India’s GDP for FY25 is projected to grow at a “conservative” rate of 6.5-7% in real terms, according to the Economic Survey for 2023-24 presented in the Lok Sabha on July 22, 2024. This forecast reflects anticipated strong growth driven by improved private sector balance sheets, increased rural demand due to favorable rainfall predictions, and a likely rise in merchandise exports with advancing economies.

The Survey notes that while India’s GDP is nearing its pre-pandemic trajectory by Q4 FY24, potential escalation in geopolitical conflicts in 2024 could lead to “supply dislocations, higher commodity prices, reviving inflationary pressures, and stalled monetary policy easing, with possible repercussions for capital flows.” These factors could impact the Reserve Bank of India’s (RBI) monetary policy.

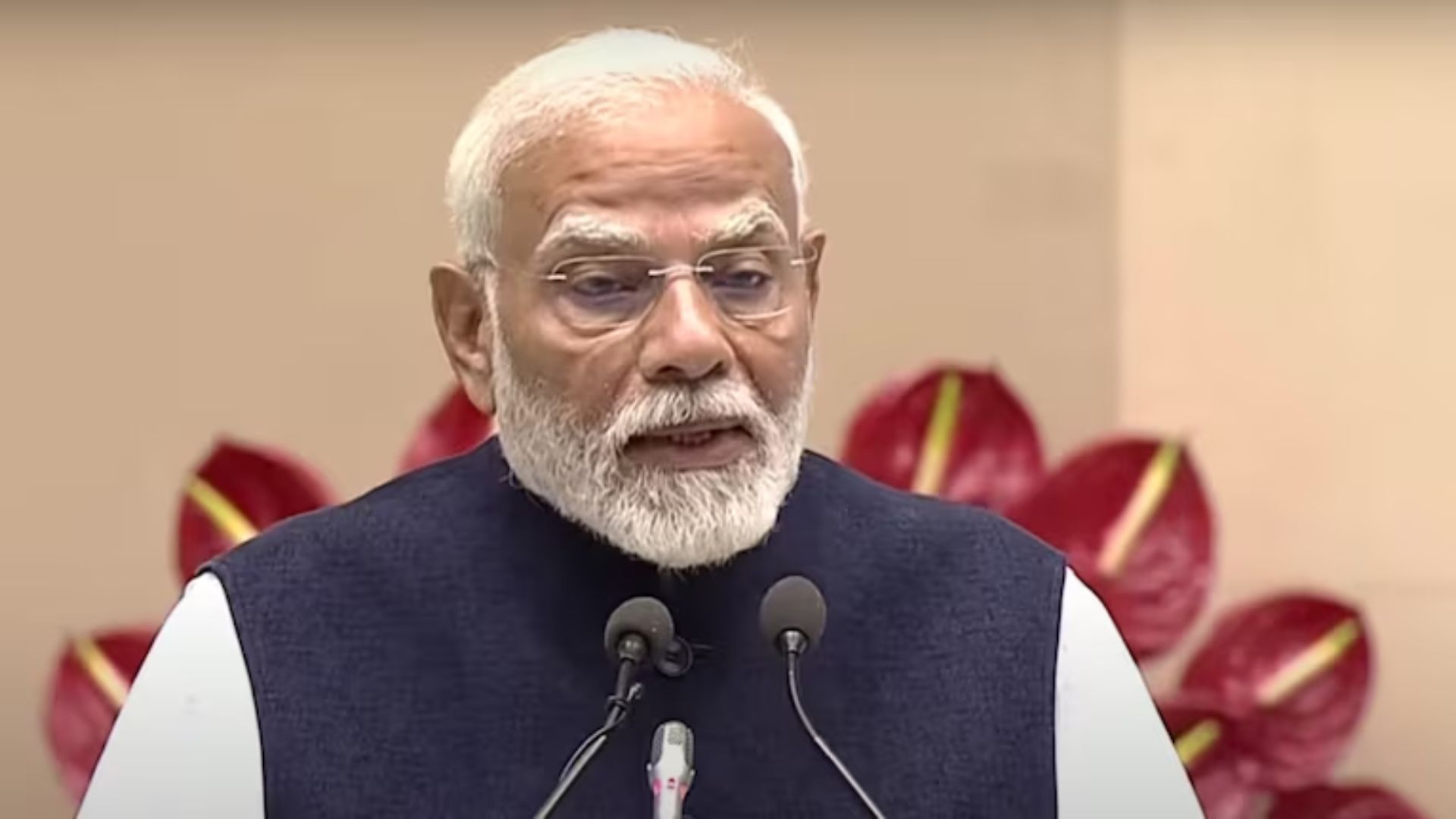

The projected growth rate is lower than the 8.2% recorded in FY24 and the over 7% growth seen in the past three financial years. Chief Economic Advisor V Anantha Nageswaran highlighted that although the Indian economy is currently on stable ground, significant domestic efforts are necessary to sustain recovery.

The Chief Economic Advisor observed that the Indian economy is currently on a strong and stable footing, showing resilience despite geopolitical challenges. He noted that the economy has successfully consolidated its post-Covid recovery, thanks to the efforts of fiscal and monetary policymakers in ensuring economic and financial stability. However, he emphasized that for sustained recovery, significant domestic efforts are required, given the challenging environment for reaching agreements on crucial global issues such as trade, investment, and climate.

Nageswaran also mentioned the need for India to maintain overseas investor interest amid rising interest rates in developed countries and increasing competition from industrial policies that offer substantial subsidies in these economies.

On the topic of employment, Nageswaran pointed out that economic shocks rather than structural issues have influenced job creation. “India suffered two big economic shocks in quick succession. Bad debts in the banking system and high corporate indebtedness were one. It took the first term of the present government and more to bring it under control. The Covid pandemic was the second shock and quickly followed the first one. So, it is difficult to conclude that the Indian economy’s ability to create employment is structurally impaired. Nonetheless, going forward, the task is cut out,” he said.

The Survey also observed a decline in overall employment in unincorporated non-agricultural enterprises, noting a drop from 11.1 crore in 2015-16 to 10.96 crore. Despite this, job growth in trade and services has mitigated the overall reduction in employment in these enterprises.

The Economic Survey urges the private sector to enhance its role in job creation and capital expenditure. “Employment generation is the real bottom line for the private sector. It is worth reiterating that job creation happens mainly in the private sector. Second, many (not all) of the issues that influence economic growth, job creation and productivity and the actions to be taken therein are in the domain of state governments. So, in other words, India needs a tripartite compact, more than ever before, to deliver on the higher and rising aspirations of Indians and complete the journey to Viksit Bharat by 2047,” the CEA emphasized.

Additionally, the Survey highlights the importance of continued government focus on capital expenditure as a critical growth driver amid global uncertainties. It noted that while government efforts to develop infrastructure are crucial, the private sector must also contribute to capital formation. “Between FY19 and FY23, the share of private non-financial corporations in overall GFCF (Gross Fixed Capital Formation) increased only by 0.8 percentage points from 34.1% to 34.9%. This was mostly driven by their fast-increasing share in the additional stock of dwellings, other buildings and structures. Their share in addition to the capital stock in terms of machinery and equipment, started growing robustly only since FY22, a trend that needs to be sustained on the strength of their improving bottom-line and balance sheets in order to generate high-quality jobs,” Nageswaran added.