In this series, my goal is to question assumptions, examine perspectives, and challenge ideas. I am attempting to go back to the first principles of the concept of “trust” and what it has to do with the state of the global economy, the sense of well-being amongst the 80-90% of people that inhabit it and the promises of a distributed trust architecture.

According to Ray Dalio, the CEO of Bridgewater Associates, and Trevor Noren from 13D, the global economy can be said to pass through phases that are trend dominated. In the last 30 years the world economy has been dominated by an over extended phase of wealth consolidation and accumulation, characterised by extreme wealth, an increasing income inequality gap, widening trust deficit, the end of the L-T debt cycle, geopolitical tensions, globalisation and digitisation. Post global financial crisis (GFC) 2008, all of the above have been bringing us to an inflection point, triggering the onset of a gradual diffusion of power and distribution of wealth, aided by changing political, technical and cultural narratives. Changing technological paradigms will propel and give expression to the decentralisation of trust and power and as a result to the redistribution of wealth and value generated amongst the masses.

I found this definition of ‘trust’ to be quite simplistic and accurate. According to a paper titled ‘An integrative model of organizational trust’ by Mayer, Davis and Schoorman, trust is the willingness of a party to be vulnerable to the actions of another party based on the expectation that the other will perform a particular action important to the trustor, irrespective of the ability to monitor or control that other part. Why do we need to trust? Because when trust exists then transaction costs reduce and people are more willing and able to engage in mutually beneficial interactions.

Over the years, trust has been injected into societies via evolving, often overlapping ways; personal relationships and tribal norms governing P2P trust, or the state-sponsored sanctionbased machinery to enforce private contracts and property rights and finally intermediary based trust (TPT model) by aggregating both sides of the market, these entities are able to build marketplaces. For example, banks intermediating between depositors and borrowers or investment banks intermediating transactions in the capital markets, while e-commerce is fully dependent on the reputation of the intermediary to safely carry out transactions online. Think Amazon, Airbnb or Uber, through which strangers interact with each other in ways they never would otherwise. With blockchain technology we can envision a blast to the primitive times and bring back transparency and mitigate the need for trusted third party intermediaries i.e. blockchain will re-invent trust; hence, its reference to a no-trust technology and the emergence of distributed trust architectures.

Let me explain this phenomenon. The business of trust is so old and entrenched, that it is hardly noticed but it is huge. In ancient times important (social or economic) transactions were agreed in front of the community at large and in such a way transparency assured that none of the transacting parties defaulted on their obligations without repercussions, as its terms and conditions were witnessed by the entire crowd. Such transactions would become common knowledge in society. The trade of milk for grain or social contracts like marriages or other important traditional events like birth showers, death rituals, convocations gained legitimacy within the tribe, via common visibility and transparency. And this was important to ensure that all tribe members were aware of the transaction. These events were recorded in the memories of all the tribal members present and thus accounting was a matter of public knowledge and a coordinated activity.

As trade grew beyond local communities, and the ability of participants to directly rely on one another reduced, the transparency afforded by smaller and proximate societies was replaced by trusted record keepers managing databases i.e. in government, in layers of bureaucracy, in large corporations. It became physically and technologically impossible for every trade to be broadcasted across the population. Pseudo-transparent measures were introduced as substitutes, for example, advertisements in newspapers, public registration of private documents, Lists range from simple checklists to complex databases, but they all have one major drawback — they’re all centralised, the database managers hold the power!

They can inflate corporate accounts, delete titles from land registries or add names to party rolls. To keep a check, we have come to rely on all sorts of tools, from audits to supervisory boards. Together, the owners of centralised databases and those that govern them form one of the world’s biggest and least noticed industries, the trust business.

In present times, what essentially is a basic peer-topeer (A-to-B) transaction assumes complexity as third-party intermediaries step in to provide the required trust. Consequently, transparency was replaced by trust. With blockchain, it becomes possible to reimagine the accounting, structuring for transactions so that reliance on trusted intermediaries is once again minimised, through “virtual witnessing,” digital signatures and mathematical guarantee of cryptography combined with power of economic incentives.

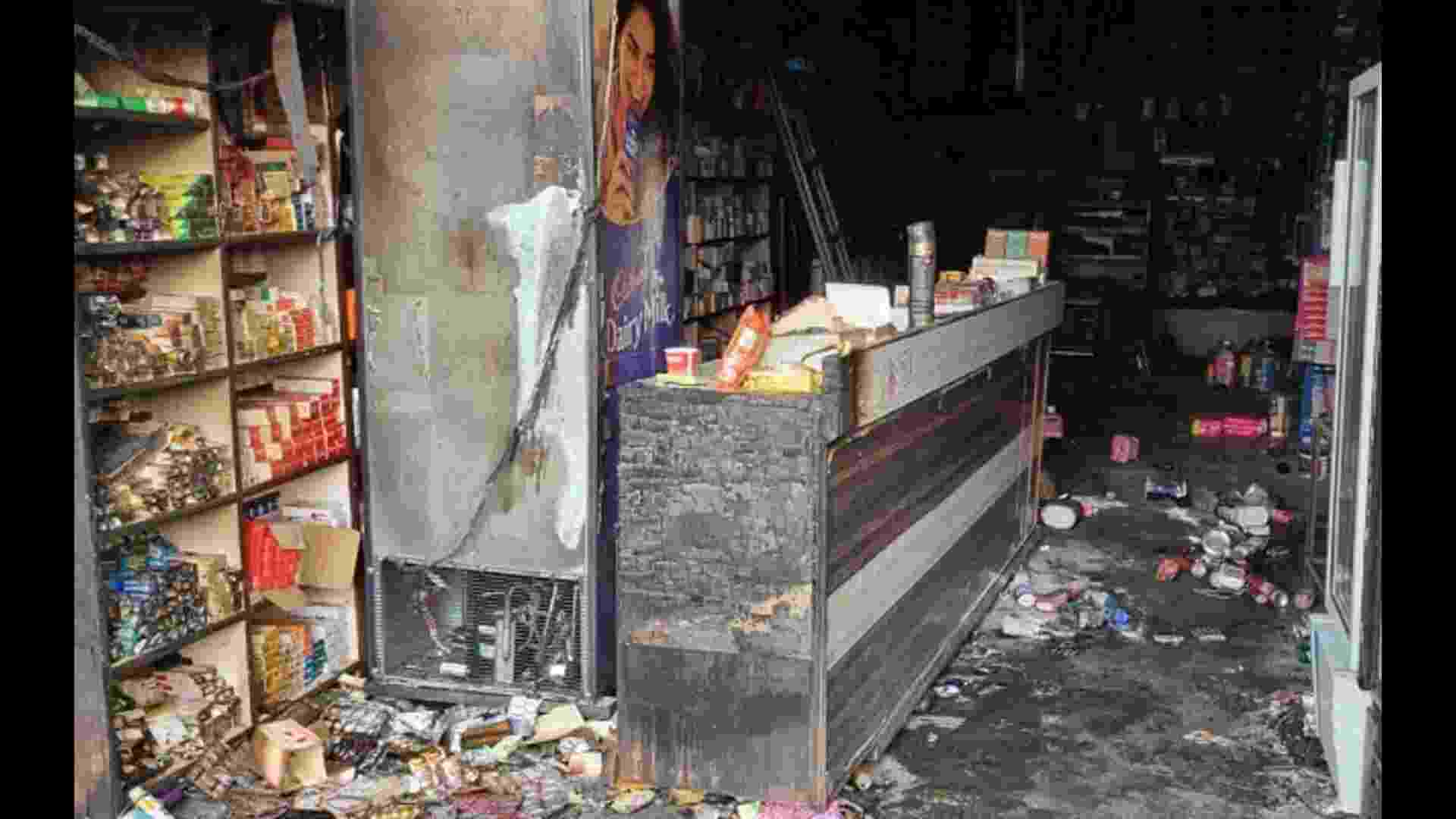

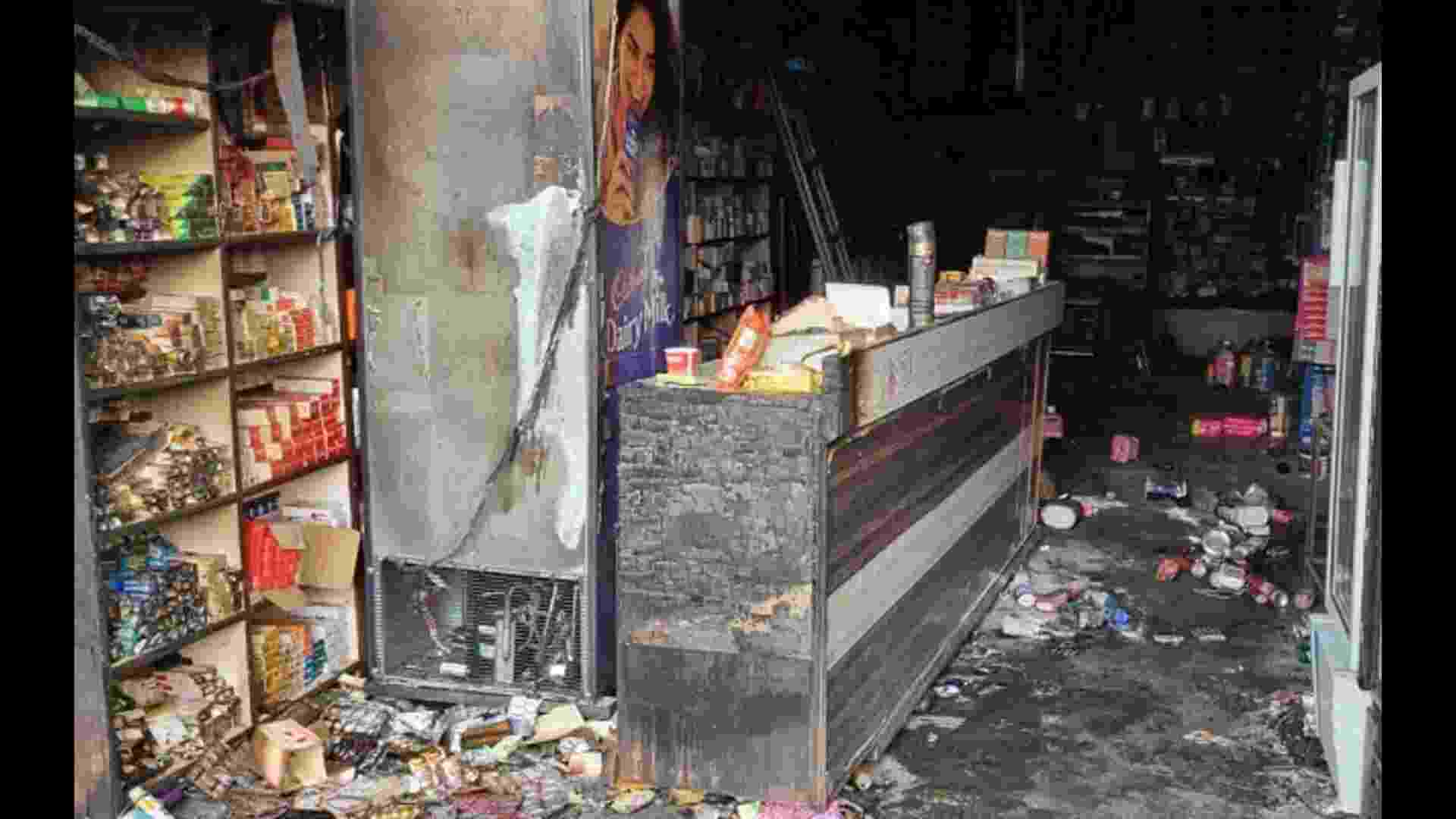

Essentially the transaction facilitating and aggregating intermediary is replaced by a distributed machine, co-maintained by unknown participants who are in it purely for the money. This enables the collaborative creation of a publicly available single source of truth to anyone/ everyone authorized to view such records/information and in some cases update the records The world has been in the midst of a trust deficit crisis and blockchain tech could address it; quoting from the Economist, “Blockchain the ultimate trust machine, biggest breakthrough in business record keeping since 1494 Italian invention of double entry bookkeeping.” There are many examples of a breakdown of trust in the world.

At the World Economic Forum, 2017 in Davos, David Edelman cited his annual trust barometer report titled an “Implosion of trust” indicating that trust in institutions has radically declined; 85% of those surveyed felt that institutions aren’t working towards their best interests, and governments are distrusted in 75% of the surveyed countries. Larry Fink, the CEO of the $6 trillion-plus asset management firm BlackRock, said, “We are seeing the paradox of high returns and high anxiety.” Low wage growth, dimming retirement prospects and other financial pressures are squeezing too many across the globe. A recent Oxfam report stated that 82 percent of all wealth created in 2017 went to the global top 1 percent. Top 8 wealthiest individuals hold as much wealth as the poorest 50% of the world. And the top 10 asset managers control 34% of all assets in the world.

Our growing mistrust in institutions and centralised power has been manifesting itself in the global political scene. The Brexit movement, the Trump and Bernie Sanders campaigns, recent populist victories in places like Italy, Mexico, Brazil, and France’s growing ‘Yellow Vests’ and Occupy Wall Street movement are all examples of people frustrated by static wage growth and a lack of faith in the centralized powers who promised to do something about it. Trump and his populist followers beat out dominant cultural narratives represented by the Republican establishment, the Democratic Party, the Clinton machine, Hollywood, academia, and mainstream media.

Existing trust architecture in the digital economy has led to the centralisation of the efficiencies unleashed by the Internet protocol in the hands of very few large tech companies acting as trusted third-party intermediaries in any online transaction. 90% of revenue generated from internet transactions goes to merely 9 companies. Peer-to-peer marketplace platforms like Amazon, AirBnB, Uber, Facebook, etc, rely on proprietary software for aggregating the contributions of users as a means to generate value within their own platforms. This shift marked the advent of a new generation of dematerialized or digital organizations that do not require physical offices, assets, or even employees. The problem with this model is that the value produced by the crowd is not equally redistributed among all those who have contributed to the value production; all of the profits are captured by the large intermediaries who operate the platform and enjoy entrenched power due to network effects.

Global governments have been slow to keep pace with regulating the digital realm amounting to windfall gains for the few large data aggregators who were able to form information cartels and do so with complete impunity. This has led to wealth accumulation; Apple, Microsoft, Alphabet, Amazon and Facebook now account for 17.5% of the S&P 500.

Blockchain, 5G, IoT, 3D and AI are all examples of tech narratives that will diffuse power and distribute wealth. With blockchain, software applications no longer need to be deployed on a centralised server. They can be run on a peer-to-peer network that is not controlled by any single party. In this way the move is not only towards dematerialised but also decentralised organisational structures with no director or CEO, or any sort of hierarchical structure, instead they are administered, collectively, by all individuals interacting via code on the blockchain.

Primarily, the benefit will accrue to users who would qualify both as contributors and shareholders of these decentralised network economies as the value produced within these platforms will be more equally shared among those who have contributed to the value creation. So as people go from merely gaining network participation value to network ownership value and start enjoying property rights in the decentralised Internet, the global economy will move from a wealth accumulation phase to a wealth diffusion phase.

The writer is the co-founder of MainChain Research & Consulting Pvt Ltd, a certified Bitcoin professional.