The term “angel tax” has recently started gaining prominence within the startup sector, causing apprehension among entrepreneurs, investors, and legislators. The angel tax, which is a direct tax levied on funds received from angel investors by unlisted companies, has had an impact on the thriving startup ecosystem in India. Nevertheless, to foster innovation and entrepreneurial spirit, the Indian government has initiated a range of constructive initiatives and solutions aimed at alleviating the angel tax’s burden.

Understanding the Angel Tax Issue

The angel tax is an expensive tax on startup funding received beyond the true market value of their shares. It was introduced to prevent money laundering and illicit fund flows by taxing any investment made in an unlisted company if the investment amount exceeded the fair market value of the shares issued. However, its implementation led to unintended consequences and challenges for startups.

Startups often receive investments at valuations that may not reflect their true market worth, especially in their early stages of growth. The angel tax, in its previous form, imposed a tax of 30.6% on the excess amount above the fair market value, creating a financial burden for both startups and angel investors. This burden hindered the growth and innovation potential of startups in India.

Effective from September 25, 2023, under these revised rules, angel investors will enjoy a complete tax reduction on contributions made to startups, even when the investment surpasses the fair market value. This transformative change is poised to have a profound impact on the startup ecosystem in India.

I believe these amended laws signify a positive step towards fostering entrepreneurship and innovation. By alleviating financial stress on startups and angel investors, they create an environment more conducive to the growth of startups. Consequently, the Indian startup ecosystem is poised to thrive in a more favorable climate, promoting expansion, and facilitating the development of innovative ventures.

POSITIVE REFORMS and Solutions

A start-up shall be eligible for the exemption from Angel Tax if it has been recognized by DPIIT and the aggregate amount of its paid-up share capital and share premium of the start-up after issue or proposed issue of shares does not exceed INR 25 crores.

The guidelines governing share valuation have played a pivotal role in reducing confusion and enhancing transparency. To safeguard interests and enforce due diligence, measures have been implemented to differentiate authentic investors from fraudulent enterprises.

In a bid to promote business, the Startup India project introduced various tax incentives in 2016, including a three-year tax holiday. An inter-ministerial organization has streamlined the examination process for angel tax, thereby easing the burden on business owners. Furthermore, the allure of startup investments for angel investors has grown due to tax benefits on long-term capital gains. These modifications collectively contribute to an improved business environment in India, one that is more appealing to investors and entrepreneurs.

While the government’s stringent regulations and adaptations appear to be making headway in alleviating the issue, the angel tax challenge has remained a contentious topic within India’s startup community. Key developments in adopting the right approach encompass raising the exemption threshold, establishing assessment guidelines, and enacting investor protection laws. Additionally, the government’s commitment to fostering innovation and entrepreneurship is evident through initiatives like Startup India and the establishment of the inter-ministerial board.

While these initial changes are heading in the right direction, it’s crucial to continuously refine the angel tax system to strike the necessary balance between preventing misuse and aiding legitimate businesses. With these ongoing improvements in place, India’s startup ecosystem is better positioned to thrive and flourish.

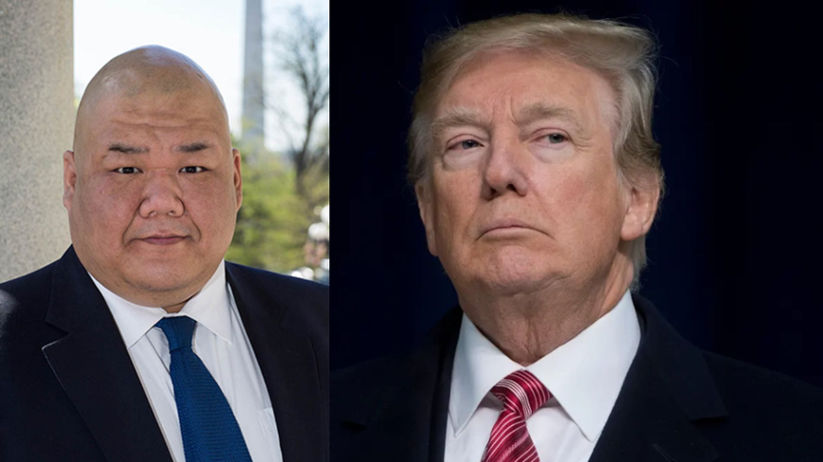

Pranay Mathur is the Partner and CEO, Realtime Angel Fund.