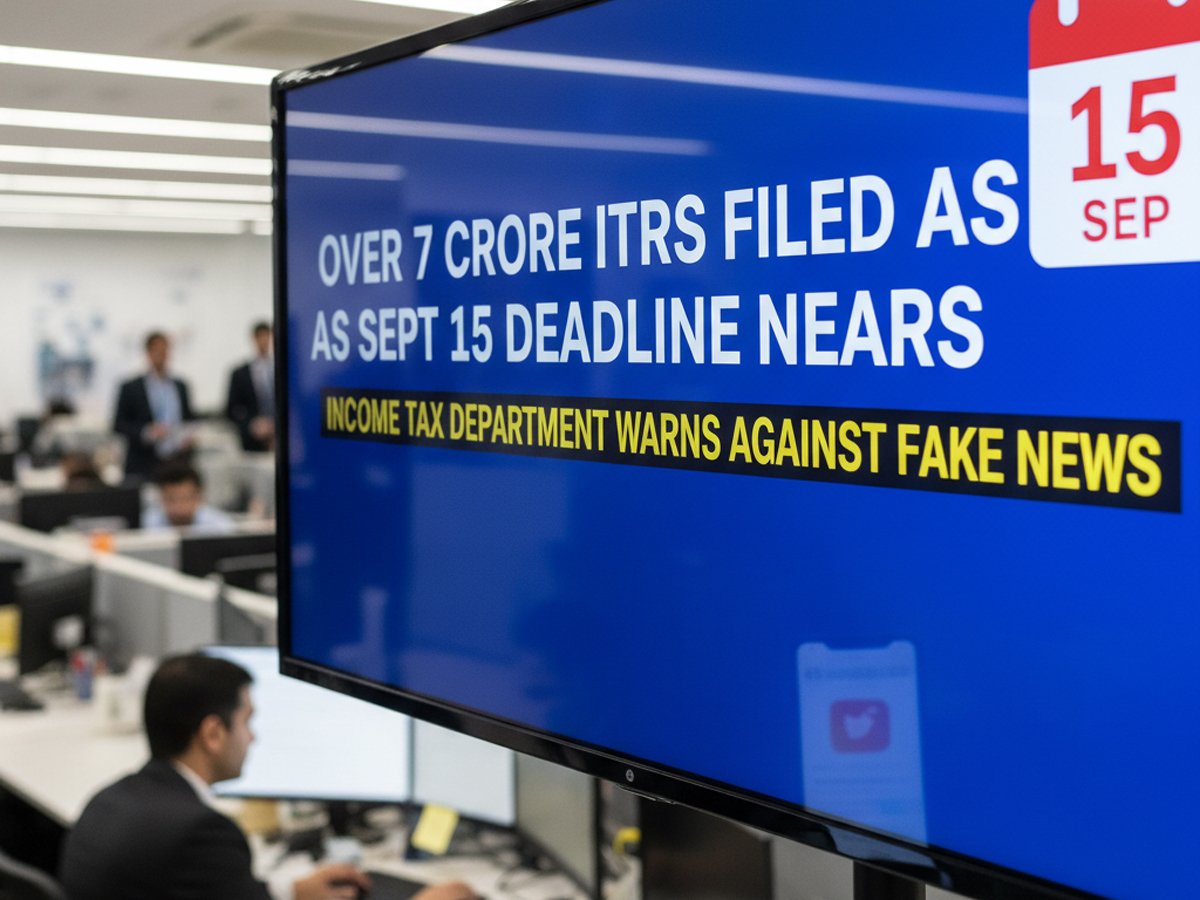

The Income Tax Department on Monday confirmed that more than 7 crore income tax returns (ITRs) have been filed for Assessment Year (AY) 2025-26. The department thanked taxpayers and professionals for their support and urged those who have not yet filed to do so quickly.

In a post on X (formerly Twitter), the department said, “More than 7 crore ITRs have been filed so far and still counting. We extend our gratitude to taxpayers and tax professionals for helping us reach this milestone, and urge all those who haven’t filed ITR for AY 2025-26 to file their ITR.”

The deadline to file ITR for most taxpayers is September 15, 2025.

Fake News on Extension Dismissed

The department also warned taxpayers about fake news circulating on social media. A post claimed that the ITR filing deadline had been extended from September 15 to September 30.

On Sunday, the Income Tax Department clarified that this was false. “A fake news is in circulation stating that the due date of filing ITRs (originally due on 31.07.2025, and extended to 15.09.2025) has been further extended to 30.09.2025,” it said.

It added, “The due date for filing ITRs remains 15.09.2025. Taxpayers are advised to rely only on official @IncomeTaxIndia updates.”

Helpdesk Open 24×7 for Taxpayers

To assist taxpayers, the Income Tax Department has kept its helpdesk services open round-the-clock. Support is available through phone calls, live chat, WebEx sessions, and even social media.

“Our helpdesk is functioning on a 24×7 basis, and we are providing support through calls, live chats, WebEx sessions & Twitter/X,” the department announced.

This move aims to ensure smooth filing and resolve issues faced by last-minute filers.

Deadline Already Extended Once

The government had already extended the ITR filing deadline for non-audit cases once this year. Initially set for July 31, the due date was pushed to September 15 for AY 2025-26.

Businesses and taxpayers requiring audits or transfer pricing reports still have different deadlines later in the year.

Rising Tax Compliance in India

Officials said the strong numbers highlight better compliance and an expanding taxpayer base. The surge in filings reflects growing awareness and responsibility among citizens.

The department has urged all remaining taxpayers to meet the September 15 deadline to avoid penalties, late fees, and interest charges.