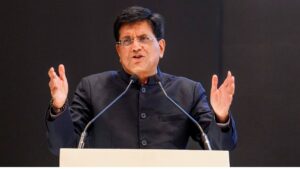

A nearly 26 per cent rise in FDI to USD 42.1 billion during the first half of the current fiscal year 2024-25 helped India’s gross foreign direct investment (FDI) inflows reach an impressive USD 1 trillion since the start of this century.

India has achieved a remarkable milestone in its economic journey, with gross foreign direct investment (FDI) inflows reaching an impressive USD 1 trillion since April 2000.

This landmark achievement was helped by a nearly 26 per cent rise in FDI during the first half of 2024-25. Ministry of Commerce and Industry in a statement asserted that such growth reflects India’s growing appeal as a global investment destination.

“FDI has played a transformative role in India’s development by providing substantial non-debt financial resources, fostering technology transfers, and creating employment opportunities.”

“Initiatives like ‘Make in India’ liberalised sectoral policies, and the Goods and Services Tax (GST) have enhanced investor confidence, while competitive labour costs and strategic incentives continue to attract multinational corporations,” the Commerce Ministry said.

Over the last decade (April 2014 to September 2024), total FDI inflows amounted to USD 709.84 billion, accounting for 68.69 percent of the overall FDI inflow in the past 24 years.

To promote FDI, the government has put in place an investor-friendly ‘policy, wherein most sectors, except certain strategically important sectors, are open for 100 per cent FDI under the automatic route.

Further, to simplify tax compliance for startups and foreign investors, the Income Tax Act, 1961 ‘was amended in 2024 to abolish angel tax and to reduce the income tax rate chargeable on the income of a foreign company.

As India continues to align with global economic trends, the government believes it is ‘well-positioned to further strengthen its role on the global stage, fostering sustainable growth and development.