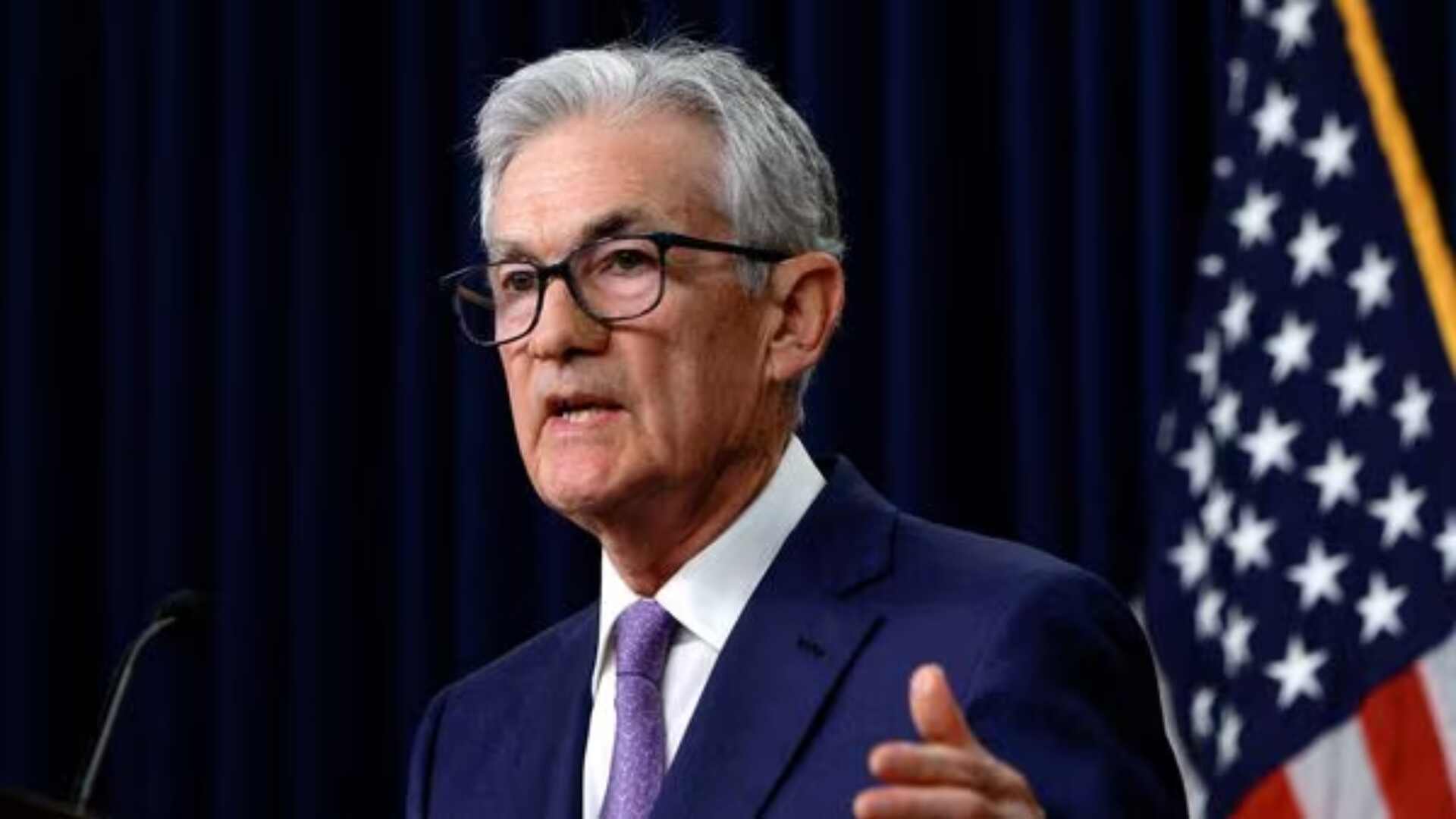

Jerome Powell, Chairman of the US Federal Reserve, is set to address the Jackson Hole Symposium on Friday, August 23, at 7:30 pm IST. His speech at this prestigious economic conference is anticipated to provide crucial insights into the Fed’s future interest rate policies.

Key Details on Powell’s Speech

Powell’s remarks will be streamed live on the Kansas City Fed’s YouTube channel. The focus of his speech is expected to be on the Fed’s strategy regarding potential interest rate cuts, with a keen eye on how the central bank will approach monetary policy in the coming months.

Why Powell’s Speech Matters

The speech comes at a pivotal moment as the Federal Reserve is widely anticipated to begin reducing its benchmark interest rate next month. Powell is likely to discuss the Fed’s confidence in achieving its 2% inflation target, a goal that has become increasingly attainable after years of high inflation.

According to Palka Arora Chopra, Director at Master Capital Services, “The likelihood of the US Federal Reserve opting for a substantial 50-basis point rate cut in September hinges on the central bank’s assessment of the employment and inflation balance leading up to the meeting. Although indicators suggest a potential rate decrease, the odds of such a significant cut are still uncertain. Currently, traders estimate a 38% chance of a 50-basis point reduction, up from an earlier expectation of 33%, while a 25-basis point cut has a 62% probability.”

Chopra also highlighted that a reduction in rates could benefit Indian stocks in sectors such as IT, BFSI (Banking, Financial Services, and Insurance), Auto, and Realty, as it generally leads to a weaker US dollar and lower borrowing costs.

The Fed’s Balancing Act

Powell’s speech will also touch on the Fed’s attempt to achieve a “soft landing” for the economy, a goal that involves curbing inflation without triggering a recession. Inflation has moderated to 2.5% as of July, down from a peak of 7.1% two years ago, indicating progress in the Fed’s efforts.

However, recent economic data, including a slowdown in hiring and a rise in the unemployment rate, has raised concerns about the risk of keeping rates too high for too long. Powell is expected to address these concerns, balancing the need for continued inflation control with the risks of potentially stifling economic growth.

What to Watch For

The minutes from the Fed’s recent meeting revealed that most policymakers are leaning towards a rate cut in September, provided inflation remains low. The potential for a more aggressive half-point cut could increase if further economic indicators show weaker labor markets.

Raphael Bostic, President of the Fed’s Atlanta branch, noted, “Evidence of accelerating weakness in labor markets may warrant a more rapid move, either in terms of the increments of movement or the speed at which we try to get back” to a more neutral policy stance.

Market Impact

The Fed’s decision on interest rates will have significant implications for the markets. Wall Street traders are currently predicting a quarter-point rate cut in both September and November, with a possible half-point reduction in December. This anticipation has already led to a decline in mortgage rates.

As Jerome Powell prepares to speak, all eyes will be on his commentary for any clues about future rate adjustments and the Fed’s overall economic strategy.