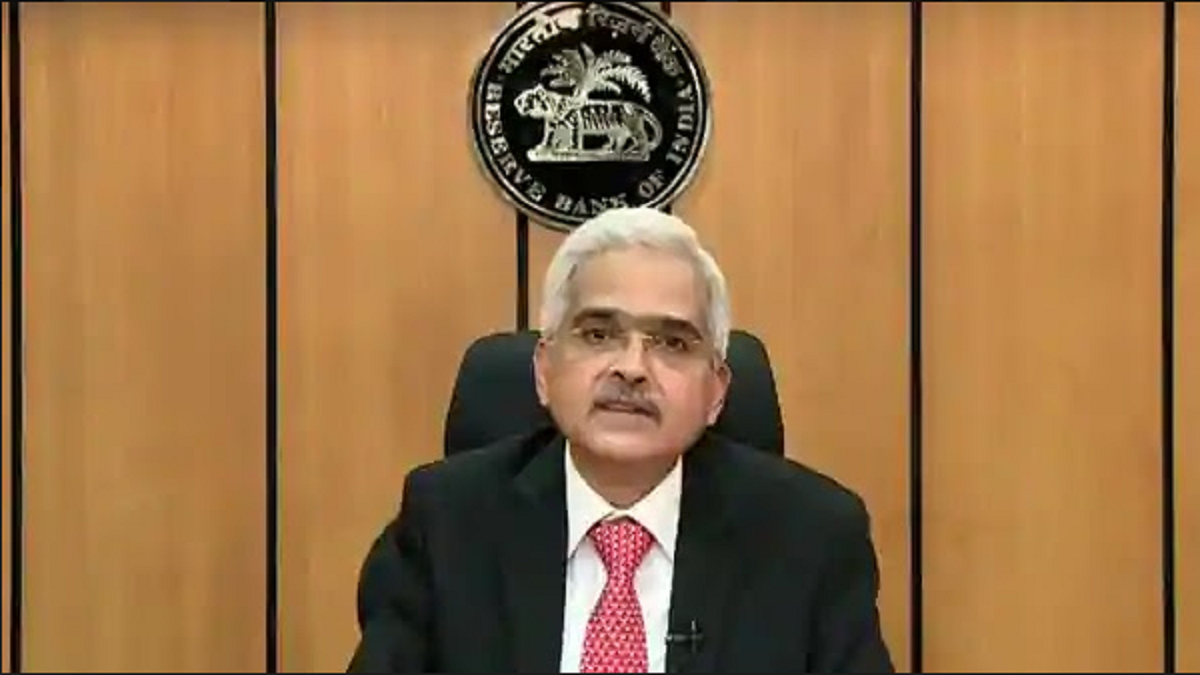

Reserve Bank of India (RBI) Governor Shashikanta Das agreed that the growth rate of GDP in the present FY (2020-21) is expected to be negative, thereby endorsing the audit report of the International Monetary Fund (IMF) and the World Bank.

Undoubtedly, it will take long time to put the economy back on tracks so that it could be restored to normalcy, given the Covind-19 pandemic impacting all the sectors in India. A high-level committee has also been set up to draft a plan for corporate loans.

There is a plan framed for loans for the small businesses which are facing financial distress. While the RBI governor was blaming Covid-19 epidemic for the flagging economy, what he forgot was that the GDP rate was at its lowest in 6 years in the second quarter of 2019. The unemployment rate had broken all records of the last 45 years.

Apparently going by the assessment made by his economic advisors, Shaktikana Das claimed to turn around the economic scenario to the extent of achieving economy of $5 trillion by 2024, while the global economists stated that 4.5 % growth rate of GDP cannot fulfill this dream. What they mean is that the country’s economy won’t lift by then.

What is visible is that the efforts are being made to cover up the failure vis-àvis economic development, and the excuse for that is Covid-19 pandemic.

As a matter of fact, the economy, which was already in a bad shape, took turn to worse on account of Covid-19. On the contrary, Government is concealing the statistics of NSSO instead of dealing with the situation. The government is doing so for the reason that compared to the last 40 years there is a considerable decrease in consumer expenditure during current FY.

Now the Governor of RBI, historian Shashikant Das has also admitted that the country’s economy is going through a bad phase. The plans made by the Government to deal with this situation are not sufficient as the facts emanating from the appraisal meetings indicate a big disaster waiting to happen in the banking sector. According to them, the bad loans have peaked to Rs 12 lakh crore. Global economist and former RBI Governor Raghuram Rajan has estimated that the bad loans shall peak beyond Rs 20 lakh crore in the current FY.

What does it mean? It means that all the banks of the country are on the verge of collapse and they are looking for relief from the government but what it has done it has merged a few more banks and is moving forward for privatisation of the banks. This is not any solution as the MSMEs have clarified that they are not in a position to repay their loans for want of a credible policy. This sector will take a long time to recover on account of Covid-19 and this shall have a definite impact on other sectors.

Media sector is also passing through a severe financial distress, with advertisements having shrunk. It can be understood that the distress of the MSME sector indicates massive decline in employment opportunities and people’s spending power.

The effects of bank being in distress and the negative GDP are destined to have a disastrous impact. Inflation has doubled compared to the returns on the investment in the banking and non-banking sector. More than 3000 companies have filed for bankruptcy and such is the number of companies waiting to file for bankruptcy. Meanwhile the Government has stopped this process.

It is clear that the foundation of the banking sector has collapsed. The policy makers are pressing RBI to keep minting currency. Whenever currencies are minted unreasonable inflation is bound to rise. There was a time when the nationalization of banks has instilled confidence in citizens, which is fading away now. Privatization of the public sector banks is underway resulting in failure of optimal returns on investments. You are bound to be stressed when the banking sector is on the verge of collapse and your money unsafe. You cannot keep money at home and there is no reliable place for investment. This is the reason for the rise in investments in gold.

RBI has decided to grant 90% loan against gold. In these times of distress your requirements of loans against other assets are not forthcoming. This is pushing the industry in the worst situation. Selfreliant plan is confined to the desk only. Employment of a general worker is being snatched away. Government has admitted before the Parliamentary Committee that 10 crore jobs have been lost due to this pandemic. Expectedly the purchasing power of people will be reduced drastically. Sale of passenger vehicles has fallen to 49.59 percent.

You might remember that when the Union budget was passed on 23 March wherein the outlay for the income and expenditure showed the crumbling economy to be resulting from Covid-19 epidemic. Now all the Government estimates of incomes are being proved baseless. Reduction in expenditure is also not showing results. Government funds are being spent more on lavish expenditures and functions than on public welfare. Steps to sell revenue generating public sector companies are underway to garner funds. Public sector Insurance companies, which provided safety insurances to the public, are also being sold. In these circumstances it is imperative that people shall avoid investing in these companies. On the other hand, Finance Secretary has clarified that he is not in a position to provide the state’s shares of the revenue in the first quarter and the states are in a predicament as they use this revenue to pay salaries to their employees. If they do not receive their share of revenue then they shall be forced to reduce the employees and their salaries, a step that will increase unemployment and poverty rapidly. Works of public welfare and development shall cease and the governments will be forced to sell their properties to garner funds for income and the public will be stuck in quicksand of poverty and corruption.

The need of the hour is that the government should not blow estimates but should draft foresightedly reliable plans. Transparency and accountability in government function should be ensured. This is the testing time for economy and development. The government should increase the spending power of the common man by providing incentives and drafting plans so that the industry may be revived and if steps are not taken well in time then we should be ready to face disastrous results. For want of farsightedness and in pursuit of personal agendas the plans of the government create troubles not solutions.