Bengaluru-based entrepreneur Aditi Chopra recently took to social media platform X to share her harrowing experience with a sophisticated financial fraud scheme. In a detailed post, she recounted how she narrowly escaped falling victim to a scam that targeted her through a clever phone call tactic.

Chopra narrated that during an office call, she received a call from an individual who claimed to need urgent financial assistance for his father due to a bank account issue. The scammer then cunningly recited Chopra’s 10-digit mobile number and proceeded to orchestrate a series of fake bank credit SMS notifications on her phone.

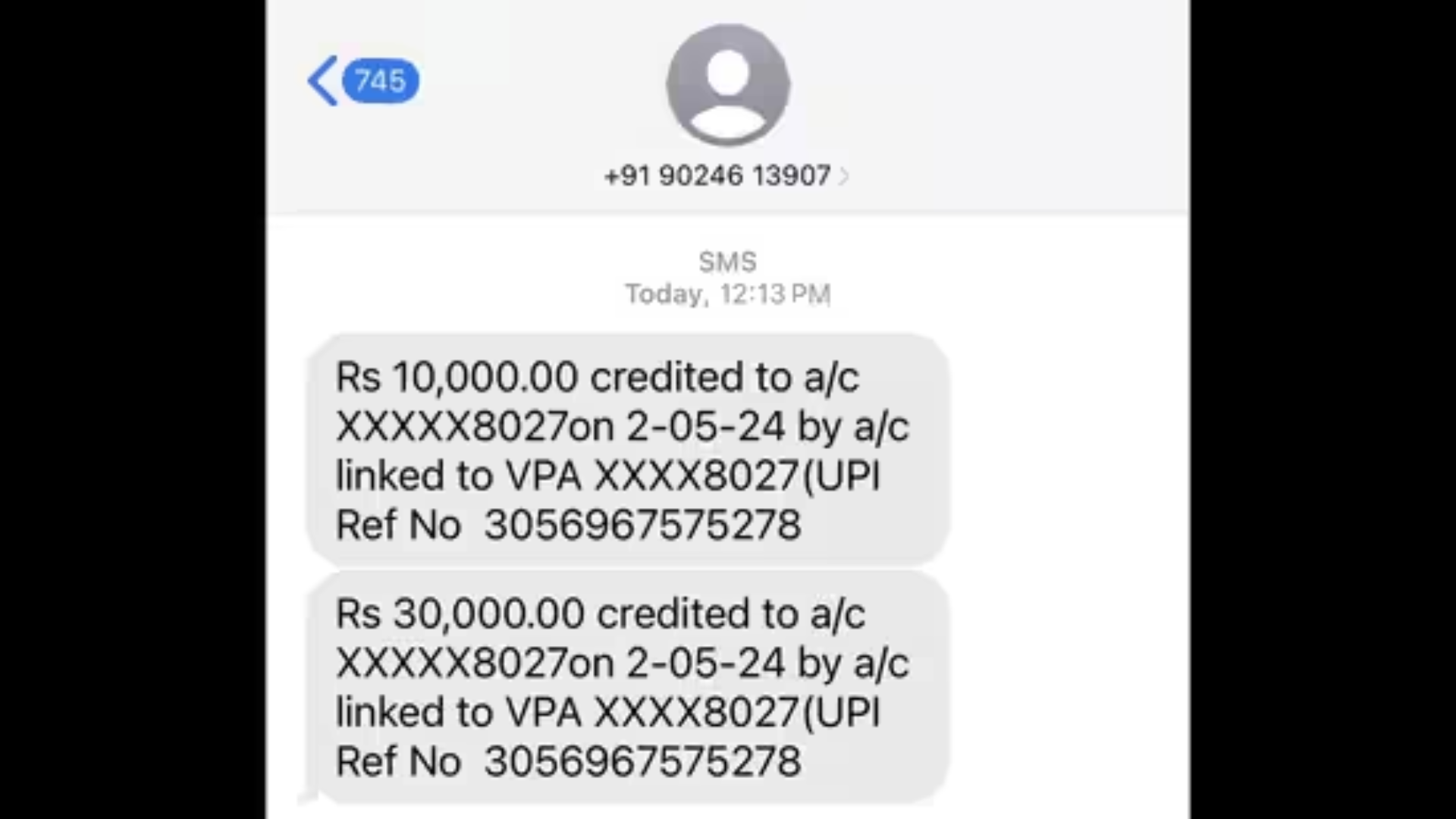

“I first received an SMS mentioning an INR 10k credit, then an INR 30k credit, all while he’s on the call,” Chopra shared, highlighting the seamless coordination of the scammer’s actions to create a false sense of urgency.

Another day, another financial fraud scheme 🥸

TLDR: Please read and make sure you don’t trust any SMSes regarding financial transactions.

Incident: Was busy on an office call when this elderly sounding guy calls me and says, ‘Aditi beta, papa ko paise bhejne the par unko ja… pic.twitter.com/5CYwwwvjG7

— Aditi Chopra | Web3 Community 🛠️ (@aditichoprax) May 2, 2024

The fraudster then feigned a mistake, claiming to have accidentally transferred ₹30,000 instead of the intended ₹3,000, and requested Chopra to return the excess amount immediately as he purportedly needed it urgently for a medical payment at a clinic. This urgency, as per Chopra, was the crux of the scam, designed to pressure victims into acting swiftly without careful consideration.

However, Chopra’s keen observation and quick thinking saved her from the scam. She noticed that the SMS notifications were from a 10-digit phone number rather than an official bank identifier, which raised red flags. After verifying her actual bank account on a separate device, she realized the scam and attempted to call back the fraudster, only to find herself blocked.

Taking to social media, Chopra shared screenshots of the fraudulent SMSes she received and advised others to always verify transactions through official channels and never solely rely on SMS notifications. She also tagged the cyber cell in her post, sparking a discussion where many users shared similar scam experiences they or their acquaintances had faced.

One user recounted a similar scam involving company-tagged messages, emphasizing the sophistication of such schemes. Others chimed in with cautionary tales and praised Chopra for her vigilance, highlighting the importance of staying alert to protect oneself from financial fraud.