One of the biggest corporate reorganizations in India is about to take place. In a matter of hours, the automotive titan, Tata Motors, will officially complete its demerger, splitting into two distinct, listed companies. The move sounds promising: more value, clearer direction. The idea is to make the business stronger and more focused. But for investors, the real question is simple—what does this mean for the money they’ve put in?

What Is The Demerger Scheme?

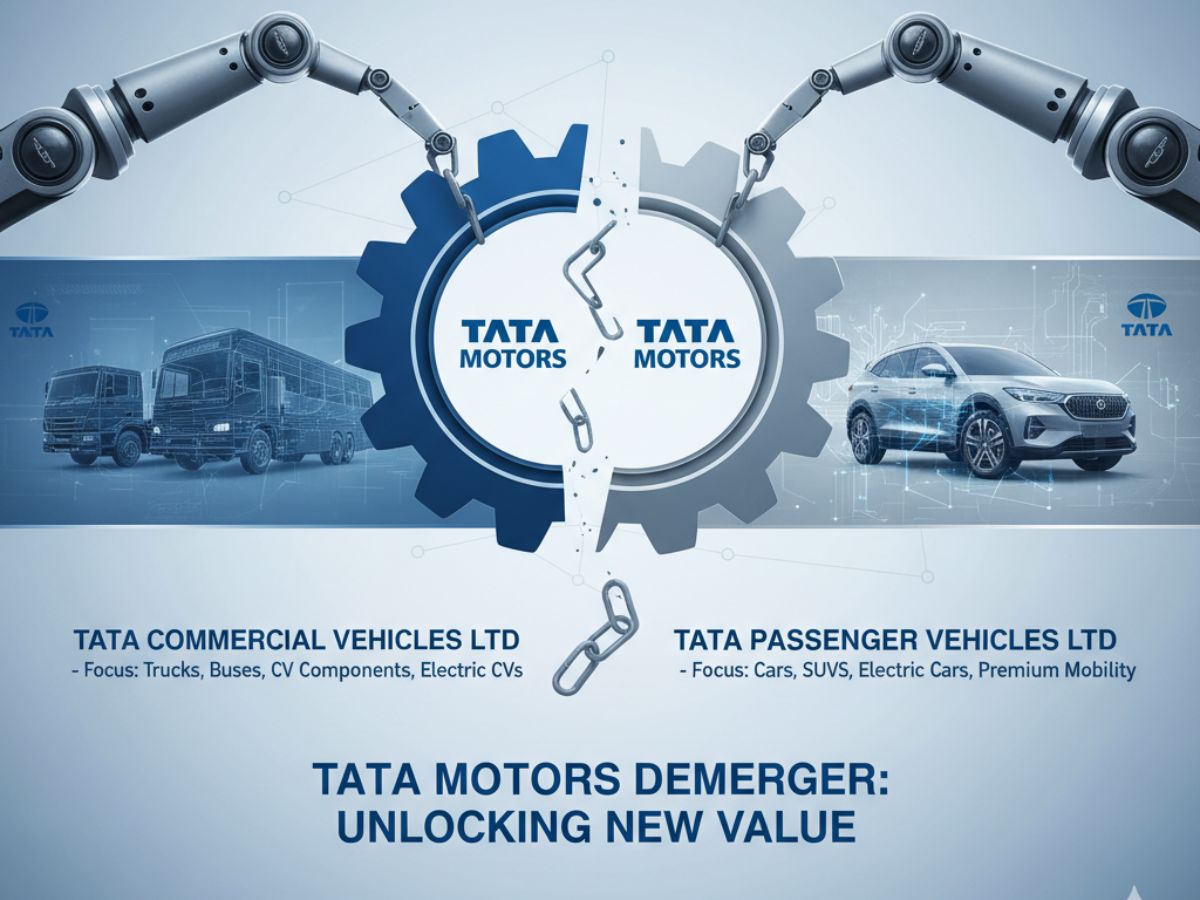

Fundamentally, the demerger is a calculated division of Tata Motors’ extensive business activities. The goal is to create two pure-play companies, each with its own dedicated management, focus, and growth trajectory. The official plan calls for the demergence of the commercial vehicle industry, which includes trucks and buses, into a new company called TML Commercial Vehicles Limited (TMLCV). The original Tata Motors company, which will house the passenger vehicle segment, will be renamed Tata Motors Passenger Vehicles Limited. This entity will oversee the popular range of cars and SUVs, the rapidly expanding electric vehicle (EV) operations, and the prestigious Jaguar Land Rover business. This separation is designed to allow each unit to sharpen its competitive edge in their respective, and very different, market landscapes.

Your Investment, Decoded: How Many Shares Will You Get?

This is the most critical question for every shareholder, and the answer is straightforward. The Tata Motors demerger operates on a 1:1 share entitlement ratio. This means that for every single share you currently hold in Tata Motors, you will receive one fully paid-up equity share of ₹2 each in the new commercial vehicles company, TMLCV. Your existing holding in Tata Motors will automatically represent your stake in the new Tata Motors Passenger Vehicles Limited. There will be no change to that portion of your holding. Additionally, the scheme includes the transfer of non-convertible debentures valued at a substantial ₹2,300 crore to TMLCV, strengthening its balance sheet from day one.

When Is The Record Date?

While the demerger is legally effective from October 1, 2024, the exact record date—the cut-off date on which shareholders must be on the company’s register to receive the new TMLCV shares—is yet to be officially announced. At recent analyst meets, the company hinted that the record date could land in mid-October—once the registrar gives the nod. For shareholders, that means it’s time to keep an eye on official Tata Motors updates and broker messages. The new commercial vehicles entity, TMLCV, is proposed to be listed on the stock exchanges separately in November.

Also Read: Who Is Barbara Marques? ICE Detains Filmmaker During Green Card Appointment

Market Reaction and Leadership Reshuffle

The markets have already been impacted by the demerger’s hype. Tata Motors’ shares closed 1.18% higher at ₹680.45, reflecting investor faith in the move. Inside the boardroom, too, changes are underway, with fresh leaders approved to chart the course of the new companies. Girish Wagh has been appointed as the Managing Director and CEO of TML Commercial Vehicles Ltd, effective October 1, 2025. On the other side, Shailesh Chandra will assume the role of Managing Director and CEO of the passenger vehicle company for a three-year term. Each company is guaranteed to have an experienced captain at the helm from the start thanks to this distinct leadership demarcation.