The Reliance Jio IPO, which is expected to take place in the first half of 2026, will be a milestone occurrence in India’s financial history as it will see the nation’s largest telecom and digital services company going public for the first time on the stock exchange.

Announcement and Timeline

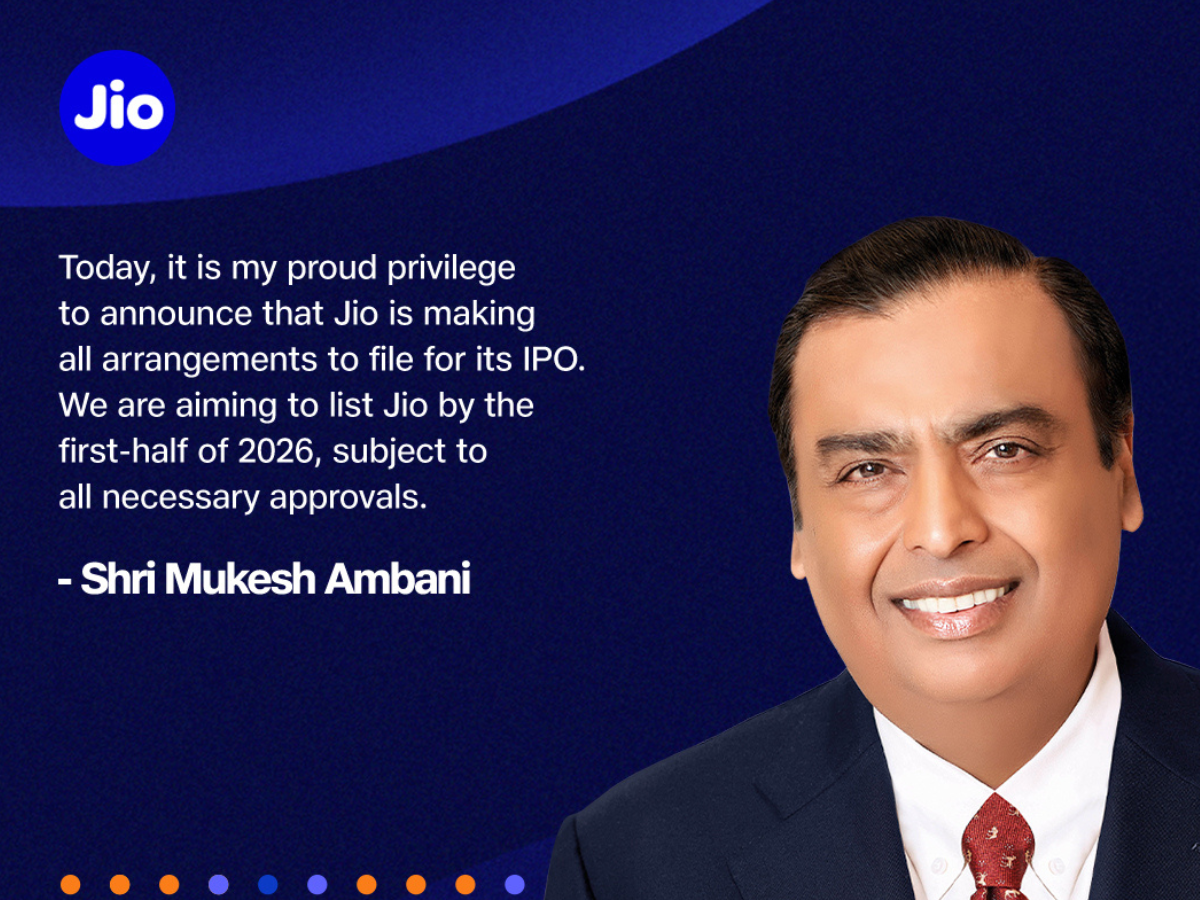

Reliance Industries chairman Mukesh Ambani officially announced at the company’s 48th Annual General Meeting that preparations are underway to list Jio Platforms by mid-2026, contingent on receiving the necessary regulatory approvals. This decision follows several years of anticipation and is in line with Ambani’s earlier goal, set in 2019, to list Jio within five years.

Shri Mukesh Ambani unveils Jio’s IPO plans, aiming for first-half 2026 with global-scale value for investors.#WithLoveFromJio #RILAGM2025 #RILAGM #Reliance #Jio500Million pic.twitter.com/AOqtIcWDc0

— Reliance Jio (@reliancejio) August 29, 2025

Scale and Valuation

The proposed IPO is estimated to be the largest in Indian market history, with the potential to raise a whopping $6 billion and put Jio’s valuation at more than $100 billion (₹8.8 lakh crore). Certain analyst projections even estimate Jio to be as high as $154 billion, considering its pivotal position in India’s digital revolution and the enormous extent of its operations, with over 500 million subscribers as of 2025.

Market leaders like Meta (10% holding) and Google (7.7% holding) are major investors, having put in more than $20 billion in 2020. This historic issue will offer an exit opportunity for these blue-chip investors while presenting a chance for a large base of retail and institutional investors.

Strategic Direction and Growth

Jio’s IPO follows as it celebrates a decade of operation, where it has positioned itself as India’s largest mobile operator. The firm continues to target increasing 5G coverage, digital services, and artificial intelligence plans, efforts that will form the basis of its future expansion. Expansion of Jio’s presence abroad is also in the works while continuing to build proprietary technology to rival international peers.

Market Impact and Regulatory Developments

The anticipation regarding Jio’s listing is also driven by recent proposals from SEBI regarding regulations, which may reduce the minimum public offer for extremely large companies, thus making such mega-IPOs more viable for the Indian market. The IPO will create new standards on Indian bourses, breaking the record of the earlier record made by Hyundai India.

Nutshell

With a vision to build value at a global scale, the 2026 Jio IPO is a breakthrough for Reliance and the Indian market in general exemplifying the size, technology aspiration, and investor magnetism of India’s most known digital brand.