As the financial year 2023-24 draws to a close, salaried employees are focusing on filing their income tax returns (ITR), with Form 16 playing a pivotal role in the process. Issued by employers, Form 16 serves as a comprehensive record of an employee’s earnings and tax deductions throughout the year.

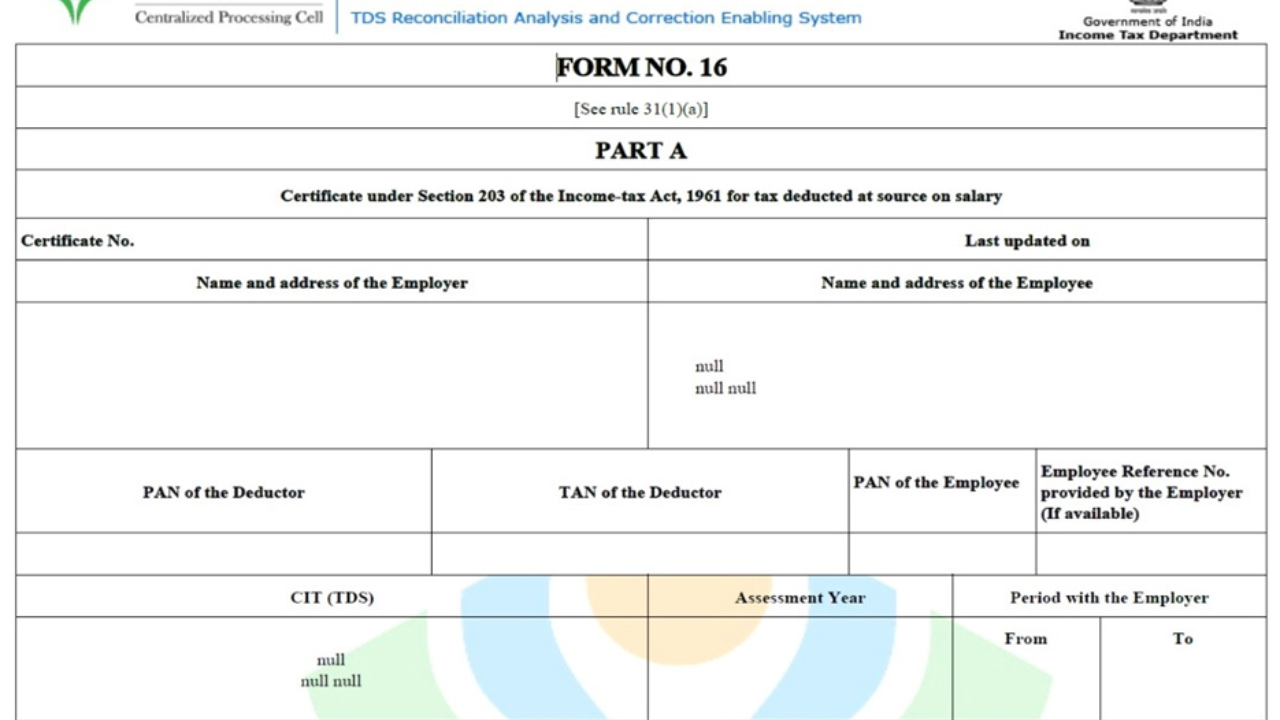

According to regulations, employers must furnish Form 16 to their employees by June 15 each year. This document details the total income earned, taxes deducted, and deposited against the employee’s PAN. It consists of two parts—Part A covering TDS details and Part B detailing the salary breakup, allowances, deductions claimed, and the tax regime selected for TDS.

Ensuring the authenticity of Form 16 is critical. It should bear the TRACES logo on both parts and be digitally signed, with the signature validated by the recipient. Part A specifically outlines quarterly TDS details, including the challan number used for depositing taxes with the government. Part B offers a breakdown of the salary components and deductions claimed.

Avinash Godkhindi, CEO & MD of Zaggle, emphasizes three essential steps for employees upon receiving Form 16:

For individuals who changed jobs during the year, obtaining this form is essential. The AIS and Form 26AS will reflect income details from each employer.

With the deadline for ITR filing set for July 31, 2024, timely rectification of errors ensures smooth processing. Apart from Form 16, gathering additional documents like bank statements, interest certificates, and proofs for tax exemptions is crucial for accurate ITR filing.

By adhering to these steps, salaried individuals can navigate the income tax filing process effectively, ensuring compliance and minimizing discrepancies.