Indian stocks experienced major sell-offs today as the BSE Sensex index lost 849 points and the NSE Nifty index fell below 24,750. Most of the sectors such as metals, pharma, realty, and automobiles recorded substantial losses as investors were apprehensive about imminent US tariff increases, devaluation of currency, and economic uncertainty in the world, further fuelled by the During this red sea, the sector of Fast-Moving Consumer Goods (FMCG) shone as a ray of hope, recording high gains and surpassing the overall market.

ALSO READ | 26 August, 2025 : Indian Stock Markets Bled Losses over 1%

Defensive Nature and Stable Demand

FMCG shares gained mainly due to their defensive nature. While cyclical industries significantly relying on exports or industrial demand tend to experience tough times when investor risk-taking appetite decreases, FMCG businesses typically generate revenues from domestic usage of basic products such as food, personal care, and domestic use items. This consistent demand provides a hedge against external factors, positioning the industry favorably when investor risk-taking appetite declines.

For uncertain investors with threats of 50% duty on Indian exports, fluctuating commodity prices, and the weakening rupee, the FMCG shares provided a haven with secure earnings prospects and consistent cash flows.

ALSO READ | Suzuki Announces ₹70,000 crores investment in India, Shares Jump!

GST Reform Expectations Fuel Optimism

Another prime mover behind the rally was optimism in the market for the government’s continued push for GST reform measures, commonly referred to as “GST 2.0.” Experts see a rationalization and potential cuts in rates for several staples and consumer items, which would drive down prices and support demand growth.

This vicarious stimulus comes after the recent income tax cuts to stimulate consumption. The idea of GST relief boosted investor optimism towards FMCG firms, particularly blue-blooded names like Hindustan Unilever (HUL), Britannia, Nestlé India, ITC, and Dabur India, all of which gained 2-3% on the day.

Positive Earnings Momentum

Early quarterly outcomes by top FMCG players also comforted investors. Most posted strong volume growth and margin improvement despite inflationary pressures on raw materials, reflecting business model strength and price power. This earnings momentum further assured investors in the capability of FMCG shares to provide stable returns in the face of broader macroeconomic uncertainties.

ALSO READ | Vikram Solar Lists with a Boom Today, Shares Plunge over 7% Up

Market Impact and Outlook

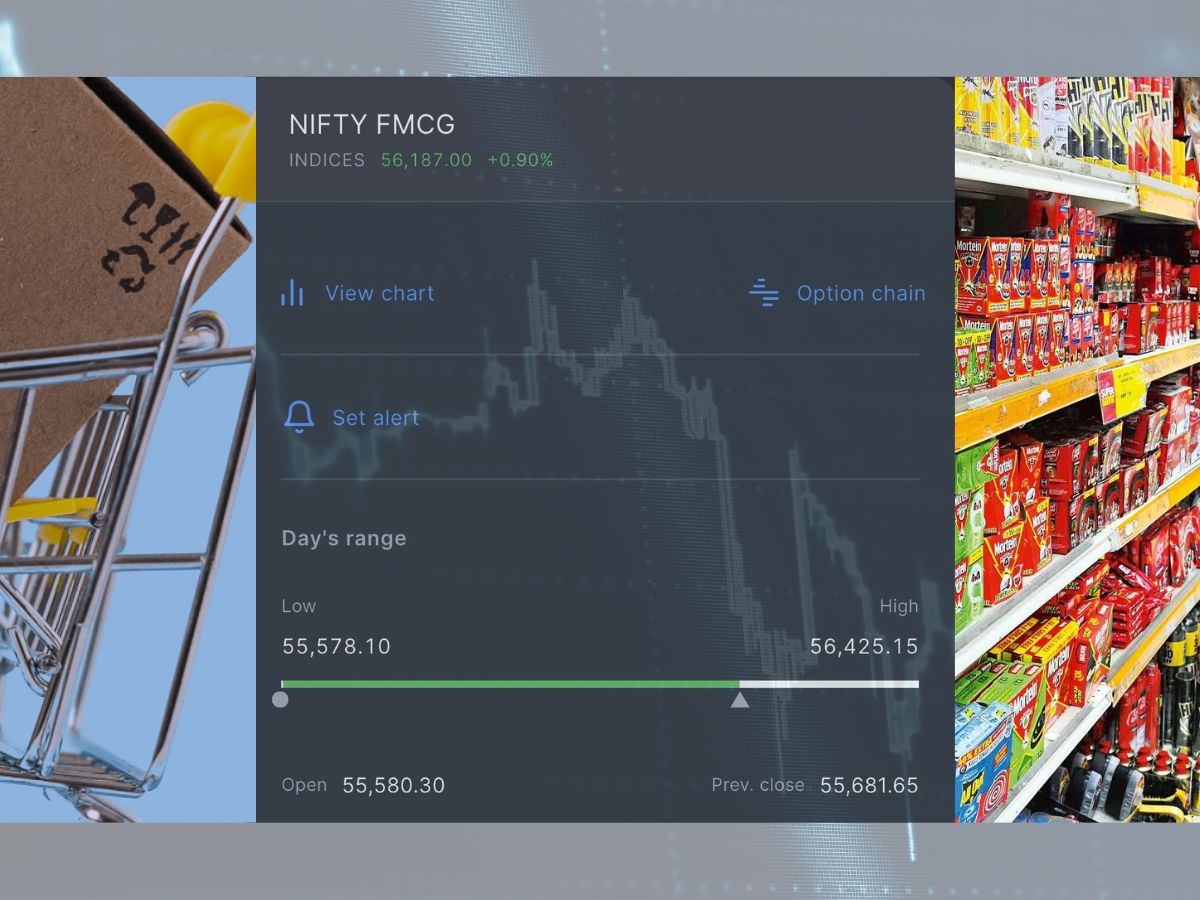

The Nifty FMCG index gained 0.91% today, emerging as one of the few sectoral indices with gains. The upsurge helped mute some of the freefalls in export-oriented sectors such as textiles, pharma, and engineering, which were battered by tariff issues and foreign fund selling.

Looking forward, FMCG can remain the preferred bet of local as well as foreign investors seeking safety, stable growth, and inflation-hedged returns. While macroeconomic headwinds and global trade tensions take toll on most sectors, FMCG’s defensive nature coupled with consumption recovery opportunities make it a relatively stable investment option in uncertain times.