The Mumbai Crime Branch has cracked a credit card scam with the detention of a 49-year-old former banker, Pradeep Maurya, who has used his extensive banking expertise to become a seasoned loan scam artist. Maurya, a repeat offender with three previous arrests, is now in custody, along with six others, for obtaining high-limit credit cards using forged documents.

Maurya exploited his banking knowledge, acquired during his tenure at a prominent private bank, to manipulate documents skillfully. In this latest case, Maurya and his gang employed falsified documents to acquire credit cards from leading banks with credit limits ranging from Rs 5 lakh to Rs 10 lakh. These cards were obtained for individuals who lacked the necessary documents, with the gang pocketing half of the available limit as a commission. The police suspect that over the past 18 months, the syndicate has victimized a minimum of 50 to 60 individuals. The other suspects have been identified as Abdul Haque Shaikh, Kadar Parmar, Jagdish Jamsandekar, Meenakshi Shridhankar, Sushma alias Shilpa Mohite, and Manju Gaikwad. Maurya is the brains behind this operation and has a history of previous arrests, including loan frauds related to luxury cars and document forgery for loan procurement.

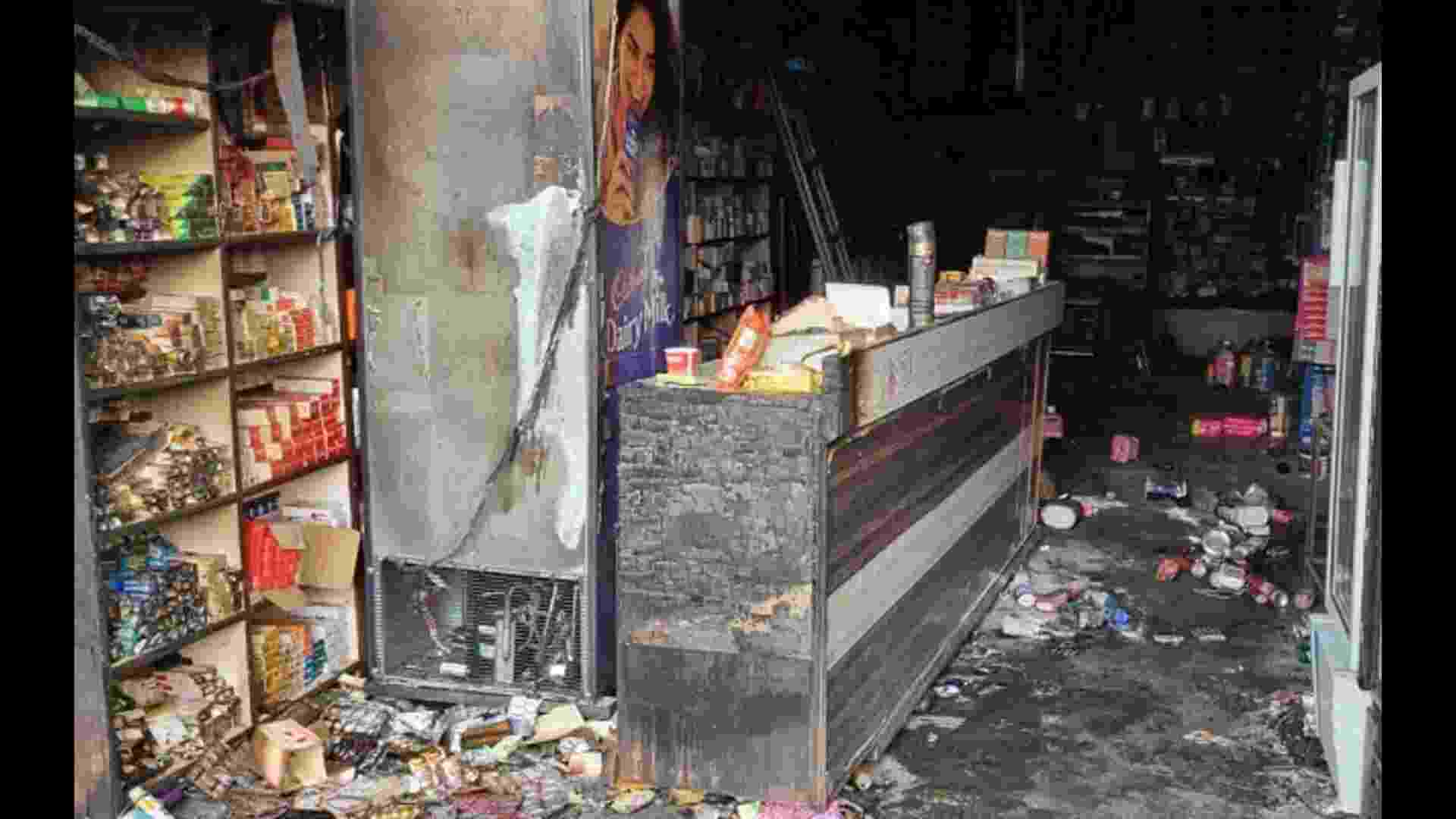

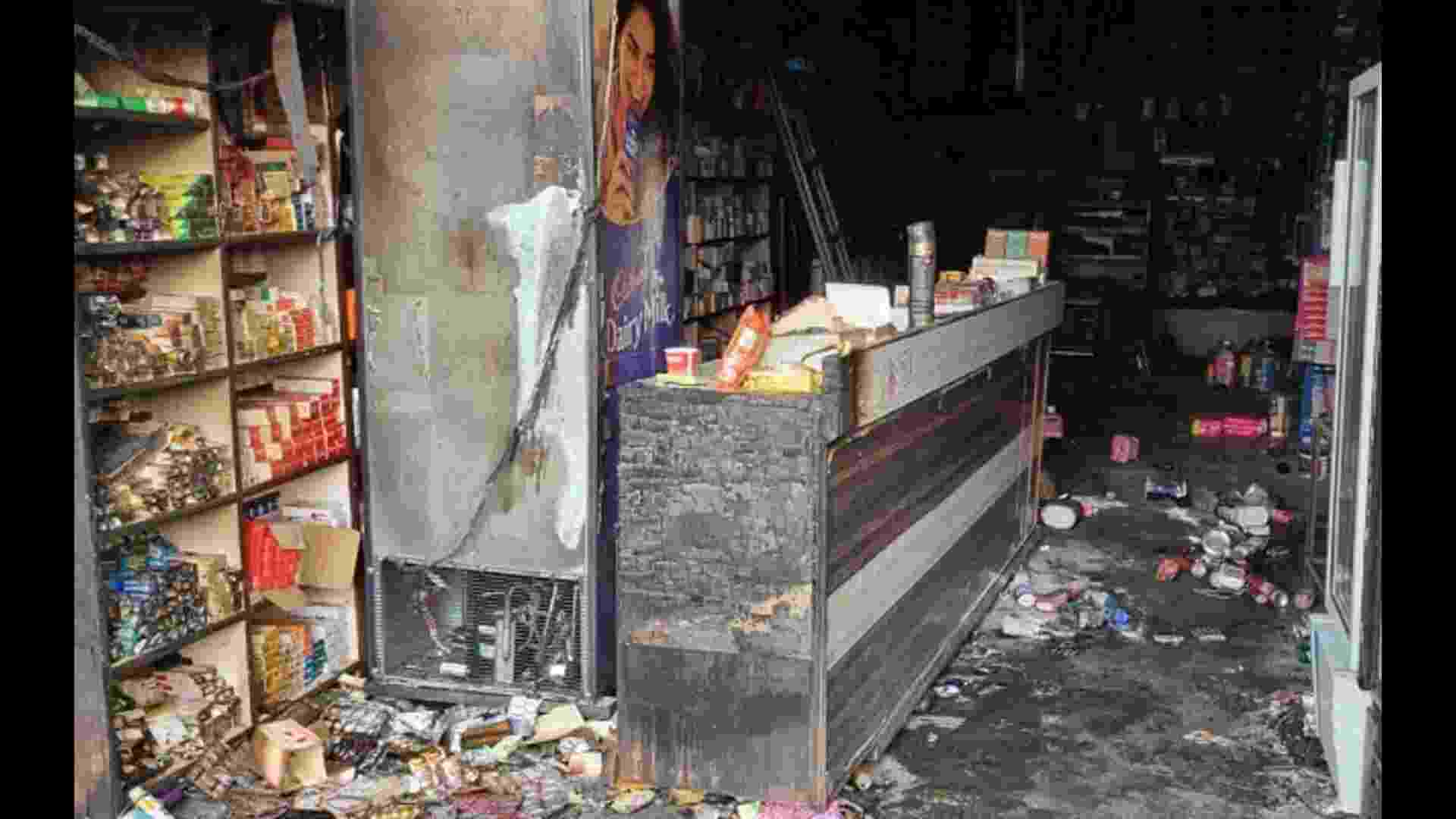

The gang operated by forging Income Tax Return (ITR) documents to obtain an online gumasta license. Using this license, they opened current accounts. The scam involved using two SIM cards for verification by bank officials. One of the gang members would impersonate the applicant when contacted by the bank. After receiving the credit card, they would claim half of the available amount as a commission, leaving the applicant responsible for EMI payments, according to Deepak Surve, senior police inspector of Unit III of the Crime Branch. Pradeep Maurya is well-versed in the banking system’s intricacies. In 2021, he acquired 20 high-end vehicles, including Audi, Mercedes, MG Hector, and Mini Cooper, using loans from banks. He then mortgaged these vehicles for half the sum, citing the need for funds for his sister’s wedding. He had previously faced an FIR in 2015 at the Bhandup police station in a similar loan fraud case and encountered legal complications with the Rabale police in Navi Mumbai in 2018. Following his release on bail in the high-end car case, the police suspect that Maurya set up the credit card scam. An officer noted, “We suspect that a significant number of people, possibly exceeding 50-60, have fallen victim to the gang’s schemes. We are actively searching for their office to gather additional evidence.”