Brent Oil advanced above $70 a barrel on June 1, 2021, after the OPEC+ alliance showed every inclination of continuing with production cuts. Any increase in the oil output by the OPEC+ alliance may not happen before July-August, 2021. The oil glut built up during the pandemic last year has almost vanished, and the inventory is depleting rapidly. OPEC’s Joint Technical Committee (JTC) forecast stockpiles will fall by at least 2 million barrels a day from September through December, 2021. So unless the OPEC+ alliance decides to raise production in July, global crude oil prices will remain northward bound.

A weaker dollar is also helping to push oil higher. Tight supply and strong demand from the USA and China could see oil climb to $80 a barrel in the next few months in the absence of Iranian supplies. New nuclear violations may derail Iran’s return to global oil markets.

Asian refiners, meanwhile, are grappling with what’s expected to be a brief period of weak profits amid the demand-sapping virus resurgence. Complex refining margins in Singapore, a proxy for the region, have slumped to almost zero since the end of April 2021, but accelerating vaccination rates are expected to aid demand and margins going forward. Exxon Mobil Corporation is pulling out of a deep-water oil prospect in Ghana just two years after the West African nation ratified an exploration and production agreement with the U.S. oil titan, further adding to global supply tightness.

Fuel prices have risen not only in India but elsewhere too. The average retail price for gasoline in the USA jumped above $3 per gallon last week, the highest price since 2014. California saw the highest prices at over $4 per gallon with reports of global oil demand outstripping supply in the order of anywhere between 6.5 lakh to 9.5 lakh barrels per day.

If the U.S. and Iran do manage to conclude a deal to restore the terms of the 2015 nuclear agreement, which would allow Iran to produce 2 million barrels per day, then global crude oil prices could take a dip and domestic prices would follow suit.

The recent bull rally in global oil prices, therefore, from a low of $18 a barrel in April 2020 to a high of over $70 in June 2021, effectively means crude oil prices have risen by an unbelievable 294% in the last 14 months. Since more than 80% of India’s oil demand is met via imports, any surge in global Brent Crude price obviously has a sizeable impact on India too, as both petrol and diesel are now fully deregulated. Maruti Suzuki, for instance, sells over 1.6 lakh units every month on average, which means it is selling about four cars every minute. Clearly, despite the brouhaha, oil demand continues to gallop away, outpacing supply, which is also reflected in rising auto and bike sales.

Theoretically, every $1/barrel fall or rise in Brent Crude price leads to a 0.45/litre reduction or rise in product prices—assuming ‘other things’ are constant. However, other things like the rupee-dollar exchange rate, cess, refining cost, import duties, shipping charges, freight rates, and dealer commissions and profit margins are never quite constant in the dynamic real world. India’s ignorant opposition has often alleged that under the inept Congress-led United Progressive Alliance (UPA-2), despite elevated Brent prices globally, local fuel prices were much lower. Well, that is because fuel prices were only partially decontrolled under the inefficient UPA-2. It was Prime Minister Narendra Modi-led NDA government, in October 2014, that took the unpopular but bold and long overdue decision of decontrolling diesel prices too.

Hence, comparing fuel price movements under the Modi government with the erstwhile Congress regime is unfair. Also, don’t forget that the previous Congress-led UPA government took loans by purchasing oil bonds of Rs 1.44 lakh crore that the Narendra Modi-led NDA government inherited and paid for. Not only this, the Modi government also paid Rs. 70,000 crore on the interest part alone, which means, in total, the Modi government discharged debt obligations of the earlier Congress regime, by repaying over Rs. 2 lakh crore. To nail the misinformation surrounding domestic fuel pricing, it is best to look at a real-time example. Petrol prices in Mumbai a few weeks back hit Rs 100 per litre. Of this Rs. 100, the Basic rate is Rs. 32.97 per litre; Central government tax is Rs 21.58; State government VAT, surcharges and levies are Rs 41.67 per litre. Also, the distributor margins work out to Rs 3.78 per litre. Clearly, it is not the Central government, but State government taxes that are the biggest component of petrol prices and also the biggest reason for the steep rise in domestic fuel prices. Effectively speaking, the State government taxes account for 41.67% of the final petrol price, whereas Central government taxes account for only 21.58% of the final petrol price per litre. Hence, before pointing fingers at the Modi government, opposition leaders like Rahul Gandhi whose party is a vital part of the ruling alliance in Maharashtra would do well to do some number crunching! In fact, along with VAT, disaster management cess, and highway liquor ban cess, the net share of State taxes in fuel prices in Maharashtra is almost 50% and the same is the case with Rajasthan, another Congress ruled State with the highest VAT.

India imports almost no petrol or diesel. It imports crude. But the price we pay for fuel is based largely on Import Parity Price or the price we would pay if India were to be actually importing petrol or diesel. India’s export of petrol and diesel is more than imports. India’s total imports in 2017-18 were worth Rs 744 million while total exports were far higher at Rs 23,858 million. Fuel is basically priced as if it is imported.

Oil refiners, who make these products in India, are paid what is called a Refinery Gate Price (RGP) based on the Trade Parity Price (TPP) which is a weighted average of the Import Parity Price (IPP) and the Export Parity Price (EPP). IPP is the price importers would pay if they actually imported the product. So, it includes not just the cost of the fuel itself, but also freight charges, insurance, customs duty, and port charges. EPP is what somebody actually exporting the product would get. IPP has an 80% weight and EPP only 20% in the TPP.

This method of calculating the price to be paid to refiners means that whenever international oil prices rise, they get a windfall. That is because Customs is an ‘ad valorem’ rate or a percentage of the basic value, unlike a specific duty which would remain fixed irrespective of basic price. Since customs duty is 2.5% of the imported price, it goes up in absolute terms as the basic price does. So, at $100 per barrel, the duty on a barrel of petrol would be $2.5 while at $200 per barrel it would be $5. India has to import 80% of the raw material (crude oil), so Export Parity could not be an option and hence an 80:20 TPP was implemented in line with the C.Rangarajan report.

Interestingly, customs on products is 2.5%, but this is applicable only on 80% of the output, effectively making it just 2%.

There are several taxes on domestic Crude such as National Calamity Duty and State Entry Tax. These are largely absorbed by the public sector oil refiners. So after adjusting these, the effective Customs duty is minimal. The burden of customs duty is largely borne by public sector refining companies and hence alleging that refiners make abnormal gains if global Crude prices go up, is false.To cut a long story short, with the State-level value-added tax (VAT) and Sales tax being levied on an Ad-Valorem basis, the tax revenues of States from petrol and diesel rise in tandem with the increase in their prices. Elevated fuel prices, however, do not help the Centre much, as the Excise duties on petrol and diesel levied by the Central Government are specific in nature, (like flat rates). Hence, whether petrol is Rs 70 or Rs 100 per litre is largely meaningless for the Central government from a revenue standpoint. On the contrary, the biggest killing is made by States, which charge Ad-Valorem rates, and the higher the price of petrol and diesel, the higher the taxes earned by States.

Again, it is nothing but sheer hypocrisy to talk of rising petrol and diesel prices, but not give the Modi government credit for the fact that compared to 2013, when LPG gas cylinder prices went to as high as Rs. 1270-1290 per cylinder. Today the average price of an LPG gas cylinder is Rs. 809. Do note that globally LPG prices in the last few months have risen from $455 per tonne to over $600 per tonne, which is a 32% increase. Locally, in India, compared to 2013, LPG prices in the last 7 years under the Modi government have fallen by anywhere between a good 36-40%.

Recently there has been a surge in edible oil prices globally. Since India imports between 55-70% of edible oils like palm oil, soybean oil, and sunflower oil, domestic cooking oil prices have risen too. Argentina, one of the biggest producers of soybean, faced huge crop losses after a severe drought. Malaysia and Indonesia curtailed exports of palm oil to India and other countries after a big rise in local demand due to a change in bio-fuel norms in these countries. Ukraine and Russia, amongst the largest producers of sunflower oil, also faced a debilitating drought leading to a sharp surge in international prices of sunflower oil.

The good news is that the area under oilseeds has expanded in India, and output is expected to be higher than the previous year. The total acreage under oilseeds increased by 18 lakh hectares or 10% during the 2020 Kharif season, aided by the increased availability of labour, after migrants workers returned to their homes in rural areas. The acreage for groundnut rose by 30% and for soybean by about 7%. Similarly, the acreage under oilseeds in the 2020-21 Rabi season was up by 4%. Mustard is the primary oilseed grown during the winter cropping season and the area under the crop is also up 5%. According to the third advance estimates of production for the 2020-21 agriculture season, oilseed output expanded by 10% to 365.65 lakh tonnes, with the soybean crop rising almost 20% and mustard by 10%. Hence, cooking oil prices should come down, going forward.

India, under PM Modi, has the enviable accomplishment and unique distinction of already vaccinating over 220 million people with the first dose of the Covid vaccine, in what is clearly the world’s fastest and most ambitious vaccination drive. By December 2021 or even earlier, the entire adult population of India will be vaccinated. The Union Budget for 2021-22 set aside Rs. 35,000 crore for the Covid vaccine. Allocation of Rs. 2.23 lakh crore for health is a 137% jump in 2021-22, over 2020-21. Again, Rs. 1.18 lakh crore for road infrastructure, Rs. 1.10 lakh crore for railways, an outlay of Rs. 3.6 lakh crore for the power sector, and Rs. 16.5 lakh crore towards agriculture credit outlay in the Union Budget, showcase how the Modi government is spending money judiciously towards a healthier, fitter, and better India. Defence allocation at Rs 4.78 lakh crore, which is up by 19% in FY22, over FY21, is aimed at a more safer and secure India. Hence, the allegations that resources raised via fuel taxes are being frittered away, are baseless.

To cut to the chase, India under Prime Minister Narendra Modi is planning to increase natural gas consumption by 2.5x, as part of the energy mix to 15.5% by 2030, from the current level of 6.2%. The ongoing transition from an ‘oil economy’, to a ‘Gas economy’, under PM Modi’s visionary leadership is steadfastly underway. Over 70% of India’s population, in over 400 districts, will have a city gas distribution (CGD) facility, soon. Only 25 lakh households in India had access to piped natural gas (PNG) in 2014, but thanks to the Modi government’s persistent efforts, the figure more than quadrupled by 2021. Again, India only had 947 CNG stations in 2014, that number rose to 1470 stations in 2018 and is set to scale up to a massive 10,000 CNG stations in the next few years. Since CNG is anywhere between 45-60% cheaper compared to petrol and diesel, this will make India self-reliant in more ways than one.

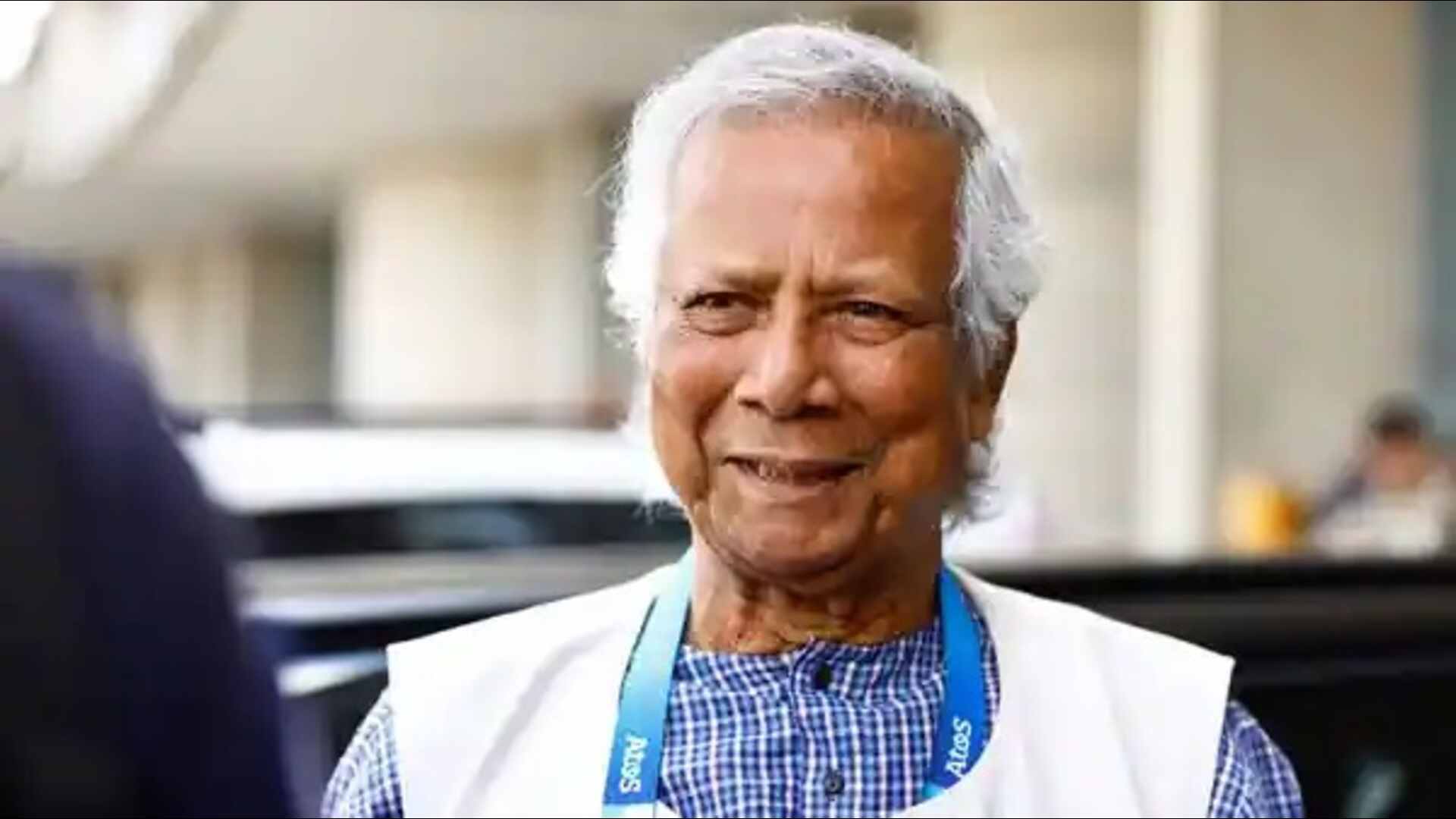

The writer is an economist, national spokesperson of the BJP, and the bestselling author of ‘Truth & Dare: The Modi Dynamic’. Views expressed are her personal.