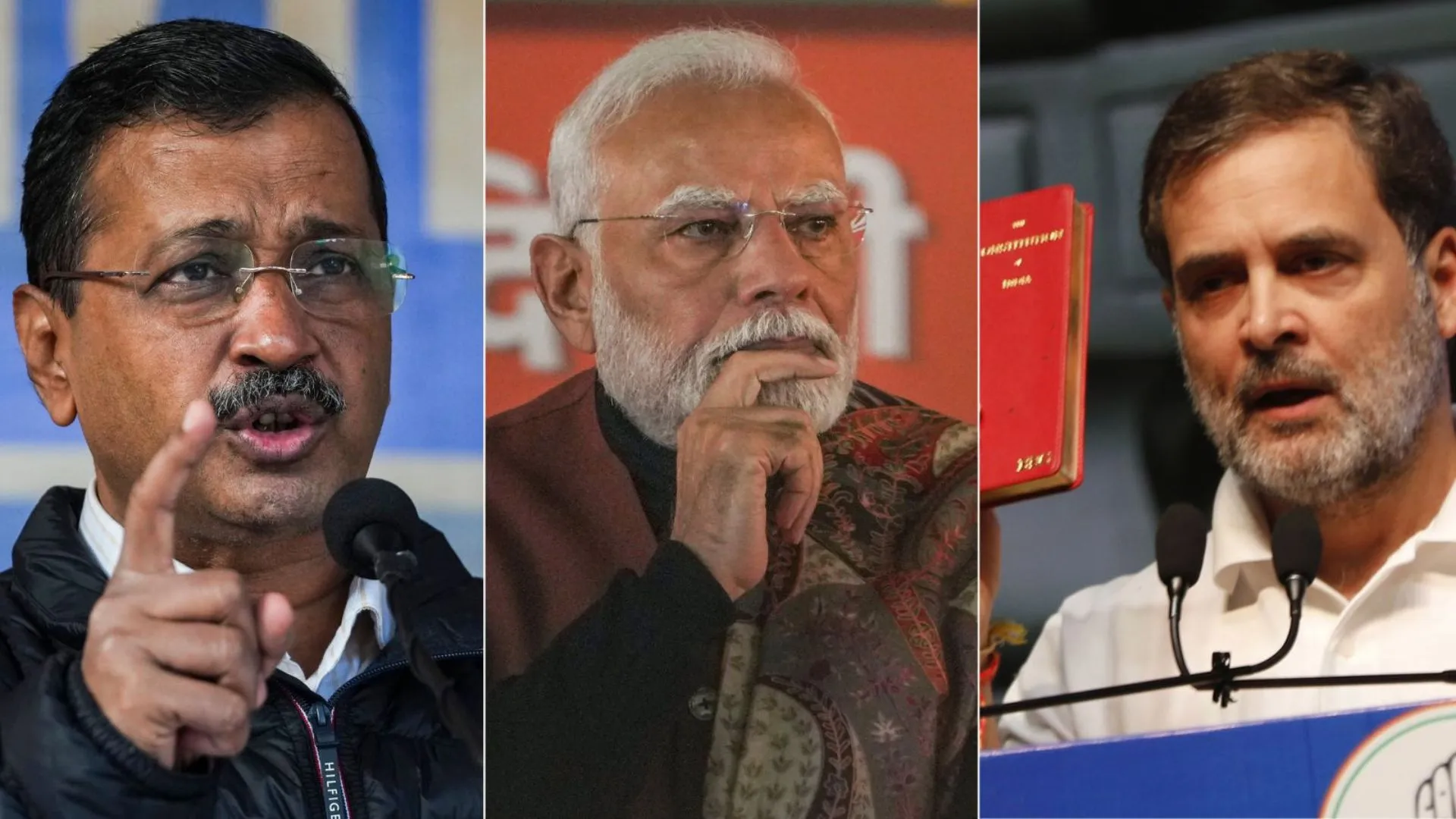

Fifty four years on the debate on the merits and de-merits of privatizing the banking sector rage on. It was the Gujarati and Parsi lobby at the time that was most strident and vocal in their call for an independent and unfettered banking industry. It will be interesting to see whether in his second or ensuing third term, India’s second Gujrati Prime-Minister Narendra Modi and his all-power number two in the government, Amit Shah will take steps to dismantle what could arguably be Indira Gandhi’s most controversial political legacy.