After making a good debut on the stock exchanges today, Sri Lotus Developers’ shares quickly increased in value. After its strong market debut, the stock increased 3.8% after listing to reach an intraday high of Rs 185.90, demonstrating ongoing investor interest.

The stock began at Rs 179.10 on the BSE, 19.4% higher than its IPO price of Rs 150. It had an 18.7% premium when it went public on the NSE at Rs 178.

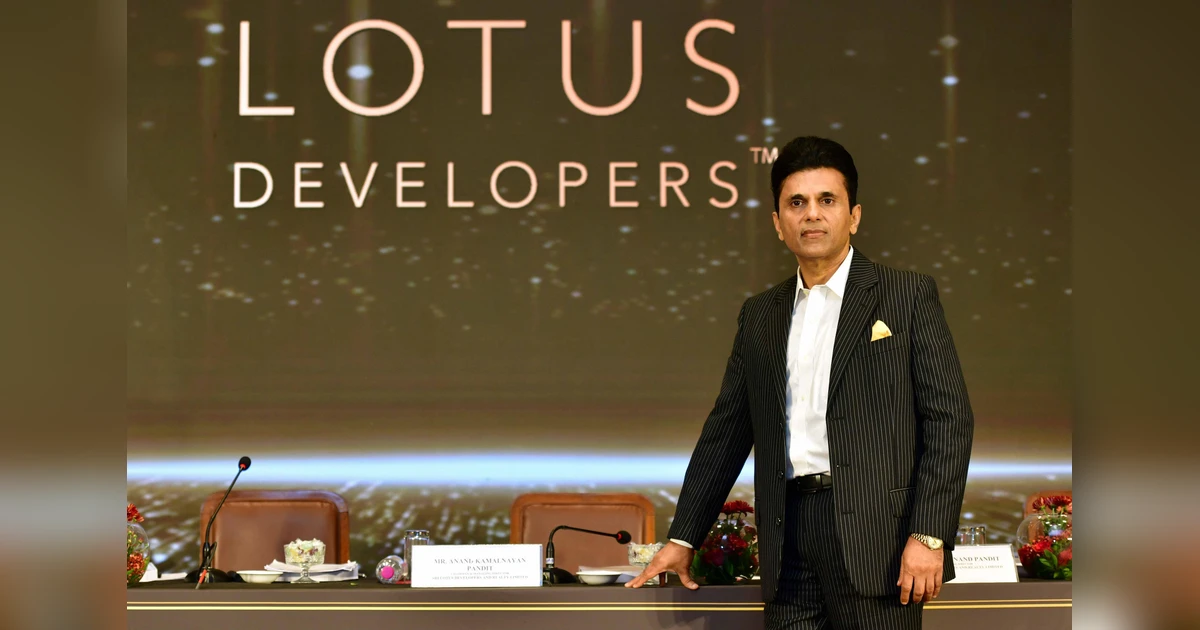

Sri Lotus Developers Shares Jump 4% on Debut

Backed by Bollywood stars Shah Rukh Khan and Amitabh Bachchan as well as investor Ashish Kacholia, Sri Lotus Developers & Realty saw its stock debut on strong footing from the first day of trade on August 6. It opened at ₹179.10 on BSE (19.4% premium over the ₹150 issue price) and at ₹178 on NSE (18.7% premium).

After listing, shares further zoomed to an intraday high of ₹185.90, showcasing continued investor interest and confidence in the luxury real estate prospects of the company.

Its IPO was a complete fresh issue, amounting to ₹792 crores. Volumes of demand were overwhelming for this IPO, being 74.10 times oversubscribed overall, led by the QIB segment at 175.61x, followed by NIIs and retail investors. Pre-listing, grey market premiums indicated potential listing gains in the range of 20%–28%, signaling bullish sentiment regarding long-term value creation.

Why the Market Loved It

While focusing on the redevelopment project, this company also works on projects in the ultra-luxury and luxury segment in Mumbai. They use an asset-light model with a strong cash flow and rich pipeline of projects for the future. It showed a healthy financial performance in FY25, posting 22% increase in revenues from 2025 to ₹569 crore and 91% increase in net profit to ₹227 crore.

Mehta Equities’ Senior Vice President (Research), Prashanth Tapse, expressed his thoughts following the listing: “Sri Lotus Developers listed broadly in accordance with our expectations despite the current market volatility, bolstered by strong subscription and listing demand — a clear reflection of investor sentiment.”

What Might Come Next

Subscribe investors were suggested by analysts to hold their stock in the medium to long term to benefit from the structurally strong demand in the super premium real estate segment of Mumbai. Non-allottees might wait for any post-listing fall to consider entry point opportunities.