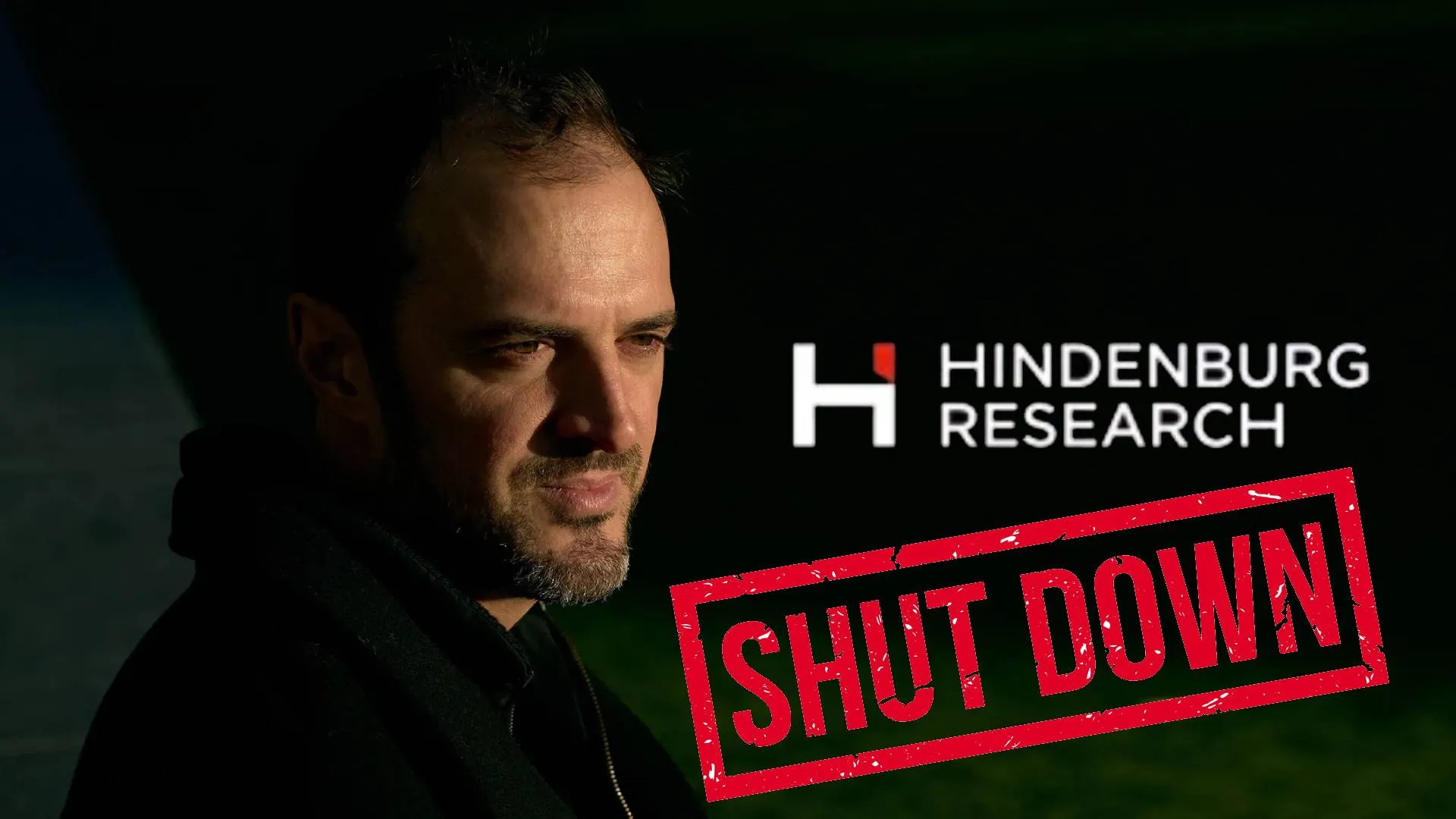

Nathan Anderson, founder of Hindenburg Research, has announced the firm he founded is closing down. It’s due to the colossal demands of what he does. Since it opened its doors in 2017, Hindenburg Research has not been stranger to controversy by publishing explosive reports on companies like the Adani Group, Nikola, and Block Inc., which led to regulatory probes, dramatic stock price crashes, and consequent financial losses.

In a statement published on the firm’s website, Nathan Anderson, 40, stated that the pressure of his position had been taking its toll and was one reason he decided to dissolve the firm. His decision has sent the global financial community into a tizzy as to what it will mean for the ongoing investigations linked to Hindenburg’s reports.

Doubts on Credibility and Accountability

Market analysts are now debating the far-reaching implications of the shutdown. Gaurang Shah, Assistant Vice President at Geojit BNP Paribas, raised questions about who will shoulder the responsibility for unresolved cases that were brought to light by Hindenburg’s investigations.

“Primarily, where will the onus lie now that these reports are in the public domain? Credibility becomes a crucial factor. These reports didn’t just concern Indian entities but extended to companies in the US and globally,” Shah noted.

He condemned the move by the firm to dissolve, saying it is a way of exonerating Hindenburg Research from all the responsibilities. “By shutting down, Hindenburg Research is washing its hands of all obligations. What happens to cases still open? Essentially, it leaves uncertainty in its wake.”

High-Profile Investigations of Nathan Anderson

Anderson rose to prominence in January 2023 after publishing a scathing report accusing Gautam Adani’s Adani Group of orchestrating “the largest con in corporate history.” At the time, Adani was ranked as the fourth-richest individual in the world by Bloomberg’s Billionaires Index.

The report wiped billions off Adani Group’s market value and even triggered regulatory investigations in India. Later, Anderson also targeted Jack Dorsey’s Block Inc. and Carl Icahn’s Icahn Enterprises, accusing misconduct in their operations. All three entities categorically denied the claims of Hindenburg.

Effects on Ongoing Investigations

Hindenburg’s shutdown raises questions about the future of unresolved cases and the firm’s approach to market accountability. Critics argue that its exit creates a vacuum in the short-selling and whistleblowing space, potentially leaving unchecked corporate misconduct.

Shah emphasized the risks: “Hindenburg’s bearish views were pivotal in exposing irregularities. Its exit leaves the market without a significant watchdog.”

Future of Short-Selling Investigations

While Hindenburg’s reports shook a few markets, the firm’s demise opens the way for others to fill the space. It remains to be seen whether new firms will carry on with the same level of integrity and care.