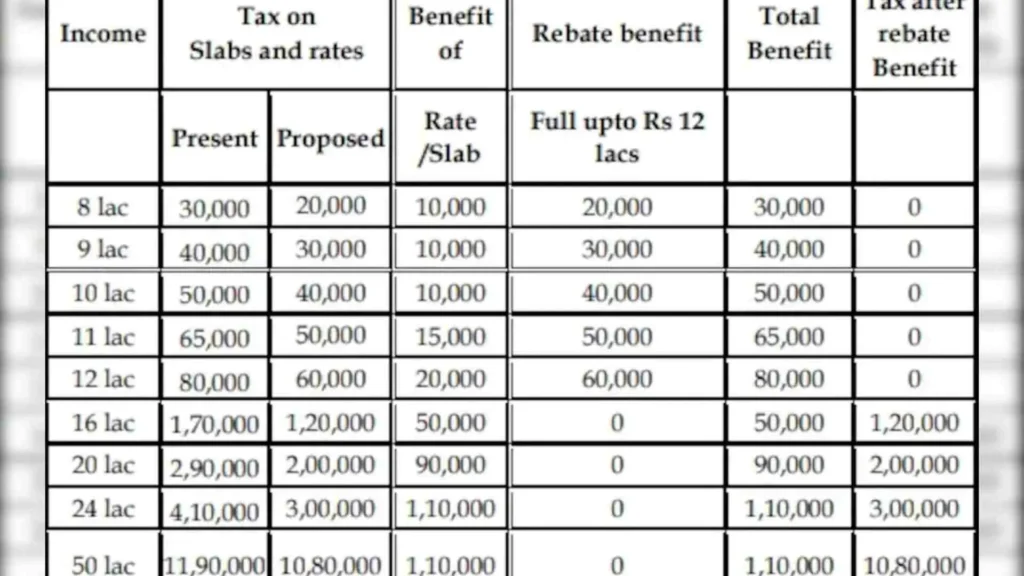

As per the Budget document, rebate on taxes will be available for individuals with an income up to Rs 12 lakh. For salaried professionals, Rs 12.75 lakh would attract rebate as the standard deduction would amount to Rs 75,000. The table is annexed to the document showing rebate structure applicable to the persons having income of Rs 8 lakh, which starts from Rs 10,000 and goes up to Rs 80,000 for a person with an income of Rs 12 lakh.

Tax Computation for an Annual Income of Rs 16 Lakh

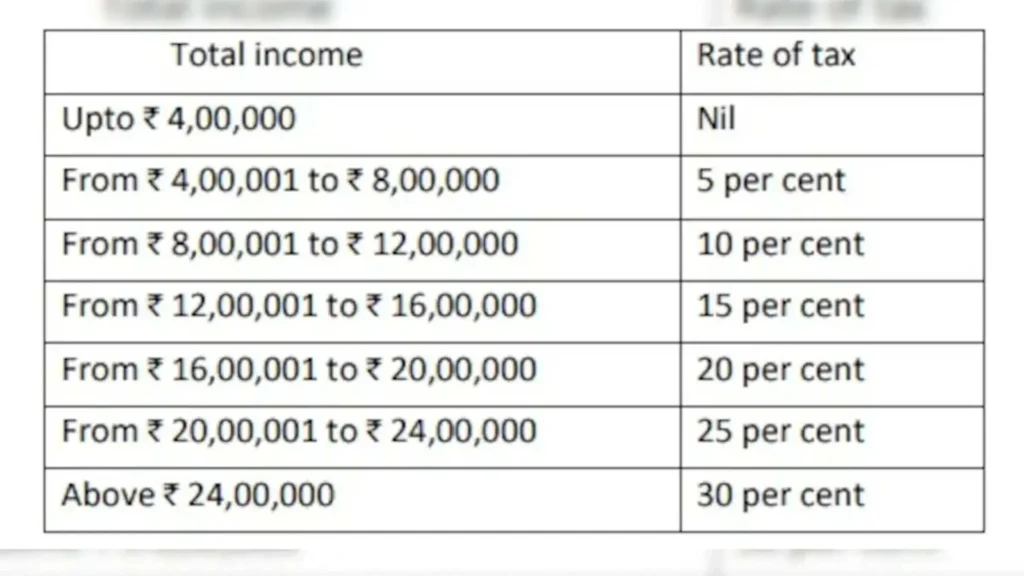

No tax will be deducted for the first Rs 4 lakh, while for the next Rs 4 lakh, which falls in the slab of Rs 4 lakh-Rs 8 lakh, 5 per cent tax will be applied. This works out to Rs 20,000. The following Rs 4 lakh (Rs 8 lakh-Rs 12 lakh bracket) will be taxed at 10 per cent, equating to Rs 40,000. The final Rs 4 lakh (Rs 12 lakh-Rs 16 lakh slab) will be taxed at 15 per cent, resulting in Rs 60,000. In total, the tax payable will be Rs 1,20,000, which is Rs 50,000 lower than the current tax liability.

New Tax Slabs

New Tax Slabs

Tax Implications for a Salary of Rs 50 Lakh

It does make over Rs 1 lakh worth of difference in tax slabs for the high-income earner. For instance, if the income is Rs 50 lakh, the revamped slabs will fetch a total of Rs 10,80,000 as income tax, which is Rs 1,10,000 more than what is being paid currently. It is believed to increase disposable income in the middle-class segment and provide some comfort to the higher segment, which could consume.

What About the Old Tax Regime?

The Budget paper clarifies that the new tax slabs would apply only to those who choose the New Tax Regime. The government has been pushing this system as a simplified way of personal taxation since it is devoid of the complexities of exemptions. Although Finance Minister Nirmala Sitharaman did not speak about the old tax regime in her speech, she addressed this during a media interaction later. When asked if the old regime was being phased out, she denied it, saying that she would have formally announced any such decision.

Should You Switch to the New Tax Regime?

The choice is between the older and the newer tax regimes is based on his financial situation as well as how much he might be able to claim in terms of exemptions. For example, if a salaried man earning Rs 16 lakh has exemptions of Rs 4 lakh, his total taxable income comes to Rs 12 lakh. In the earlier tax slabs, he will pay Rs 1,72,500-a total of Rs 52,000 more.

According to Deloitte India’s Partner Divya Baweja, while talking to NDTV, “one would have to see what if a taxpayer is going under the old regime then what kind of deductions or exemptions he should be looking at so that the benefit he could take is similar to the new regime. That comparison factor will depend on an individual scenario basis the same. Therefore, one has to judge that which regime is more beneficial for him/her. With widening the slabs under the new regime, taxpayer needs to have a higher amount of deductions or exemptions so that he could make a tax equal in the new regime.”