Nowadays, the State of Andhra Pradesh has become a peculiar State, performing outside the purview of the accounting practices and even it adheres the Constitutional violations by diverting VAT on Liquor to Government incorporated Corporation instead of transfer to the Consolidated Fund by a special GO for raising additional Loans outside the FRBM limits— it is nothing but a mere window dressing of accounting practices and systems as a bad precedent for future of the country and most particularly the state itself. After careful examination of Financial Statements for the second quarter of the current financial year 2021-22, several key indicators of Andhra Pradesh financial adversity have been exposed with danger bells.

Estimated revenue collections and revenue expenditure in the budget and actuals thereof is very much vital in any Government since revenue surplus or deficit plays the crucial role for serving the capital expenditure for the future revenue-generating assets for the country or state; then it serves the interest on debts which impacts primary deficit and thereafter very much important component Fiscal Deficit arrives out of the impact of the all together above. Hence, Revenue Deficit is the root cause of all the other liking heads in the FINANCIAL Statements. Generally, revenue surplus for any State indicates a positive performance, and at least those states, which minimize the gap between revenue collections and revenue expenditure to register the shorter revenue deficit are also reasonably good.

As far as Andhra Pradesh is concerned, first indicator, Total Revenue Collections, estimated in the Budget for the Financial Year 2021-22 was Rs. 1,77,196.48 Crores and Estimated Total Revenue Expenditure was 1,82,196.54 Crores, Hence Estimated Revenue Deficit for the whole year was Rs. 5000.06 Crores. Total Revenues had registered for Rs. 64,871.99 Crores by September where the whole year estimated revenue was, it means, only 36.61% of the current financial year total revenue achieved after the lapse of 50% period in the year. But, the actual revenue deficit for the first two quarters of the current financial year has registered as Rs. 39,933.22 Crores, which means nearly 800% of the actual revenue deficit has emerged in the first six months itself when compared with the whole financial year’s revenue deficit. In these circumstances, we can predict that how worse the situation of Andhra Pradesh in the next 6 months.

Second indicator i.e the Capital Expenditure Targets are concerned, Andhra Pradesh had not achieved the target of 45% of the total Capital Expenditure estimated in the Budget for the financial year 2021-22 of Rs. 31,119.38 Crores in the second quarter of the current financial year to avail the additional loan as an incentive allowed by the Union Government based on the performance of creating future revenue-generating assets by incurring the targeted Capital Expenditure. Although, first-quarter target to incurring 15% of the Capital expenditure was achieved, it had not attained in the second quarter due to the lenient approach of the State Government in the exercise of Financial factors.

Apart from this, the State government had utilized the insurance premium, which was paid by the Women in the Self Help Groups for Rs. 2,100 Crores and LIC had openly declared in the newspaper advertisement that they were withdrawing the Agreement with Andhra Pradesh Government to pay future obligations to the beneficiaries since the State Government of Andhra Pradesh violated the terms and conditions and declared that the future obligations will be cleared by the nodal agency of the State Government Department SERP. Further, Recently the State government of Andhra Pradesh had incorporated Andhra Pradesh State Financial Services Corporation as an NBFC. Unfortunately, the State government had issued a direction to divert their bank deposits from every State Government Corporations, Departments, Boards etc., which are maintained in the Scheduled Banks to AP Financial Services Corporation forcibly— it causes the damage of independence of the respective Corporations, Departments, Boards as those funds have been diverting for unproductive expenditure which may hurt the actual system of the activity. And many experts have been questioned that Whether AP Financial Services Corporation is the reserve bank of Andhra Pradesh. There is an agitation of NTR Health University employees is going on against to transfer of Rs. 400 Crores of University-Corpus fund to the AP Financial Services Corporation from the Scheduled Bank. Ironically, State Government is expressing that Deposits in the Scheduled Banks are unsafe, whereas the people of Andhra Pradesh are in a feeling that the present approach of the State Government is not safe.

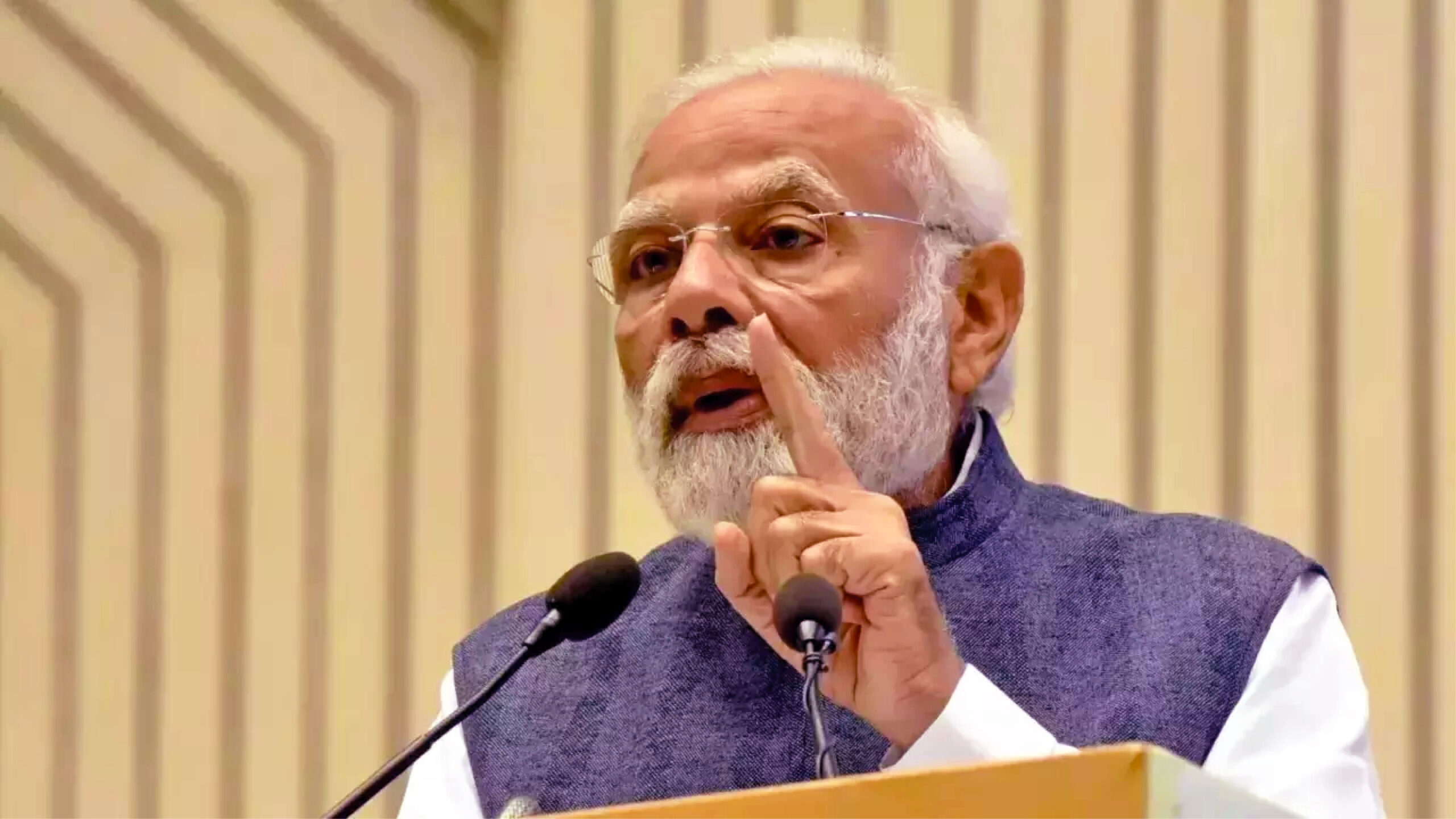

The financial destructive methods implemented by the State under the leadership of YS Jagan Mohan Reddy had cautioned by the CAG in their Report. The series of illegitimate and unconstitutional practices since the inception of YSRCP led State Government leads to Economic Nuclear explosion now. The State needs to repay 1.10 lack crores in the next seven years but the condition of the State is: it requires to raise debts even to repay the interest. As per the past expectation, the Revenue Deficit of the State should have reached zero by 2021, but the actual Revenue Deficit was registered for Rs. 36,000 Crores due to huge unproductive expenditure had been incurred. Further, the State Government was eligible to provide a guarantee on loans for Rs. 5,600 Crores only, But the same has crossed for Rs. 1.00 lack crores and the Government is trying to give guarantee for additional 1.00 lack crores where the gap in State Government Guarantees is eligible up to 90% as per norms, but State government has amended it up to 180%.

At present financial precarious condition has been emerged as Total Revenues and Debts are not serving the Budgetary Allocations other than the unproductive and illegitimate expenditure with corrupt practices. On the one hand, Total Debts had been registered for Rs. 39,914 18 by September where the whole year estimated debt was 37,029.79 Crores, it means more than 100% estimated debts for the financial year 2021-22 had crossed in the first two quarters itself without future revenue-generating productive assets through Capital expenditure and on the other hand, We can notice the Unconstitutional methods in the financial practices harm the state Brand Image, such as recent Order by the State Government to transfer the VAT on Liquor revenue to Beverage Corporation to raise debts. After analyzing the facts in the September month CAG report, danger bells of the AP State Financial Health have been ringing in all parameters and it needs remedial measures with immediate effect to put the things in order, otherwise, future financial damage to the state is unimaginable.